The direct-to-consumer homebuying and selling platform is live in Jacksonville, Florida.

Blog

Bigger may be better but, as Harry and Tash have discovered, that doesn’t mean it’s easier.

After days of umming and ahhing, the father and daughter duo became the first contestants to use their Hipages lever, which gave them access to a small army of tradespeople, free of charge.

Contestants usually hold off using this lifeline until much later in the competition, when energy and cash is in short supply.

But, faced with the prospect of renovating a master bedroom that was almost double the size of their competition, in a week cut short by a public holiday, Harry and Tash bit the bullet and called in the troops.

A good thing, too, as the pair felt this huge room was their biggest chance to create a showstopping space that could finally knock Jimmy and Tam off the top of the leaderboard.

RELATED: Favouritism allegations hit The Block 2020

The one thing you won’t see on The Block again

Luke and Jasmin’s doorless walk in robes

“There is no way we could finish with the $19,000 budget we have with the time that we have, with the size of room we have,” Tash explained of their decision to pull the lever.

The only concern was whether they might have left their run too late. And that was thanks largely to foreman Dan, who spent most of the previous days talking Harry out of getting the extra help.

Having tired of trying to talk him out of trying to get back on track without the Hipages lever, Dan instead turned his attention to niggling the poor man about how far behind he was with his epic renovation project.

“With Harry we still have to hold his hand and babysit him because he’s still a bit lost,” Dan moaned before detailing, yet again, how Harry took too long to make decisions or get work done.

Amid all the hard slog, the exhausted teams were called off site to take part in one of the naff games presided over by hosts Scott Cam and Shelley Craft.

Scotty was in his element with this particular game as the sound engineering team had given him access to a fart sound effect, so beloved of schoolboys, which he played with increasing hysteria every time an unsuspecting real estate agent launched into his spiel about the Brighton property market.

Luckily, agents are fellows with sizeable enough egos not to let a little thing like a gassing gag distract them from delivering their pitch.

The aim of this, “Guess how much the property is worth?” quiz was to decide which real estate agent each team would use for their auctions. There was also a gnome up for grabs, which gave the winning team $5000 in cash and a bonus point to add to the judges’ scores. And the gnome was won by — you guessed it — serial success stories Jimmy and Tam~ Watching the Queenslanders pocket yet another prize left the still empty-handed remaining teams more than a little disgruntled.

Jasmin feels she’s being victimised by a wardrobe company.

Mirror, mirror on the wall, who was the most fed-up of all? That would be Jasmin, whose foul mood following yet another loss to Jimmy and Tam was compounded by having to shell out for a dressing room mirror.

Why, she moaned, did she have to pay when the wardrobe supplier Kinsman had supplied them free of charge to the other teams?

Shelley poured more fuel on the Jasmin fury fire when she and Scotty popped in to give them a pep talk and pointed out that their walk-in wardrobe didn’t look very luxe without doors.

The mother-of-two was left in tears, ranting that Kinsman had talked her into cheap-looking white wardrobes and then refused to give her a mirror.

However, Scott wasn’t going to let a much loved (and lucrative) show sponsor have their reputation trashed on air.

He confronted a defeated Jasmin with footage of her consultation with the wardrobe designer which showed that she was behind the poor design choices she was now complaining bitterly to all and sundry about.

And she could have had a mirror, too, had she not told the Kinsman rep she was “too busy” to talk to them when they were giving a limited number away to contestants. Whoops.

Scott sets Jasmin straight about her Kinsman claims

Scott decided to stir the pot with other contestants too, pointing out to Jade and Daniel that if Jimmy and Tam kept winning, they would have such a giant pool of prizemoney that they would become unbeatable.

Fellow host Shelley pointed the finger of blame back at Scott. It was his turn for some criticism.

“You’ve created this,” Shelley said of Jimmy and Tam’s winning streak.

“By handing out the same budget every week it now means no-one can splurge on a room except the people who’ve won money.”

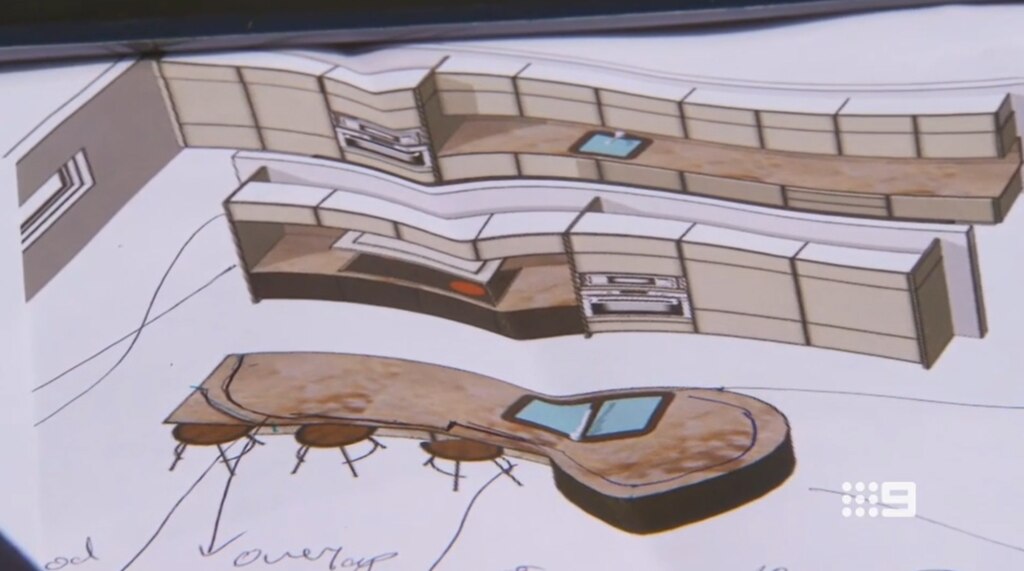

That wasn’t the worst of Jade and Daniel’s problems. A visit from their agent revealed a major (phallic) flaw in their kitchen floor plans.

“That looks like a penis to me,” the bewildered agent said of Jade and Daniel’s unusual long and bulbous kitchen bench design.

Daniel and Jade’s penis shaped island bench cum dining table

He added that their amended lay-out would make the property difficult to sell because people don’t want kitchen benches that double as a dining room. He urged the couple to abandon the changes they had made to the architect’s original plans ASAP.

Unfortunately, all the couples had to lock in their kitchen designs way back in week one, so it was a race against time to cook up a better plan for the room.

A quick call to Kinsman (yes, yet another plug for these cupboard manufacturers) and some time spent with a tape measure, meant the couple could reconfigure the cupboards, appliances and that trouser-snake-shaped bench into the original location, giving them far more living space.

So, fingers crossed that listening to their agent will be winner, winner, chicken dinner come kitchen week.

And that X-rated bench? It has survived, in a slightly more discreet position.

MISSED AN EPISODE?

Episode 9 recap: Favouratism allegations hit The Block

Episode 8 recap: Judges pull no punches on grieving Daniel and Jade

Episode 6-7 recap: Sack your builder: Keith slams ‘pathetic’ work

Episode 4 recap: Luke and Jasmin’s big stuff up

Episode 3 recap: “So two years ago”. Team’s boring room slammed

Episode 2 recap: Disappointment as Block houses are handed out

Episode 1 recap: Block 2020 tears start flowing early

The post The Block 2020 episodes 10 and 11 recap: The new rule that could wreck the season appeared first on realestate.com.au.

In an ongoing effort to open up its technology, Matterport’s Capture app will now work with 3D camera maker Insta360’s new ONE R line of devices.

Veteran real estate professionals share what it takes to build a business, forge relationships, manage finances and create a mindset built for success.

This week, we want to hear about the worst marketing and branding blunders you’ve seen throughout your career. What was your takeaway from it? How could it have been avoided?

Personas are semifictional representations of your ideal customers based on data and research. This is how they come into play when defining your brand and understanding your target market — and why they can help agents attract, serve and retain clients.

The WomanUP! Conference, which took place last week, was jampacked with insights and inspiration for agents. Here are 10 important takeaways agents should consider when making a survive-to-thrive mindset shift.

People living and working in Melbourne face a difficult path out of tough COVID-19 restrictions after the Victorian Government revealed its long-awaited roadmap on 6 September.

Despite a dramatic decline in weekly average case numbers, the government announced a conservative plan to bring the state into what it is calling ‘COVID normal’ – the scenario where there are no new cases for 28 days and no active cases.

The plan is to maintain restrictions on business to prevent large numbers of the community coming into contact with each other and spreading the virus, with the goal of bringing case numbers down to a sustainable and manageable level while the world waits for a vaccine. All of this relies on weekly case numbers remaining very low.

Melbourne’s roadmap out of coronavirus restrictions will depend on keeping average fortnightly case numbers low. Picture: Getty

Impacts of stage 4 restrictions on the real estate industry

With physical inspections on properties banned in metro Melbourne, the real estate industry has largely been paused. However, a number of home sales in more affluent areas have bucked this trend, selling sight unseen.

Tenants experiencing financial distress learned that moratoriums on evictions have been extended for tenants in Melbourne.

Melbourne’s real estate industry will not fully reopen until 23 November under the roadmap. But once that happens, the industry is expected to come back to life with a longer spring season, even pushing into the traditionally quiet period around the Christmas and New Year holiday period.

Impacts of stage 4 restrictions on the construction industry

Effective from 5 August, construction of critical and essential infrastructure and services is allowed provided the workplaces have a High-Risk COVID Safe Plan in place. Critical repairs to residential premises are also allowed, where required for emergency or safety.

Electricians, plumbers, tilers, concreters, plasterers and carpenters have been included on a list of specialist trades allowed to move between up to three sites per week, meaning that many people in the trade and construction industries can continue to work.

How do property and construction contribute to the economy?

When it comes to the ways in which these industries contribute to the broader economy, the effects will be felt across the state, said Cameron Kusher, executive manager of economic research at realestate.com.au.

“In Victoria, dwelling investment contributed 6.7% to the state’s gross state product and transactions of properties accounted for a further 1.9% of total GDP,” Mr Kusher said.

“While this may sound like a small proportion, it is a significant contributor to economic growth and with transactions in Melbourne virtually ceasing it will contribute, among other things, to a weakening of Victoria’s economic performance.”

Construction and real estate are big employers within the Victorian economy. Picture: Getty

Fewer property transactions will mean that government revenue from stamp duty will fall from previous levels, which typically helps pay for things like roads and hospitals, said Mr Kusher.

“The latest data shows that in 2018-19, Victoria was getting approximately $121 million in stamp duty revenue each week.”

What are the changes to restrictions announced in the roadmap?

The changes announced on 6 September included a multi-step rollback of the toughest restrictions experienced at the peak of stage 4 restrictions.

From 28 September, provided case numbers are below 50 on a fortnightly average:

- Two people or a household can meet outdoors

- The limit on outdoor time is increased from one hour to two

- Those living alone can have one visitor to their home

- Childcare and parks reopen

Other changes proposed from 26 October, provided case numbers are below five on a fortnightly average:

- No curfew

- No more 5km restriction on travel

- Phased return to school for primary and secondary students

- Retail reopens including hairdressers.

The post Melbourne stage 4 extension: New roadmap for property explained appeared first on realestate.com.au.

Auctioneer Stuart Davies and agent Michael Pallier at a Vaucluse auction that delivered the sellers more than $7m. Picture: Gaye Gerard

Sydney’s home auction market has been heating up despite the weaker economy and sellers in some pockets have been scoring prices that would have been unthinkable six months ago.

New research showed auction clearance rates have been creeping up over the past month and there were more than 10 sales over $5m in August – unusual for the normally quiet winter selling period.

The top recent sale was the $8.65m paid for a Hunters Hill estate on Point Rd, while Manly, Burraneer and Vaucluse had sales over $7m.

MORE: How prices will change this spring

High drama at north shore auction

The clearance rate for August sales was 68.1 per cent – marginally higher than the 65 per cent rate reported over July, according to data from My Housing Market.

The August clearance rate was boosted by strong sales in the closing weeks of the month – the clearance rate for the last two weeks of August was over 70 per cent.

Top regional performers were the northern beaches with a clearance rate of 73 per cent and the Central Coast with a rate of 72.3 per cent.

My Housing Market reported this indicated “rising pre-spring buyer momentum”.

Real estate experts said the auction market defied a wider slowdown in the housing market as a whole because upsizing families were struggling to find houses with backyards.

The shortage, combined with strong demand for this housing category, created ideal conditions for auction campaigns.

The auction at 12 Harkness St, Woollahra, which sold for $5.71m. Picture: David Swift

“There isn’t much quality stock on the market. The homes that tick all the boxes are getting a huge response from buyers when they come up for sale,” McGrath agent Charles Stevens said.

“It’s the opposite in the unit market. Sellers are getting smashed because they don’t have any point of difference.”

My Housing Market economist Andrew Wilson said in a recent report that spring was shaping up well for the market.

“The prospects for the Sydney housing market continue to improve with the clear likelihood of a typically active spring selling season ahead with upward pressure on prices set to emerge,” he said.

Auctioneer Andrew Cooley at the sale of 42 Bulls Rd, Burraneer, which sold at a record auction price for the Shire.

“The local challenges from coronavirus constraints remain but have clearly waned over recent months with consumer confidence on the rise.

“Governments continue to provide strong support for economies under stress which remains a positive factor for a resurgent Sydney housing market.”

TOP AUCTION SALES IN AUGUST

1. 7A THE POINT RD, HUNTERS HILL $8.65M

2. 31 OLOLA AVE, VAUCLUSE $7.25M

3. 42 BULLS RD, BURRANEER $7.1M

4. 3 WOOD ST, MANLY $7.05M

5. 6 LISTER AVE, LITTLE BAY $6.4M

6. 46A WOOLWICH RD, HUNTERS HILL $6.35M

7. 22 LLANDILO AVE, STRATHFIELD $6.305M

8. 12 HARKNESS ST, WOOLLAHRA $5.71M

9. 19 WALLANGRA RD, DOVER HEIGHTS $5.65M

10. 26 JAMES ST, FIVE DOCK $5.1M

.

The post Top winter auction sales: properties change hands for up to $8.6m as clearance rates rise appeared first on realestate.com.au.

It wasn’t too long ago that issues like price rises, interest rates and negative gearing dominated one of Australia’s favourite backyard barbecue topics, the property market – but COVID-19 has changed all that.

The coronavirus crisis has seen vast changes across almost every aspect of Australian culture, also filtering into our obsession with real estate and shifting the focus to a new set of issues.

New data from realtime media monitoring provider Streem shows news reports about residential property prices in Australian media dropped significantly between March and August 2020, compared to the six months prior.

This change is largely because “coronavirus is taking up so much media oxygen”, said the company’s Media and Partnerships Lead, Conal Hanna.

“A study we did earlier this year found coronavirus reached up to a point in March where it was being mentioned in about 80% of stories being published [across Australian media outlets],” Mr Hanna said.

But while media coverage of property prices might have fallen during the pandemic, some real estate issues have gained traction.

The new topics in Australian property

Mr Hanna said the best way to sum up the changes in Australian property price reportage since COVID-19 is to say there is “less reporting on housing as an asset and more reporting on housing as a basic human need”. In particular, renting coverage has spiked.

Since March, property media coverage including the topic of landlords increased by 147%, while renters and rental prices went up 41% and 30% respectively.

Australia’s rental market has been hit hard amid the health crisis, with swathes of young renters, many of whom work in the hospitality and tourism sectors, forced to vacate their homes due to job losses and financial hardship.

As a result, rental listings have increased on realestate.com.au and landlords have been left with the difficulty of finding tenants to inhabit their investment properties, pushing many to offer rent reductions and other perks as incentives.

As a property industry spokesperson, chief economist at realestate.com.au, Nerida Conisbee, said she has never before discussed the rental market as often as she has since the pandemic.

“If you think about it, the really big impact from COVID [so far] has been on the rental market, but we haven’t seen such a huge impact on house prices… there’s been a real shift in the discussion [in the media] around renting,” Ms Conisbee said.

Meanwhile, the topic of open homes increased its presence in property media coverage by 199% in the six months to August 2020, compared to pre-lockdown times when widespread bans on open homes were unimaginable let alone newsworthy.

Mr Hanna said Streem recorded a huge spike in media conversation around open homes between March and May.

COVID has opened the door to a brand new way of talking about property. Picture: REA Group

“The conversation pretty much increased by about 500% overnight, just because it was literally something that people can relate to so much. Not many people feel confident buying a house without having been inside…so when all those [lockdown] rules came in that had real impacts on the conversation,” he explained.

Among the other topics that gained traction in property price coverage between March and August compared to the six months prior to the health pandemic were listings (6%), stamp duty (6%) and auctions (5%).

In addition, media talk of property price falls increased by 40%, while discussions around property price rises dropped by -33%.

Meanwhile, mentions of sellers increased by 20% and buyers dropped by -9%, but there were still more mentions of buyers overall.

The news items that have “fallen off the radar”

On the flip side, interest rates, a once hotly-awaited news item, dropped by 50% in the six-month period, which is a very significant decline given its dominance as a property news issue before the coronavirus crisis.

“Australia as a country has been fairly obsessed by interest rates…I certainly remember working on news desks when the first Tuesday of the month was watched extremely closely for any movement because there was a huge public interest in what was happening with interest rates,” said Mr Hanna, who is a former journalist.

“But now they’ve been fairly locked and they’re not going anywhere anytime soon, so there’s really a lot less media coverage on that as a topic.”

The RBA’s interest rate announcement was once the most hotly-awaited property news item. Picture: Getty.

Ms Conisbee echoed Mr Hanna’s sentiment saying interest rates have become “irrelevant” in the current climate. “They can’t go any lower, and they’re certainly not going up so, for now, they’re quite irrelevant as to what’s happening,” she said.

Meanwhile, the once much-discussed topic of negative gearing showed a -68% decrease in mentions in property media coverage in the six months from March, followed by capital gains (-62%), housing affordability (-60%), bubble (-48%) and housing stock (-33%).

Real estate coverage has a new vocabulary

In terms of broader real estate coverage in Australian media since the pandemic took hold, certain words have become far more prevalent.

The word COVID showed the biggest increase in frequency, but this is because the word didn’t even exist before the health crisis. Similarly, the words coronavirus, lockdown, Victoria and restriction all showed increases.

But while some words have been popping up in property news stories more often since the pandemic, other once-popular words are becoming less popular, such as growth, investment, China, trade war and Donald Trump.

“International border closures have had real impacts on the ability to attract foreign investment in property, causing topics such as investment to fall off the radar,” said Mr Hanna.

“The trade war itself with China is something that 12 months ago, in particular, was a really hot topic, as well as the ramifications for that on different industries, so that’s something that’s fallen from the headlines a little bit this year,” he added.

Where is the property conversation headed?

With the spring selling season upon us, it’s possible the property conversation could take on new, or even old, dimensions, said Mr Hanna.

“In spring there is plenty of activity in the property market and you tend to see plenty of activity in the media off the back of that…it will be interesting this year to see whether that leads to a return to the traditional coverage of property or not,” he said.

The spring selling season could re-shape the property conversation yet again. Picture: realestate.com.au/buy

Ms Conisbee predicts the topic of intergenerational equity will emerge as a hot topic in property in the coming years, particularly as a result of the coronavirus crisis.

“COVID is impacting the health of older people the most, but is impacting the livelihoods of young people the most,” Ms Conisbee explained. The long-term financial consequences for young people will likely see many of them locked out of the property market.

“Intergenerational equity has been ramping up over the past four years… now when I’m talking to boards or I’m at events with really senior people in the industry, it’s quite mainstream for them to talk about this rising unfairness.

“I think that will be a continued discussion…it’s going to get worse because COVID has hit young people the most in terms of employment loss, so that inequity is becoming even greater as a result of COVID.”

How does news impact consumer behaviour in the property market?

Media coverage of any kind has a powerful impact on those who consume it because it helps people work out how they “feel” about a particular issue, according to Dr Paul Harrison, chair of Consumer Behaviour and Marketing at Deakin Business School.

“Most people aren’t experts, and so they go to their trusted sources to help them work out how to feel about something,” Dr Harrison said, adding that people tend to look for information that confirm their beliefs.

“So if we’re feeling like the real estate market is in a decline, we tend to be more responsive and take more notice of reports that say that’s the case.

Most people look to their trusted news sources to help them decide how they feel about an issue. Picture: Getty

“If we’re feeling uneasy about the market and all of the evidence or all of the things that we’re reading tell us that there is reason to be uneasy, then that kind of reinforces and feeds into our current kind of thinking.”

He said deciding to purchase a property is an incredibly emotional choice, which makes consumers even more sensitive to what is being discussed in the media, but whether or not that has the power to shape the sector depends on how close consumers are to the decision.

“If you’re thinking about buying a rental property for Super or something like that, you would have quite a strong emotional response [to the current media coverage about the rental market], but if you have 30 investment [properties]… then it’s not going to have as much of an effect because you’ve got a less emotional attachment to those investments,” Dr Harrison said.

The post How COVID-19 has reset the property conversation appeared first on realestate.com.au.