Last week, we asked you, our readers, to share the important things that are helping you get through the year and keep your business afloat. Here’s what you had to say.

Blog

Month: <span>August 2020</span>

Looking for a little clarity on this week’s news? Windermere Chief Economist Matthew Gardner dives deeper into the lesser known components of the Case-Shiller Home Price Index and what they can tell us about the health of the market.

Buying new construction is typically much more involved than purchasing a resale, and there are often a lot of moving parts and COVID-19-induced challenges. Here are eight things buyers should know about buying a new home in 2020.

Three real estate investing experts share their thoughts on coronavirus-induced urban flight and what it means for property investors.

Brad Inman kicks off today’s Connect Now digital event with a talk from the heart. Read an excerpt, and make plans to join us today live at 11 a.m. ET / 8 a.m. PT.

Melbourne’s stage four lockdown could cut back access to HomeBuilder grants.

Melbourne homebuyers could miss out on the federal government’s $25,000 HomeBuilder grants as a result of the stage four lockdown.

Victoria’s construction industry groups are urgently negotiating fine detail to the planned restrictions amid fears they will hit harder than intended.

Key concerns are understood to centre around whether tradespeople will be able to move between sites and projects during the six-week shutdown, as well as if land development and civil works will be able to continue — vital to preparing land to be built on for the grants.

RELATED: Victoria stage four restrictions: How COVID lockdown will affect real estate, inspections, auctions

Victoria stage four restrictions: How COVID lockdown will affect property and construction industry

HomeBuilder facing weeks long delay as nation awaits digital portal

A raft of industry restrictions including caps on tradespeople on sites were announced yesterday by Victorian Premier Daniel Andrews, who described the coming six weeks as part of a “pilot light phase” for builders and developers.

The Master Builders Association of Victoria and the Urban Development Institute of Australia’s Victorian chapter will work through high-level meetings with state government and Department of Health and Human Services teams overnight to address concerns the industry could be practically shut down despite an intention to keep the “pilot light” on.

UDIA Victorian chief executive Danni Hunter said changes to civil works could have significant ramifications for homebuyers and could drastically cut the land able to be built on in time to access the federal government’s $25,000 HomeBuilder grants.

A limited supply of titled land could impact Victorians’ ability to find somewhere to build.

“We were already pushing hell and high water to get more lots to meet demand for HomeBuilder,” Ms Hunter said.

“And if we can’t keep going on the normal rate we won’t be able to deliver. We would say it (HomeBuilder) needs to be extended in Victoria for at least six months and possibly 12 to get us through the shut down and the period needed to start up again.”

RELATED:

Builders worried apartments, townhouses caught short by HomeBuilder grants

New figures reveal almost 10,000 Victorians have registered interest in HomeBuilder

Recent land sales figures recorded by real estate research firm RPM Real Estate indicate Melbourne notched more than 2000 land lot sales in June, with a similar amount in July.

The firm previously warned with just 2700 titled lots available as of June, only about 2000 more could be added to the supply by December 31.

Federal government figures showed almost 10,000 Victorians had registered interest in the grants by the end of June.

The industry is still concerned over missing details over the looming shutdown.

To date, no Victorians have been able to access the grants scheme, announced on June 4, as the state and most of Australia awaits the completion of an online portal for applications.

Industry sources indicate it could be operational by mid this month, which has prompted some home builders to flag they will be exceptionally busy in the coming shutdown.

Burbank Group managing director Jarrod Sanfilippo said they were yet to “capitalise” on sales made over the last two months thanks to the grants.

“So there is a lot of work to be done to convert the idea of HomeBuilder to the actual contract and to get the site started.”

Ms Hunter added that while documents leaked earlier in the week had hinted no new construction would commence after the 11.59pm Friday deadline to reduce building site workforces to bare minimums, there had been no confirmation this was the case.

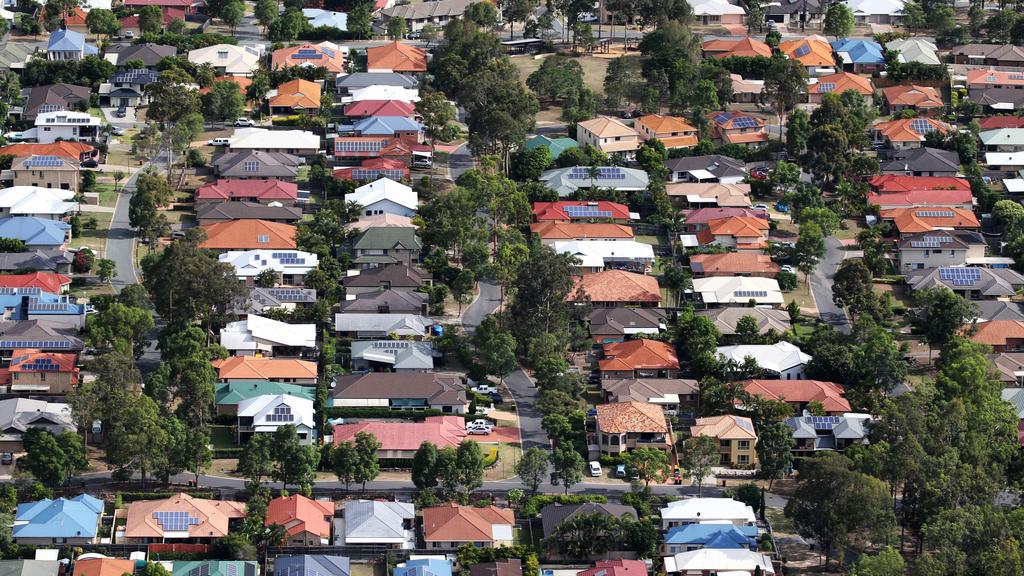

It is believed Melbourne home builders will be able to commence construction under the “pilot light phase”. Picture: David Caird

“There is no advice to say they can’t commence new projects,” she said.

MBAV chief executive Rebecca Casson said onsite COVID-19 testing, daily sanitisation and temperature screening showed the industries commitment to beating the virus.

However, she warned there were still “challenges ahead” as they worked with the DHHS and state government.

“This scaling down of the building and construction industry will have a huge impact on the Victorian economy,” Ms Casson said.

“Given the 300,000 strong workforce and the 13 per cent of the economy it accounts for we could be looking at daily losses in revenue of up to $456 million with what has been announced. Many businesses will have to consider whether it’s feasible to work under the conditions as they are written.”

She also flagged the industry was seeking more clarity on how the 25 per cent capacity rule would be applied to large commercial projects.

The industry has had an acknowledgement from the Premier to say clarifications were needed and that anomalies would be cleared up.

MORE: How COVID lockdown will affect real estate, inspections, auctions

How COVID lockdown will affect property and construction industry

Skybarrels: Buninyong villas to thrill on extinct volcano’s edge

The post HomeBuilder: Melbourne’s stage four restrictions could hurt grants appeared first on realestate.com.au.

At its regular monthly meeting on Tuesday, The Reserve Bank of Australia held official interest rates at 0.25%, where it has been since mid-March.

The RBA acknowledged that the Australian economy is going through a very difficult period and is experiencing the biggest contraction since the 1930s. But as difficult as this is, the downturn is not as severe as earlier expected.

At its meeting today, the Board decided to maintain the current policy settings, including the targets for the cash rate and the yield on 3-year Australian Government bonds of 25 basis points – https://t.co/YnEMgjQzYX

— RBA (@RBAInfo) August 4, 2020

However, in a statement, the Central bank said: “this recovery is likely to be both uneven and bumpy, with the coronavirus outbreak in Victoria having a major effect on the Victorian economy.”

On Sunday, Victorian Premier Daniel Andrews announced six weeks of stage 4 restrictions for metropolitan Melbourne in a bid to stop the spread of coronavirus cases, which have surged in the state. Premier Andrews also placed all of regional Victoria into stage 3 lockdown.

The RBA has decided to hold official interest rates at a record low 0.25%. Picture: Getty.

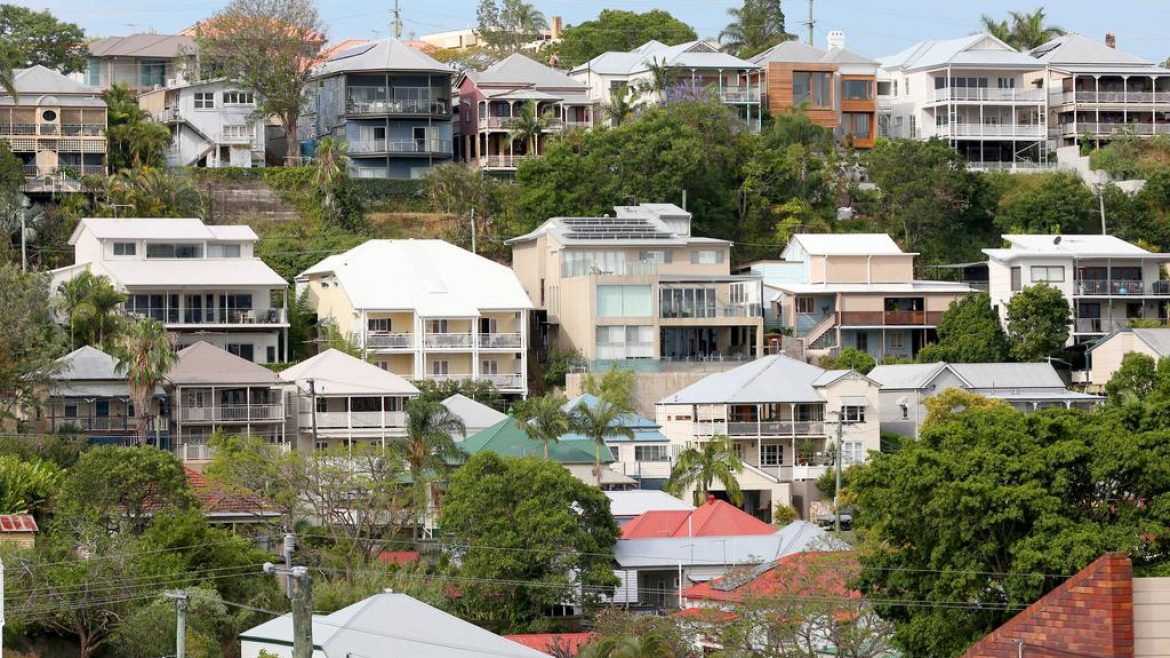

Stage 4 lockdown across metropolitan Melbourne is expected to cause a slow down in the real estate and housing sectors.

The RBA has signalled it would not start lifting interest rates until inflation approached its 2-3 per cent target range and the jobs market was strengthening.

Interest rate rise “even further away” amid Melbourne’s stage 4 lockdown

Given what’s happening in Melbourne, an interest rate hike looks even further away now, said executive manager of economic research at realestate.com.au, Cameron Kusher.

“Although the RBA has forecast inflation to remain on target for the next few years, it seems the bank is not willing to use additional unconventional monetary policy to help spur on inflation,” Mr Kusher said.

“Given lockdowns in Melbourne, the bank is now forecasting a higher peak unemployment rate than federal treasury predicted last week.”

In a baseline scenario, the Board predicted output would fall by 6% over 2020 and then grow by 5% over the following year. In this scenario, the unemployment rate would rise to around 10% later in 2020 due to further job losses in Victoria and more people elsewhere in Australia looking for jobs. Over the following couple of years, the bank expects the unemployment rate to decline gradually to around 7%.

According to federal treasury’s July Economic and Fiscal Update, weighing up the devastating impact of the health crisis on the economy, unemployment in Australia is expected to peak at 9.25% by Christmas. That’s another 240,000 people out of work.

More to come.

The post RBA holds interest rates at record low as Melbourne enters stage 4 lockdown appeared first on realestate.com.au.

Star Casino CEO Matt Bekier has sold in Vaucluse. Picture: Justin Lloyd.

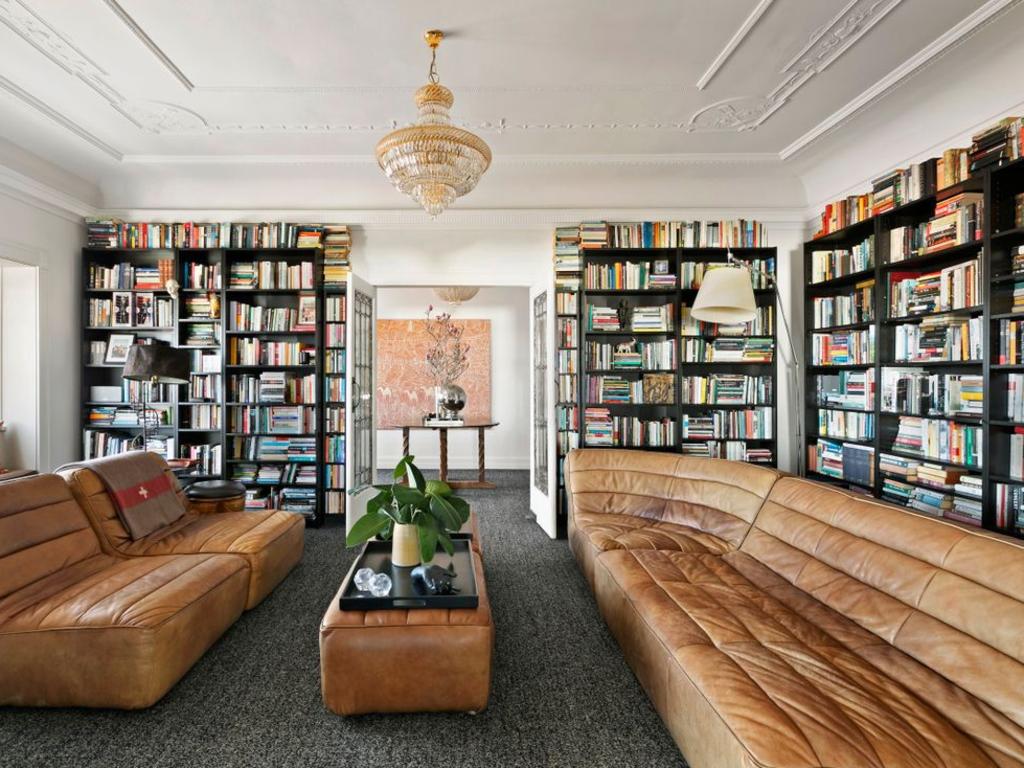

The Star casino chief Matt Bekier and his wife Melinda snappily sold their seven-bedroom, five-bathroom Vaucluse home last week.

It had been listed with a $7.5 million to $8.2 million guide by Raine & Horne agent Samuel Schumann.

MORE: Hemsworth reveals new plans for Byron estate

Notable chef lists inner city base

A gorgeous spot in the heart of Sydney.

It’s easy to see why it sold so quickly.

It seems it happened so quickly the agency hadn’t quite updated the open for inspection web notifications, so hopeful attendees were still turning up yesterday.

The three-level house last traded in 2012 for $4.05 million when sold by former rugby league player-turned hotelier Steve Bowden.

They bought it in 2012.

Opulent.

The home was bought shortly after Bekier departed Tabcorp, where he was CFO.

Fairview’s prior owners include the art dealer Marlene Antico. It now comes with $667,000 approved plans from Weir Phillips Architects that would see a top floor redesign, accessed by a spiral staircase as well as a lift.

The Bekier’s have owned a beachfront house at Callala Beach on Jervis Bay since 2014 that cost $1.1 million.

The post The Star casino chief Matt Bekier sells seven-bedroom Vaucluse home appeared first on realestate.com.au.

Homeowners who refused to refinance were losing thousands in extra interest payments according to experts. Picture: Richard Walker

It’s taken the coronavirus pandemic to do it, but just under half of mortgage holders – who lose thousands in “loyalty tax” on expensive home loans – are now ready to kick their financier to the kerb to capitalise on record low rates.

MORE:

Instant property mogul: 10 homes for just over $3m

‘Ramshackle’ QLD reno named Australian House of the Year

The Caribbean meets Gold Coast glamour

Experts are predicting that interest rates on mortgages will continue to fall despite the Reserve Bank of Australia today deciding to ignore the market, holding its cash rate target at 0.25 per cent.

The market had predicted that the RBA board would cut the official cash rate to zero at its August 4 meeting on Tuesday.

Governor of the Reserve Bank of Australia Phillip Lowe has defied market predictions that the official cash rate would drop to 0.00 per cent.

“The ASX 30 Day Interbank Cash Rate Futures August 2020 contract was trading at 99.875, indicating a 57 per cent expectation of an interest rate decrease to 0.00 per cent at the next RBA Board meeting,” according to the ASX RBA Rate Indicator – August 2020.

But as COVID-19 takes its toll and mortgage rates hit record lows, many borrowers who have also been sitting on their hands can’t justify inaction any more.

RateCity.com.au research found that the percentage of people keen to refinance had doubled in just two years, jumping from 19 per cent after the banking royal commission in 2018 to 43 per cent now.

It warned that owner-occupiers were wasting thousands of dollars on high mortgage costs, paying over 1 percentage point more than they needed to.

RateCity research director Sally Tindall said “the loyalty tax gets worse the longer you stick with your bank”.

“It’s taken a pandemic to get people to shift their mindset, but hopefully we’ll come out of it more budget-conscious and less complacent towards our mortgages,” she said. “People won’t just tolerate overpaying anymore.”

If they switched to the lowest ongoing variable rate, they could save $2,805 in the first year, the research found, with the figure rising to $19,235 over five years including switching costs, on a typical $400,000 owner-occupier loan. The calculation was based on an owner-occupier who switched five years into a 30-year loan.

Experts say market rates will continue to drop despite the RBA not moving on the official cash rate target. Picture: NCA NewsWire/Jeremy Piper.

“The latest figures from the ABS for May showed refinancing increased 63 per cent compared to last year, and our research suggests it is not losing steam.”

“The best way you can get a rate cut is to turn yourself into a new customer and switch. If you aren’t in a position to refinance, pick up the phone and try some old-fashioned haggling with your bank.”

According to Canstar’s database, there were 64 cuts to variable home loan rates and 201 cuts to fixed rates in July alone. “Variable rates were cut by an average of -0.19 per cent while fixed rates were cut by an average of -0.24 per cent.”

Tips from Canstar to manage your personal finances:

Home loan repayment strain:

Switch to a lower rate if you can right now and pour any savings into your offset account to help reduce the interest burden.

Savings goal:

Switch to a higher earning savings account and play the rate game of chasing a better promotional offer every three or four months.

Credit card debt:

Look at a balance transfer offer and get the debt down during the interest-free period, but don’t add more debt along the way.

Source: www.canstar.com.au.

Canstar home loan expert, Steve Mickenbecker, said “now is the time for borrowers to be in budget repair mode”.

“You don’t have to be alarmist to see now as the time to look for massive loan repayment savings, while you can. Anyone with a mortgage who has been fortunate enough to avoid any impact to their income during the pandemic could be right for refinancing to save more on their monthly repayments. The door to refinance could still be open for borrowers who have seen their income reduced as long as they are making their regular loan repayments.”

FOLLOW SOPHIE FOSTER ON FACEBOOK

The post ‘It’s taken a pandemic’ but 43pc ready to ditch home loans now appeared first on realestate.com.au.

The appointment marks a return to RealtyTrac for Rick Sharga who previously served as senior vice president of the foreclosure listings and search portal from 2004 to 2011.