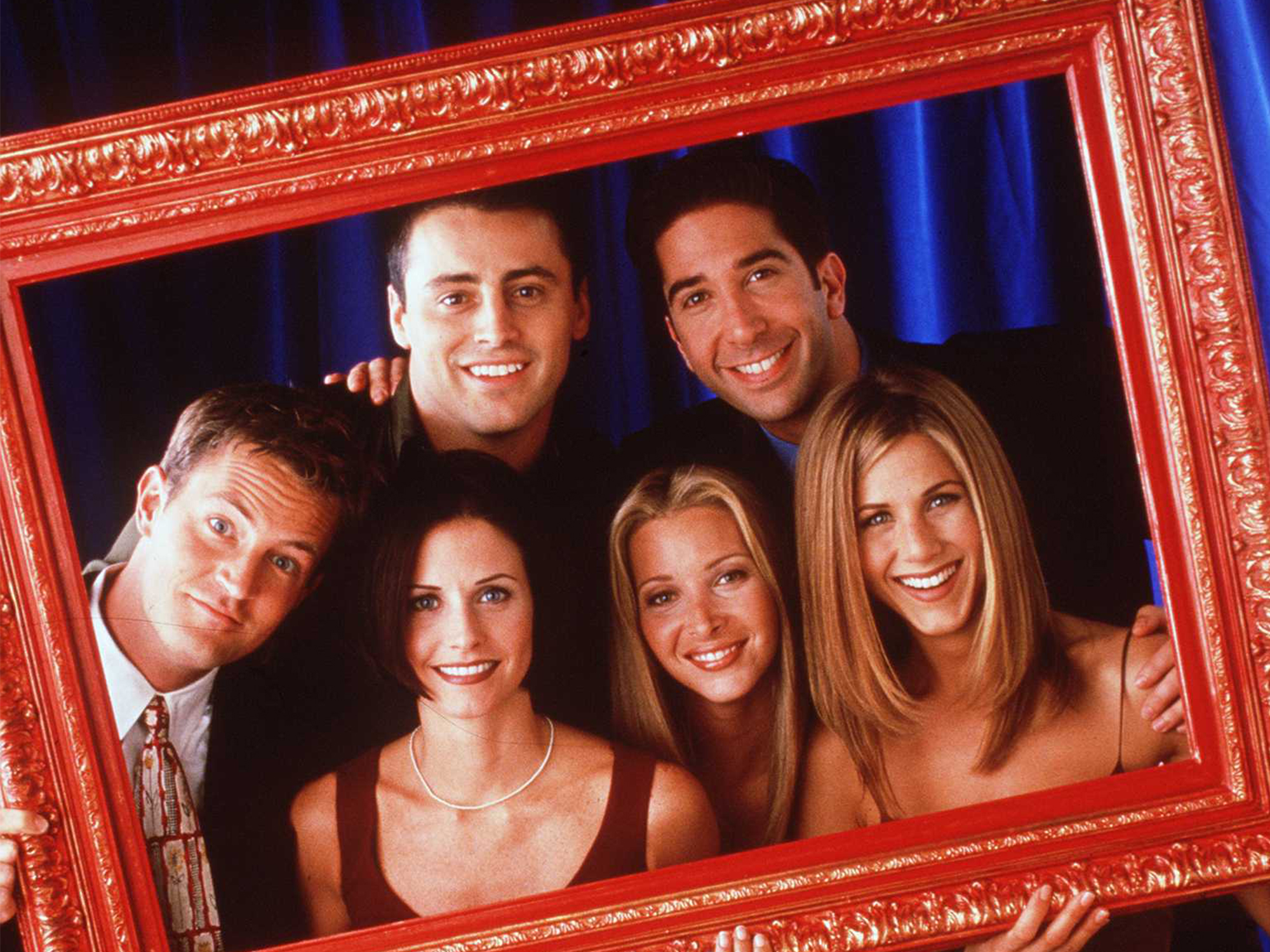

At home with cabaret artist Carla Mattiazzo. Photo: Nick Clayton.

It was often joked that she could sing before she could speak, so it’s little wonder Carla Mattiazzo blossomed into a cabaret artist.

The 34-year-old has certainly come a long way since those lounge room debuts, performing at the likes of Adelaide Fringe, Sydney Fringe and Adelaide Cabaret Festival.

“I was the kid that would get my family, neighbourhood kids and friends together to put little shows together. In all honesty, I would rather not exist if I couldn’t create and perform,” she says.

Over the past two years, Carla has been working on her own show ‘The Catchelorette’ which debuted at last year’s Adelaide Fringe to much acclaim.

“The inspiration was my ‘love’ live – oh boy, material just seems to find me,” she says.

Despite postponing her Australian tour due to COVID-19, Carla says she’s keeping positive.

“If Australia is COVID-19 free and restrictions have evaporated, The Catchelorette will be at The World Fringe in Perth in January 2021,” she says.

“Until then, my pianist Lainie Jamieson and I are performing a Christmas special/online show in December via Instagram and we are about to start a podcast in September based on my cabaret show. Look out for The Catchelorette and Friends on Spotify.”

Facebook.com/carlasconfessionalcabaret

MORE NEWS:

Pick the best family home design

Why this villa sold for almost $60,000 more than expected

Character home that starred on House Rules snapped up

At home with cabaret artist Carla Mattiazzo. Photo: Nick Clayton.

At home with cabaret artist Carla Mattiazzo. Photo: Nick Clayton.

AGE

34

WORKLIFE

Cabaret artist.

CAREER HIGHLIGHTS/BEST KNOWN FOR …

2020 Adelaide Fringe Best Cabaret Award for ‘The Catchelorette’.

I’VE LIVED IN MY HOME FOR …

Six months.

MY HOME IS A …

Joyful and calm place.

I LIVE WITH …

Maximus Sparticas and April (my fur babies).

I LOVE MY HOME BECAUSE …

My dogs live here ha, it is decluttered, colourful and full of purposeful art that reflects my travels or my cabaret achievements.

BUT I STILL NEED TO …

Get a proper front hall table and bar stools for the kitchen.

At home with cabaret artist Carla Mattiazzo. Photo: Nick Clayton.

At home with cabaret artist Carla Mattiazzo. Photo: Nick Clayton.

MY DECORATING STYLE IS …

Colourful minimalist.

RECENT PURCHASE

Squeaking Pig gin.

I COLLECT …

Dresses/gowns.

FAVOURITE PART OF YOUR HOME

Ohhh that is so hard. Studio because of my cabaret gowns. Lounge for the layout and because the doggies hang out in there.

HOME FAVOURITES

■ Doggies.

■ Pink terrazzo pots/stands as they remind me of my Nonna Anna’s bathroom floor.

■ Art.

IN MY GARDEN I HAVE …

Nothing, it is minimal, grass with edge of mulch and out the front some natives.

WHEN I GET HOME AT NIGHT …

I am cooking, hanging out with doggies, dancing, singing, reading and occasionally watching the television.

AT WEEKENDS I LIKE TO …

Walk the dogs, see friends and family, go to pilates, barre or yoga … and shop.

MY FIRST CAR WAS …

A VY Commodore wagon.

At home with cabaret artist Carla Mattiazzo. Photo: Nick Clayton.

At home with cabaret artist Carla Mattiazzo. Photo: Nick Clayton.

I LIKE TO LISTEN TO …

Beyonce, Alicia Keys, JT, Armchair Expert, Just the Gist, Wilosophy, the old crooners and the old soulful divas.

AT THE MOMENT I AM READING …

Talkin’ Up To The White Woman – Indigenous women and feminism by Aileen Moreton-Robinson.

FAVOURITE FILM

La Dolce Vita and Nine the musical.

CLEAN FREAK OR MESSY BESSIE?

Clean freak.

ON MY WISHLIST IS …

An automatic vacuum … all the dog hair.

WHEN I’M HOME I LIKE TO COOK …

My home cooking is basic and clean. Vegan and gluten free over here.

FAV CAFE/RESTAURANT/ BAR

Brother Bear, Hains and Co, Casa Bla Bla, Tell Henry and Nutrition Republic.

FAVOURITE DRINK?

Water ha ha … watermelon juice.

At home with cabaret artist Carla Mattiazzo. Photo: Nick Clayton.

At home with cabaret artist Carla Mattiazzo. Photo: Nick Clayton.

WHEN I WAS A CHILD I WANTED TO BE …

A singer.

FAVOURITE CHILDHOOD MEMORY

Playing with my animals in the backyard and singing to them while I jumped on the trampoline.

FAVOURITE SA HOLIDAY SPOT/ACTIVITY

Carrickalinga / Lady Bay and hiking at Mt Lofty or the Marino walk.

DREAM HOLIDAY DESTINATION

Spain, Africa, Hawaii and NYC.

SOMETHING YOU WANT TO ACHIEVE IN THE NEXT 10 YEARS?

World Cabaret Domination and love/marriage/baby … these eggs are getting old.

MY NEIGHBOURS ARE …

They keep to themselves.

I COULDN’T LIVE WITHOUT …

My dogs.

IF I COULD AFFORD IT I WOULD LIVE IN …

Walkerville, Florence, Italy, NYC, Melbourne or Hyde Park.

HOME MEANS …

Peace.

The post At home with cabaret artist Carla Mattiazzo appeared first on realestate.com.au.