HomeLight announced on Tuesday the acquisition of listing management platform Disclosures.io and its rebrand to HomeLight Listing Management.

Blog

Month: August 2020

One in three tenants impacted by the coronavirus pandemic had requests for rent reductions ignored or rejected without reason, leaving some “facing homelessness”, a damning new report has revealed.

The Tenants Victoria survey of 370 renters also found many struggling renters didn’t even ask for discounts, with 16 per cent stating they were too “scared”, 19 per cent claiming they were confused by the system, and 12 per cent noting they were discouraged by their real estate agent’s behaviour.

Tenants Victoria chief executive Jennifer Beveridge said she was concerned by the startling number of respondents who refrained from asking for reductions despite being eligible.

RELATED: Melbourne’s most popular rental streets: Federal St, Footscray No. 1

HomeBuilder grants: 1100 Victorians apply in a week

West Footscray California bungalow renovated with contemporary industrial edge

Tenants face a looming end to the eviction ban in September.

“We have a new cohort of people who are experiencing financial disadvantage through COVID-19 and they’re not at all used to asking for help,” Ms Beveridge said.

“They’re going to other places for help or they’re burning through whatever savings they have, or finding other ways to get through.”

Of the tenants who did ask, 22 per cent said they were told the landlord needed the income, or that they were ineligible for a rent cut, usually without advice on eligibility requirements.

A further 12 per cent of landlords offered to defer rental payments to a later date rather than agree to a reduction, leaving their tenants at risk of future debt.

RELATED: Coronavirus: Very few Victorian tenants have secured rent reductions

Just 2 per cent of respondents said their landlord initiated a discount without them having to ask.

Ringwood tenant Jarrod Farr applied for a rent reduction after losing his job as a project manager during Melbourne’s first lockdown.

But his requests fell on deaf ears after his property manager claimed they were unable to make contact with the landlord.

“At the moment, without exaggerating, I’m facing homelessness in a month,” Mr Farr said. “I’m not trying to bludge, I’m paying as much as I can afford.”

Mr Farr said he feared his landlord was waiting until Victoria’s eviction ban ended in late September to boot him out of the property.

Madeline Byrne rents with her Italian Greyhound pup Vinny. Picture: Sarah Matray

Courtney Windross lost her job at a local restaurant due to COVID, but her partner’s income and JobKeeper payments have kept them in their rental. Picture: Alex Coppel.

Premier Daniel Andrews flagged an extension of the moratorium on evictions for struggling residential and commercial tenants in early August, but further details have not yet been released.

Tenants Victoria is calling for an extension to the end of March, to align with the end of the federal government’s JobKeeper payments.

“Landlords are in the business of providing homes for people and we forget that,” she said. “At a time like this when we’re being told to stay at home, they’re not complying with the social contract around protecting the housing of the renter.”

Barry Plant Doncaster East’s director of property management, Brendan Di Rago, said some owners were “hurting just as much as tenants”, but “just having to make a deal” regardless.

“There are still tenants hurting and they’re requesting extensions,” Mr Di Rago said.

“It’s a big, vicious circle.”

He said while discussions between tenants and landlords had often been “heated” during Melbourne’s first lockdown, tensions had since simmered.

A recent Victorian parliamentary inquiry report showed more than 17,500 rent reduction agreements were registered with Consumer Affairs Victoria by July, at an average discount of $155 per week or 27 per cent.

READ MORE: Victoria dominates list of happy sellers

Croydon house buyers are dying to inspect after stage four eased

St Kilda sales: Melbourne lockdown prompts spending splash

The post Struggling Melbourne tenants ignored by landlords: report appeared first on realestate.com.au.

No. 306 Widgiewa Road, Carwoola is up for sale.

Dreaming of a French provincial lifestyle but not keen to leave Australian shores?

This stunningly-crafted, rustic, stone and timber property at Carwoola, a mere 30-minute drive from Canberra, could be the perfect fit.

Created and nurtured by artist, Kerry McInnis, alongside Mike MacGregor, an industrial engineer who specialises in metal work, 306 Widgiewa Road evokes sentiments of a French provincial home amid the peaceful privacy of the Australian bush.

MORE: Chance to buy into exclusive cul-de-sac

Canberra’s most in-demand streets

Grand Forrest home perfect for car enthusiasts

The property, dubbed Heaven’s Bridge, features a coverage carriageway, stone courtyard and striking stone walls, as well as timber doors constructed from recycled bridge timbers.

A romantic setting.

Beautiful stone work.

Beautiful cottage gardens, soaring native trees, an orchard and the meandering Whiskers Creek, which flows through the property, provide restful natural surrounds.

Selling agent Ryan Broadhurst, from Belle Property, Queanbeyan, said the property represented a tale of two worlds – a secluded position on a bush block, yet just half an hour to the heart of Canberra.

“Two artists have built this property over the last 30 years. They’ve built it themselves and it’s absolutely beautiful,” Mr Broadhurst said.

“It really has the best of both worlds – 40 acres within half an hour’s drive to the centre of Canberra.”

The two-storey property offers three bedrooms in the main home, which has a cosy fireplace and hand-forged detailing in the main living area, while the breakfast room captures a vista of the garden and orchard.

Cosy living.

There are several buildings that are part of the property.

There are several outbuildings including an expansive artists’ studio with a mud brick machinery workshop and built-in forge. In addition, there is a self-contained cottage and studio with a sprung wood floor that could cater as a dance, yoga or martial arts space.

The garage has capacity for three vehicles and there is also an attic.

The property is due to go to auction on Thursday 3 September at 5pm.

The post French provincial living in the heart of the Australian bush appeared first on realestate.com.au.

Buyers looking to secure a bargain should look no further than Townsville, with sellers offering the biggest vendor discounts in Australia’s regional markets.

CoreLogic’s latest quarterly regional review, which analyses 25 of Australia’s largest non-capital city markets, found that Townsville sellers were, on average, offering a discount rate of 5.9 per cent to secure a sale on their house.

There be some hefty discounts out there yonder. Picture: Evan Morgan

But buyers should act fast, with that vendor discount rates falling from 7 per cent one year ago.

Townsville houses are also selling faster, down from a median days on market of 62 days a year ago to 55 days today.

The stunning renovated miners cottage in South Townsville has seen a “big price reduction” and is now listed for $339,000. Source: realestate.com.au

It is a similar story for units, with vendor discounting falling from 6.9 per cent to 6.2 per cent and days on market down from 70 days to 62 days.

As a result, the number of houses and units changing hands has significantly increased, and is up 9.7 per cent on a year ago and 1.5 per cent on the five year average.

This has resulted in the median sales price for both houses and units are also gaining ground.

MORE NEWS: Townsville property market at ‘start of recovery’

Critical rental sector in free fall

Landlords set to win as vacancy rates tighten across QLD

It is a similar story in Cairns, where vendor discounting has dropped 0.7 per cent to 4.3 per cent for houses and 0.6 per cent to 4.7 per cent for units.

However, the time on market for units has increased from 59 days to 72 days, likely the result of the brakes being applied to the tourism sector due to COVID-19. Time of market for houses remains unchanged at 58 days, according to CoreLogic.

The rate of vendor discounting and the length of time a property stays on the market has also decreased in the resource rich region of Mackay-Isaac-Whitsunday, which has seen a resurgence in the mining sector.

The South Townsville miners cottage has been beautifully renovated.

CoreLogic head of research Tim Lawless said that regional housing values, broadly speaking, had so far held up better during the pandemic than their capital city counterparts.

Tim Lawless

He said that dwelling values across the combined regional areas of Australia had slipped by just 0.1 per cent between March and the end of July, while capital city home values were down 2 per cent over the same period.

“While the region by region data shows diversity, the relatively steady conditions across the regional markets of Australia can probably be attributed to factors such as less impact on housing demand from stalling overseas migration,” he said.

“Also there likely remains some momentum in the trend towards rising demand for lifestyle properties that was prevalent prior to COVID-19.”

Mr Lawless said that regional areas offered up a variety of advantages and risks compared with their capital city counterparts.

“On the positive side, housing prices tend to be lower, providing a more affordable entry point to the market, population densities are generally lower which is something that might be even more appealing as we move through this pandemic, and in many examples, regional areas will offer some lifestyle advantages, either via the locations proximity to the coastline or wide open spaces,” he said.

“On the downside, regional economic conditions can be more volatile, especially those areas that are heavily dependent on a single industry for economic prosperity, and some areas may not show the same level of amenity and access to essential services as a capital city or major centre.”

This executive home in Annandale is listed for $845,000-negotiable after a price reduction.

In Townsville, vacant lots are hot property, with new home and first home buyers making the most of generous government incentive, and some established houses are selling in hours, in some cases sight unseen by interstate buyers desperate to flee the big smoke.

And considering the cost of a similar house in Sydney or Melbourne, its a bargain.

Many residents have also returned home to Townsville, with others shifting to town before borders closed, driving down the rental vacancy to a record low of 1.7 per cent.

That’s down from 2.9 per cent in March, and the record high for the city of 7.1 per cent in September 2016, according to the latest REIQ Vacancy Rate Report.

REIQ CEO Antonia Mercorella said regional Queensland vacancy rates were the tightest since the GFC.

REIQ CEO Antonia Mercorella. Picture: Supplied

Meanwhile, the Herron Todd White Month in Review Report for August has both the Townsville house and unit markets at the “start of recovery”.

The REA Markets Trends report for August shows that the biggest vendor discounts for houses in Townsville are currently being offered in Heatley, Condon and Mundingburra.

A renovated miners cottage in South Townsville and an executive home in Annandale are just two of the Townsville properties that have seen price reductions.

***

Top 10 suburbs with the greatest average vendor discounting

Heatley -10.5%

Condon -9.2%

Mundingburra -8.7%

Aitkenvale -8.4%

Rasmussen -8.1%

Kelso -7.9%

Deeragun -7.8%

Currajong -6.4%

Cranbrook -5.9%

Douglas -5.3%

(Source: REA Market Trends Report – August)

The post Where to bag a bargain before vendor discounts dry up appeared first on realestate.com.au.

This floating house at 6-7 Sand Close Indented Head was inspired by Modernist architecture.

The coronavirus lockdown has sparked unprecedented interested in a private bayside hideaway for sale in Indented Head.

There’s been a flood of inquiry from Melbourne buyers keen to swap city life for the 6300sq m oasis with a Modernist-inspired home just 200m from the beach.

With a swimming pool, entertainment pavilion, self-contained cottage and separate home office, 6-7 Sand Close, Indented Head is ideal for isolation.

RELATED:

Clifftop Clifton Springs property has private beach access

Past Geelong mayor’s house ready for next chapter

Lakeside dream home nets big price

Spend lazy summer days by the pool.

There’s a great outdoor connection in the living room.

RT Edgar, Point Lonsdale Felix Hakins said he had already received one offer within the first week of the campaign.

Expressions of interest in the four-bedroom house close on September 7, with price expectations of $1.85m-$2.035m.

Mr Hakins said the level of buyer inquiry was “remarkable” and he was fielding phone calls and emails every hour.

The swimming pool and decking separates the main house from the self-contained cottage. home office and garage.

The main bedroom has a lovely garden view.

He said he was working to set up some form of a virtual open home so Melbourne buyers could inspect the house from a distance.

“The response to the market has been amazing with everyone trying to get out of Melbourne,” he said.

“It is like the perfect time to be marketing it.

“We’ve also had interest locally.”

Plywood, solid timber and a Corian benchtop feature in the kitchen.

Multiple decks provide options for relaxing.

The self-contained studio could be used for a short stay or guest accommodation.

The secluded house is surrounded by native landscaped gardens and a thriving vegetable patch that paves the way for a self-sufficient lifestyle.

Passive design, solar panels and water tanks are incorporated into the eco-friendly package that includes hardwood floors, plywood details and a Cheminees Philippe wood fire.

Walk to the bay.

Green thumbs will be in their element.

The pool, pond and decking links two pavilions, one of which is home to the main living zone, three bedrooms and two bathrooms.

Mr Hakins said the self-contained one-bedroom cottage provided great flexibility to accommodate extra family members, while the separate home office had never been more appealing.

The post Coronavirus real estate: Bayside haven sparks huge interest appeared first on realestate.com.au.

The Hyams Beach property is described as “arguably the trophy beachfront property in the village with an extra wide frontage, elevated position and of course private beach access”.

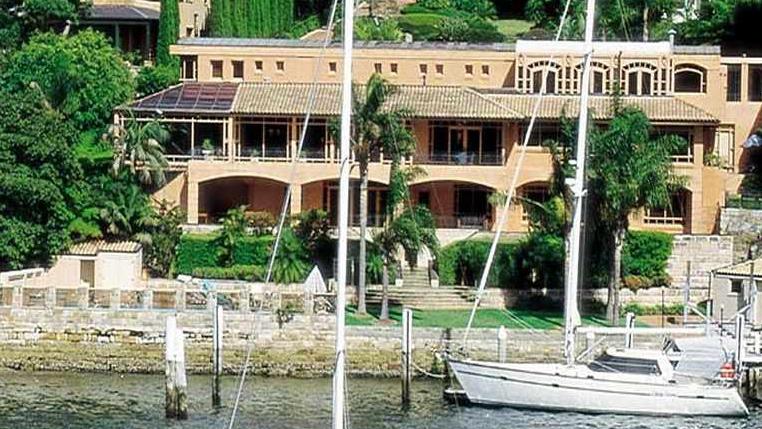

Yachties Jim Cooney and Samantha Grant — who took line honours in the Sydney to Hobart last year in Comanche — have bought a $4m beachfront holiday home at Hyams Beach.

The couple, who reside in the seven-bedroom Kurraba Point mansion ‘Shellcove’ purchased for $13.5m in 2004 on Sydney’s lower north shore, are already renovating the three-bedroom Cyrus St property that they’ve snapped up off-market from Vaucluse eye surgeon Ilan Sebban and wife, Shira, a writer.

The July 1 sale is still short of the Hyams Beach record price of $4.8m, when the Canberra-born but now Jersey-based businessman and philanthropist Graham Tuckwell — with an estimated net worth $683m — and his wife, Louise, purchased a beachfront on a 1,378 sqm block a few doors along in May, 2018. Though that had two homes on the block.

Amid the COVID-19 travelling restriction period, buyer’s agent Simon Cohen was known to have been scouting for a beachfront property for a mystery client in the tightly held town of just 143 homes, famous for its well-publicised “whitest sand in the world”.

The local real estate agent, Craig McIntosh, principal of the Holidays Collection, was tight-lipped, but sources said that he had helped identify a willing seller.

MORE:

Randwick house price record smashed

Tim Minchin eyes off $10m mansion

Jim Cooney and Samantha Grant with their son, James, after Comanche won line honours in the 2019 Sydney to Hobart Yacht Race. Picture: Richard Jupe.

The Hyams Beach property has panoramic views.

The outlook extends all the way up the “whitest sands in the world” to the navy base.

But it was only when CoreLogic reported a July 1 sale of the Sebban home to a company linked to Cooney and Grant that the cat was out of the bag.

On a wide 1433sq m block, the home has panoramic ocean views taking in Point Perpindicular lighthouse and the famous stretch of sand all the way to the HMAS Creswell navy base.

When the property last traded in 2013 for $2.6m, it was described as “arguably the trophy beachfront property in the village with an extra-wide frontage, elevated position and of course private beach access”.

Steps lead down to the beach from the home.

Renovations are already underway.

The view from the beach.

There are two bathrooms, two rumpus areas, a large open-plan kitchen, dining, lounge and a single garage.

All the living areas and a wide deck around the front of the house capture the amazing views of Jervis Bay.

Entry to the property is secluded and well treed along the rear boundary.

Despite residing over the Bridge, Cooney and Grant have close ties to Sydney’s east.

The couple reside at Shellcove, in Shellcove Road, Kurraba Point, purchased for $13.5m in 2004.

The view from the terrace of Julia Cooney’s Darling Point apartment purchased for $8.67m in 2018.

Comanche in full flight. Picture: Rolex/Carlo Borlenghi

In June 2018, the Wentworth Courier reported that Cooney had bought a luxurious $8.67m six-bedroom duplex on the waterfront at Darling Point for his university student daughter, Julia, then aged 20.

And last year he bought a block of land on the Point Piper waterfront for $22.5m before later selling it for a similar figure.

Cooney had sold his wireless telecommunications business TCI to Service Stream for $45 million in 2006.

The post Yachties Jim Cooney and Samantha Grant buy ‘trophy beachfront’ at Hyams Beach appeared first on realestate.com.au.

With 11 per cent of mortgages in loan deferrals, concern is rising about how struggling homeowners will cope.

The coronavirus pandemic has had a dramatic effect on homeowners, with more Aussies now acutely aware of financial fallout – but there’s a ticking time bomb in the wings for some.

MORE: Luxury builder lists his dream home

Tenants warned of rent increase pain

Welcome to QLD’s power streets

The latest Financial Consciousness Index by Comparethemarket.com.au and Deloitte Access Economics found a silver lining off COVID-19, saying more people had become financially aware as they worked to reduce the impact of the pandemic’s economic downturn.

It found 8.9 million Aussies save 10 per cent or more of their income each pay cycle, up by 1.6 million people compared to last year, with the proportion highest in ACT (52 per cent), with Queenslanders least able to do so ( (41 per cent).

Changing mortgage repayment options to interest only is one of the strategies some homeowners have employed to rebuild savings for a period during COVID-19.

But Comparethemarket general manager digital banking, David Ruddiman, said while the health crisis had forced many people to be more conservative in their spending because of job security fears and reduced incomes, the lagging effect on the economy was the unknown right now.

“Unfortunately we do have a situation where 11 per cent of mortgages are in loan deferrals,” he said, with the top 20 authorised lending institutions seeing 11 per cent of their $195 billion in mortgage related debt in deferrals by mid-year.

“Initially when relief was granted to banks to put people on repayment pauses in late March, they gave them until September and then they have to commence paying. But deferment means that interest keeps accruing, and many australians whose loans are in deferment will find their loans will be bigger than when they went into repayment pause.”

Mr Ruddiman said some options for people looking to adjust finances included changing mortgage repayment options to interest only to rebuild savings for a period, downsize to reduce the size of home loans and set a budget by looking at household expenditure and ways to save money.

”If we want to see our economy bounce and we don’t want house prices to plummet, we need to be more aware of financial circumstances. Little things can have a big impact on people that are really struggling. My message on big ticket items like homes is if your home loan doesn’t start with a 2 you’re failing in terms of taking action. You’ve got to get out there and take action.”

Queenslanders were bang on the national average for overall financial consciousness, scoring 51/100 for the FCI test, up from 48 last year.

Queenslanders scored 51/100 which was also the national average financial consciousness score.

There was some good news at the lower end of the spectrum too, with a 10 percentage point reduction in the number of Queenslanders who were failing the test, sitting at 33 per cent this year compared to a massive 43 per cent last year.

New South Wales, Victoria, and South Australia also aligned with the national average, according to the third annual study which looks at financial sophistication, willingness, capability and wellness.

“Research around this report indicates people are certainly thinking about finances more and it’s also fair to say because we’ve had these lockdowns, the vast majority of us who are full-time employed have been able to save more.

He warned that Australia was yet to feel the true impact of the pandemic on the economy, given government assistance was helping cushion the blows right now.

“It’s not the great equaliser that everyone thought it was going to be. It certainly has caused a divergence of people, with some affected more than others, for example, white collar workers coming out better compared to blue collar workers.”

The impact on industries like hospitality and tourism had also increased the gender gap, with females affected more.

FOLLOW SOPHIE FOSTER ON FACEBOOK

The post COVID-19 has changed homeowners: Survey appeared first on realestate.com.au.

46 Maning Avenue, Sandy Bay. Picture: SUPPLIED

ASTONISHING, awe-inspiring, remarkable … there are a bunch of words that spring to mind when visiting this large family property in one of Tassie’s finest suburbs.

No.46 Maning Avenue, Sandy Bay is perched at the top of its street on a block of land that near boggles the mind.

Charlotte Peterswald for Property director Kim Morgan says it is one of the last properties in the avenue and it stretches out across 2700sq m of land.

“That alone in Sandy Bay is exceptional,” he said.

“It is a beautiful, private and secluded property where the home is surrounded by a wonderful, private and well-established garden with a little rivulet running through it — not something you see a lot of in this suburb.

“You can cross a bridge to a garden gazebo, which gives you a different perspective on the house.

“It is quite a lovely, secret garden type of location.”

Make a splash.

Selling point.

Private oasis.

Kim expects the size of the property will be among the things that jump out at potential buyers.

He said in some ways it was an unconventional property in that it is so spacious with five bedrooms and five living spaces, too.

“There is a home theatre room that the current owner uses for entertaining with a projector on the wall and the addition of a grand piano and an organ,” he said.

“There is a formal lounge and formal dining area alongside less formal spaces like the mezzanine sitting room with an open fireplace.

“It is a huge home that would be a delight for entertainers.”

Upon arrival at the property, landscaped greenery lines a gently winding driveway, leading to the elevated front entrance of the impressive home.

From the wide, central staircase, room after room expands across either side of the home, ascending to the master suite at the very top.

Light and airy.

Cook up a storm.

Time to relax.

The north-facing kitchen is highlighted by granite benchtops and crisp, white tiles and cabinetry.

The culinary space extends outside to the split-level, sun-drenched timber deck overlooking the pool and an outdoor kitchen and barbecue encased in stainless steel.

Privacy is paramount around the pristine pool, which is sheltered by low trees while capturing the maximum warmth from the sun. Adjacent, a hot tub and sauna add to the elements of complete relaxation and contemporary luxury.

Adding to the decked area, indoor and outdoor dining options are seemingly endless.

The lavish formal setting opens to a side patio with its own open fire, a casual sitting area below the kitchen, and a large sheltered balcony overlooking the glorious gardens.

At the apex of the home, three generous bedrooms provide quality and comfortable accommodation.

Entertainer’s paradise.

Parklike grounds.

Soak in the tub.

The master, with private access to the back yard and pool area, comes complete with a walk-in dressing room and a luxurious ensuite with an oval spa bath, shower and toilet.

A fourth bedroom, within a self-contained lower level, also features an ensuite and a private entrance.

Returning upstairs, a home office, study or additional bedroom has garden views.

The home is serviced by three bathrooms and there is a large laundry that has plenty of room for storage and appliances alongside direct outdoor access.

Warmth and comfort effortlessly flow throughout with ducted and underfloor heating.

An audio/visual panel allows for music and media to be controlled from the kitchen and to be enjoyed throughout the home through wall-mounted speakers.

Carefully designed and landscaped, pathways and stairs on either side of the home lead to the top garden.

A double garage provides secure housing for multiple vehicles, and additional parking is available in the driveway.

Priced at $1,850,000-plus, it is not too much of a stretch to imagine the property being sold for around the $2 million mark.

“I imagine it will be bought by a local purchaser,” Kim said.

“Although we have sold a number of properties to interstate purchasers in the past few months that have been essentially sight unseen.”

The post This Sandy Bay home is in a class of its own appeared first on realestate.com.au.

Findex Geelong is the new top floor tenant at 235 Ryrie St, Geelong.

A leading advisory firm has a new Geelong home after starting a 10-year lease in Ryrie Street.

Findex Geelong has occupied the top floor at 235 Ryrie Street, Geelong, after completing fit-out of the 1015sq m space, which is understood to be valued at mid $300 per square metre.

The 10-year lease, brokered by MP Burke Commercial, includes 15 on-site car spaces at the property.

RELATED: Clifftop house has private beach access

Breakwater: Upside to industrial warehouse

Mud-brick master Alistair Knox design up for grabs

The tenancy features a new fit-out, open-plan collaborative and client engagement areas and meeting rooms, and has extensive views across Geelong’s CBD, Corio Bay and the You Yangs.

Findex is a leading integrated advisory firm with private, business and government clients across a 110 office network.

Executive managing partner Mark Whelan said: “Findex is proud to have partnered with Costa Asset Management and MP Burke Commercial to deliver a workplace experience for our people that we are proud of and that reaffirms our commitment to growth in the Geelong market.”

The building owner, Costa Asset Management acquired the property (which includes the neighbouring building anchored by Bendigo Bank) in mid-2018 for $9.5m, settling in June, 2019.

Mr Burke said the owners had looked to capitalise on Geelong’s strong growth by taking a proactive approach to attract new tenants, retain existing tenants and futureproof the asset.

Findex Geelong is the new top floor tenant at 235 Ryrie St, Geelong.

“This has been achieved through an extensive capital works program to enhance the building’s

presentation, improved services and an extensive upgrade of the building’s facade,” Mr Burke said.

The building opened in the 1980s for the then-Capital Building Society.

Victorian Regional Channels Authority had been the previous tenant, before relocating to the Federal Mills precinct in North Geelong.

MP Burke Commercial also negotiated a new six-year lease extension with ground floor tenant Clinical Laboratories.

A fully fitted 290sq m ground floor suite is the final area available for lease.

Mr Burke said the Geelong leasing market remains strong with several new office developments underway and strong support from local businesses, state and federal governments.

As the COVID-19 pandemic takes hold in central Melbourne, Geelong stands out as an opportunity for Victorian and national businesses, government and enterprise to diversify their operations, reduce their costs and secure quality staff by establishing their business in one of Australia’s fastest growing and exciting regions,” he said.

The post Findex: Accountants find new Geelong digs in 10-year Ryrie St commercial lease appeared first on realestate.com.au.

Hear what people are saying about Inman Connect Now. You won’t want to miss the next two. “Inman Connect WOW what a fun ride filled with relevant facts, humor, suggestions, and relevant tools, tips and tricks to up your game! Kudos!!”