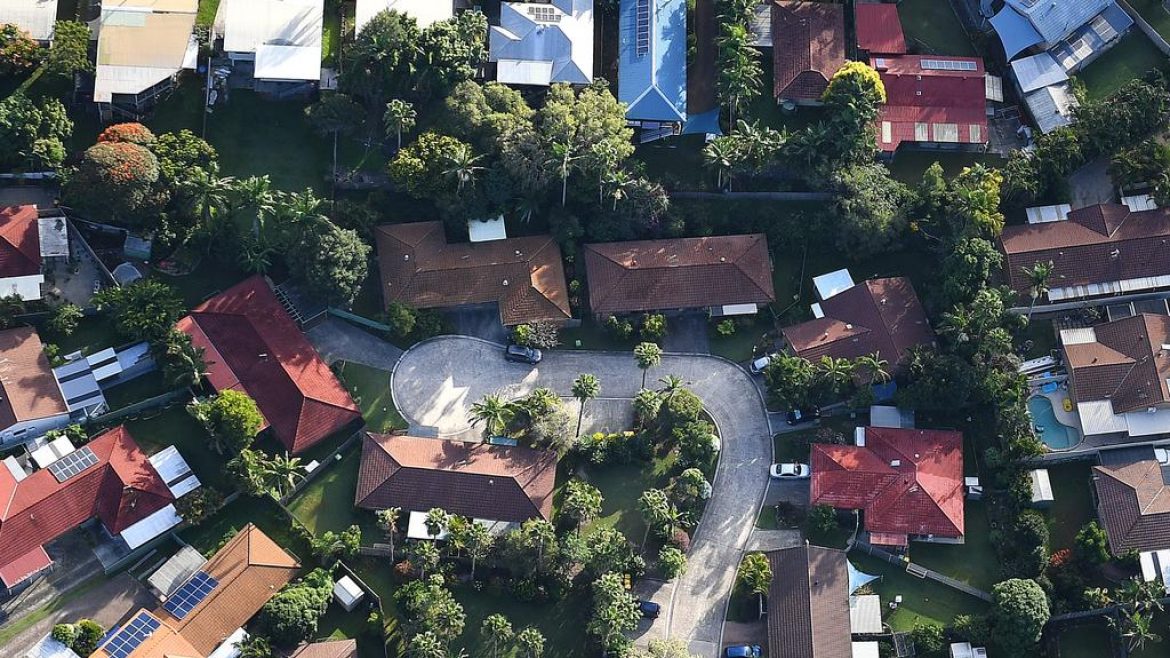

Billie Chrisofi has 20 properties in her portfolio.

A Melbourne-mum-of-four has revealed her savings and investment secrets which led her to owning 20 houses by the age of 37.

Billie Christofi, director of property investment service Reventon, started saving and investing from the age of 16 to be able to buy her first home at just 22.

RELATED:

Where home prices are falling fastest

Man with 200 houses bags six more during lockdown

Teacher with 16 homes says opportunity is being missed during COVID-19

Ms Christofi bought her first property on a part-time wage and took advantage of the first homeowners’ grant.

“It was a big moment, and one I’d worked towards for a long time,’ Ms Christofi told Femail.

View this post on InstagramFresh air 💙 #reflectiontime #peace #newpaths

A post shared by Billie Christofi (@billie_christofi) on Jul 21, 2020 at 1:40am PDT

She sold the house just 18 months later – and it had increased in value by $150,000.

“I used this capital to then buy two properties and kept compounding after that using the growth of my investments to leverage and buy more properties,” Ms Christofi told Femail.

From a young age, she also put her money into shares and entered the commercial property market, she said.

The Melbourne mum now has an portfolio of 20 different properties. Picture: iStock

Twenty properties later, Ms Christofi has four homes in her personal name and 16 together with her husband – and she’s looking to buy her 21st property through her superannuation.

The mum recommends looking at your cashflow and savings to see where you can buy in the market as a good starting point, then gaining equity so you can invest further. She said it pays to take risks, but only if you’re not going to end up with debt.

View this post on InstagramWhen your first drink out of fasting is worth every drop… #lastweek #brokethefast 🍷🍷🍷

A post shared by Billie Christofi (@billie_christofi) on Mar 16, 2019 at 9:01pm PDT

Ms Christofi said it’s important to be disciplined with savings and spending, cutting back where you can and being mindful of how you’re spending – especially avoiding impulse purchases. She advised to wait 24 hours before making a purchase decision on anything that is considered a “want item”.

MORE: Friends’ star selling ‘kickass beach house’

Suburbs where lower salaries can now buy

$12m mansion built by toilet brush empire

“The impulse tends to wear off if you give it some time,’ she said. “It’s so easy for spending to get out of hand. I advise people to sit down and tabulate their finances the old-fashioned way with a budget table and dissect where their finances are going.”

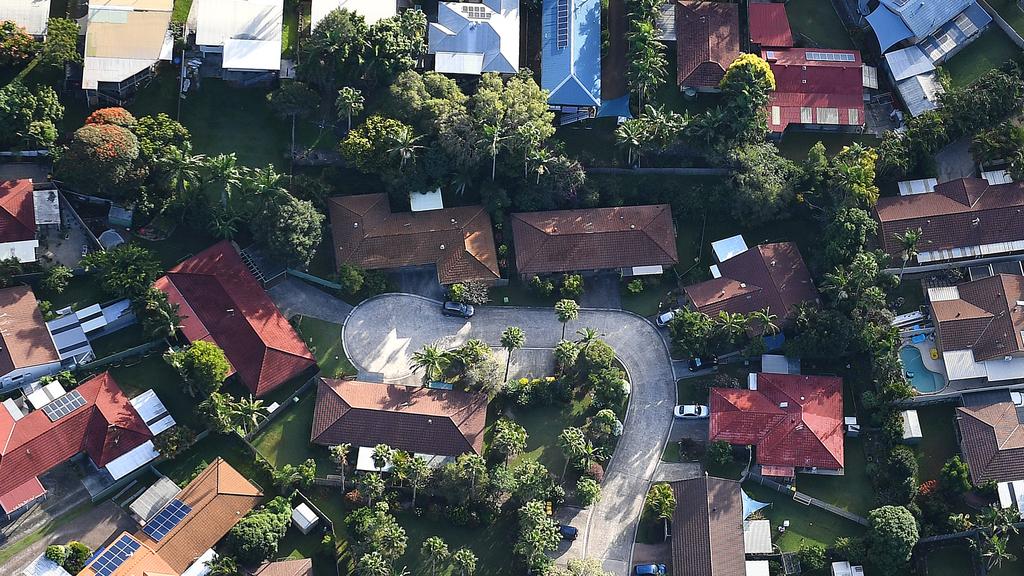

She’s now looking to buy her 21st property through superannuation.

It’s important for women to not leave all the financial decisions to men, she added, reiterating it’s vital to educate yourself and “take charge” of your own money.

“Play an active role in understanding money and getting the support you need to make sound investment decisions,” Ms Christofi said. “You should learn to do your own research and understand what is right for you and your affordability.”

View this post on InstagramA post shared by Billie Christofi (@billie_christofi) on Jan 13, 2019 at 6:25pm PST

As the director of her own property investment service, she has helped 3000 clients gain financial progression and build their wealth. She also recommends seeking the help of a financial adviser.

The post Melbourne mum reveals her simple strategy to building a 20-house portfolio appeared first on realestate.com.au.