Convinced renting is the low risk alternative to buying? You could be right. In these desirable suburbs, by choosing to rent, you’re paying far less than the cost to own the home you live in.

2020 has thrown a few curveballs. If you were planning to buy this year, you might be having second thoughts. The good news is, right now, it’s a renter’s market.

Whether you plan to buy in the future or not, renting right now makes a lot sense, says Sam Nokes, head of property management at Jellis Craig Stonnington, Richmond and surrounds. He says, in particular, it’s a tenant’s market for inner-city dwellers.

“Some properties have remained popular throughout the COVID-19 downturn but, overall, the inner city is the place for deals,” Nokes says. “Look at the CBDs in most capital cities; there is huge vacancy with next-to-no new tenants entering the market.

“If you want to live in the CBD, now’s the time.”

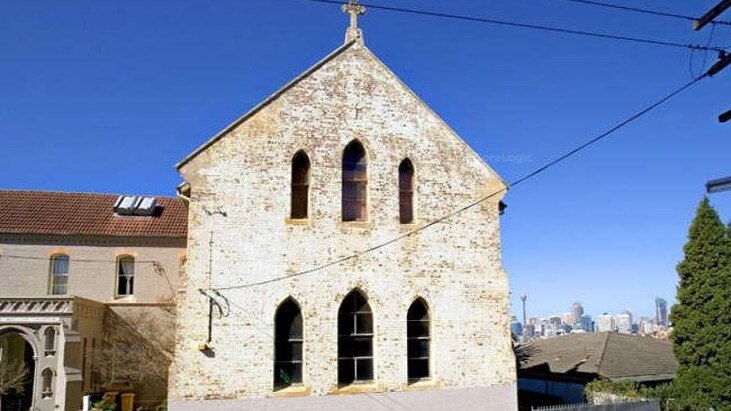

This property in Woollahra, which sold for $3.2m in 2019, has been snapped up by savvy tenants. Picture: realestate.com.au/rent

When there’s risk in the market, renting is a safer bet, says Nokes.

“We’re facing the likelihood of a long and deep recession and prices might keep going down,” he says.

However, if buying is in your future plans, he cautions on holding out too long.

“If you look at New Zealand, their selling market took off when lockdown ended and those waiting missed their opportunity,” adds Nokes.

Where to find rent at a fraction of the cost of owning

Need some help deciding where to ride out the storm? We looked at realestate.com.au data to find the top 10 suburbs around Australia where the cost disparity between monthly rental payments and monthly mortgage repayments was greatest – in favour of renting.

The monthly repayment, based on the suburb median house price, is calculated with a 20% deposit and 3.02% interest rate for monthly repayments over 30 years. The monthly rent, based on the suburb median rent, is calculated by weekly rent x 52 (weeks) / 12 (months). The data is restricted to two-bedroom properties.

Land value has nothing to do with rent

Topped by Woollahra in Sydney’s east, riverside Nedlands in Perth and North Bondi, part of Sydney’s trendiest beach locale, the list of suburbs where rental payments are cheaper than mortgage repayments is a promising set for any renter concerned with maintaining a hip lifestyle.

Poolside living in North Bondi is yours for the fraction of the cost of buying. Picture: realestate.com.au/rent

In Woollahra, you’ll make a saving of as much as $3,857 a month by renting! That’s not even taking into account what you’ll dodge in the outlay for the deposit.

“What this tells us is that land value has nothing to do with rent,” Nokes says. “A house on a large block and a house on a small block usually don’t differ greatly in rent. Good and great streets also don’t always have a large impact. What matters more to rent is what you get to use, not what you get to own.”

In suburbs like Woollahra, Nedlands and North Bondi, “what you get” is access to a great lifestyle. If you were planning on moving away from the inner city this year to buy a property in the suburbs, you might want to consider holding onto the lifestyle perks a little longer. It might not cost you that much more if you rent.

On the rental market for $800 a week, there are homes in Mount Waverley you’d pay a lot more to own. Picture: realestate.com.au/rent

In Victoria, which has seen greater economic impacts of the coronavirus pandemic than any other state, it was not inner-city but leafy eastern suburbs around 10-15km from the Melbourne CBD that made the top 10 list of suburbs where rental payments are far less than mortgage repayments.

“Surrey Hills and Mount Waverley are great examples of where the land values have surpassed the rental values because tenants aren’t really concerned with how much land they get,” Nokes explains.

“Both of these areas also have a lot of older properties where the land value is high. These are more likely to be leased out than the large luxury homes that push up sales prices in these areas.”

Scroll down to find the top two suburbs where it’s cheaper to rent than buy in your home state or territory.

Individual states and territories

These are the top two suburbs in each state where it’s cheaper to rent than buy.

Listed by suburb, monthly rent, estimated monthly mortgage payment and the monthly price difference.

ACT had no suburbs where it was cheaper to rent than buy, while Tasmania only had one.

NSW

Woollahra – $3,857.14 – $7,608 – $3,751 cheaper to rent

North Bondi – $4,500 – $7,498 – $2,998 cheaper to rent

QLD

Camp Hill – $1,800 – $2,654 – $854 cheaper to rent

Bardon – $1,842 – $2,491 – $648 cheaper to rent

SA

Prospect – $1,542 – $2,066 – $523 cheaper to rent

Norwood – $1,800 – $2,290 – $490 cheaper to rent

Tasmania

Sandy Bay – $2,357 – $3,085– $728 cheaper to rent

Victoria

Mount Waverley – $1,800 – $4,466– $2,666 cheaper to rent

Surrey Hills – $1,992 – $4,624 – $2,631 cheaper to rent

WA

Nedlands – $1,928 – $5,139 – $3,211 cheaper to rent

Cottesloe – $2,421 – $5,072 – $2,650 cheaper to rent

Still need help deciding on a suburb? Talk to friends, neighbours, the hairdresser, your barista – anyone who’ll listen! – about your options. A second opinion never hurts.

The post Top 10 suburbs where it’s cheaper to rent than buy appeared first on realestate.com.au.