Battler suburbs are tipped to lead Melbourne’s property market recovery while traditionally bulletproof blue-chip pockets trail behind.

Outer suburbs Braybrook, Carrum, Kings Park and Frankston will rebound better than the city’s typical top performers after the pandemic, industry experts predict.

CoreLogic head of research Tim Lawless said “different factors at play” meant affluent areas like Abbotsford and Kew East, which had the city’s largest price gains three years after the Global Financial Crisis, would not rise as quickly to the top after this downturn.

RELATED: Coronavirus: Regional Victoria property markets hit by ban

Coronavirus: Very few Victorian tenants have secured rent reductions

Coronavirus: Tradies will abandon Vic as building economy plunges over next two years

1/6 Rigby Street, Carrum is for sale.

26 Lawn Crescent, Braybrook is under offer.

“In most cycles, the top end of the market tends to lead a downturn and the commencement of the growth cycle,” Mr Lawless said.

“We saw through 2012, and then at the beginning of last year, that the top end drove the growth … but I think if we are in a situation where we do see a lot of (first-home buyer) incentives, it could disrupt that normal pattern.”

He said first-home buyers eligible for government support would boost demand for affordable pockets like Braybrook, Heidelberg West and Kings Park, while lifestyle perks would attract people to Carrum and Frankston.

CoreLogic head of research Tim Lawless.

23 Brunei Cres, Heidelberg West sold for $682,000 in May.

Full Circle Property Advocates director Rob German said “satellite cities” like Frankston and Geelong were set for even more demand in years to come.

“These are areas where all services are available and they connect buyers really well to the southeast and west, where a lot of first-home buyers may have family,” Mr German said.

“People looking to spend $1.2m in the southeast can go out to Frankston South and spend about $800,000 to $900,000 on the same type of property.”

6 Merlin Court, Frankston sold for $450,000.

Frankston’s real estate market is expected to bounce back. Picture: Wayne Taylor

Craigieburn, Mickleham and Roxburgh Park in Melbourne’s north, and Clyde and Cardinia in the east, would also attract plenty of attention in the future, he added.

“In 2008 people still had a major need to be in the inner suburbs to have good access to their workplaces, but with huge growth in IT and communication people don’t have that same need anymore,” he said.

“It’s going to shift our thought patterns on where we need to live.”

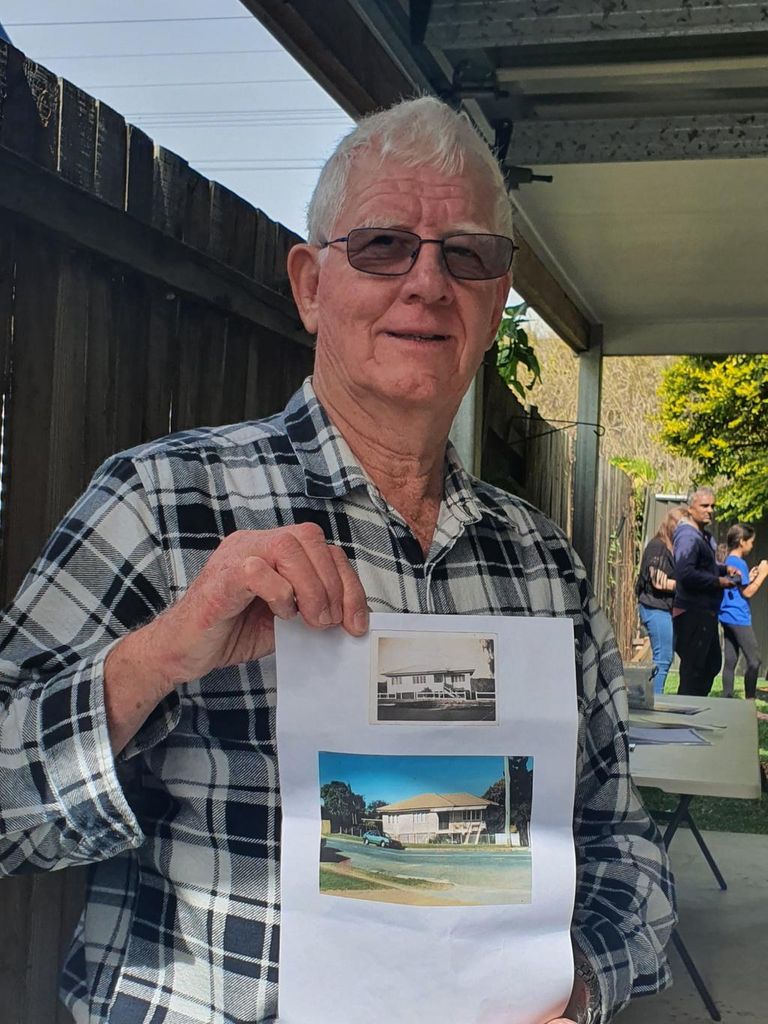

Wallan resident Peter Slay, who is selling his property at 9 Arno Court in the Hidden Valley estate, said most interested buyers were looking to escape the city.

“It’s partially because they want a bigger block and not such immediate neighbours,” Mr Slay said.

“We have three acres (1.2ha) so it feels like you’re living in the country, but you’re not too far from work in the city and all the amenities you need.”

Peter Slay is hoping to sell his Wallan home after restrictions ease. Picture: Jay Town

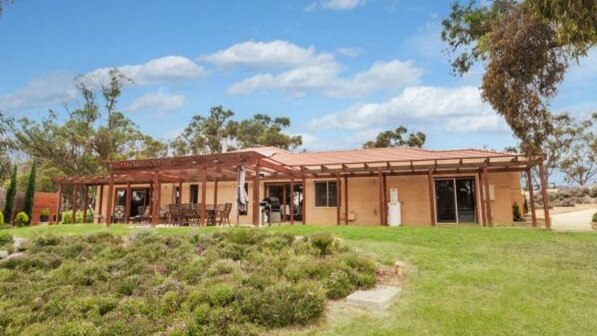

9 Arno Court, Wallan is for sale.

He is selling via Upside Realty, which reported a record amount of property appraisals in Victoria two weeks before stage four lockdown, according to state regional manager Matthew Florance.

“There’s a tsunami of properties that are building up for sale … I know it’s going to be even bigger than what we expect,” Mr Florance said.

He said country towns like Bendigo and Ballarat would also attract more demand from “mum and dad investors who are now emptying the city”.

Buyers from the inner city had been interested.

There’s plenty of space on the property.

“The type of person who previously bought in Kew East will be looking to invest in regional areas, where they’re going to get return without putting their hands too deeply into their pockets,” he said.

“Investors are flocking to these country fringes for better returns, while people are also moving there because they see really good, fast and reliable infrastructure being built.”

SUBURBS TIPPED FOR FAST RECOVERIES POST-CORONAVIRUS

BRAYBROOK $713,419 median house price

HEIDELBERG WEST $730,747

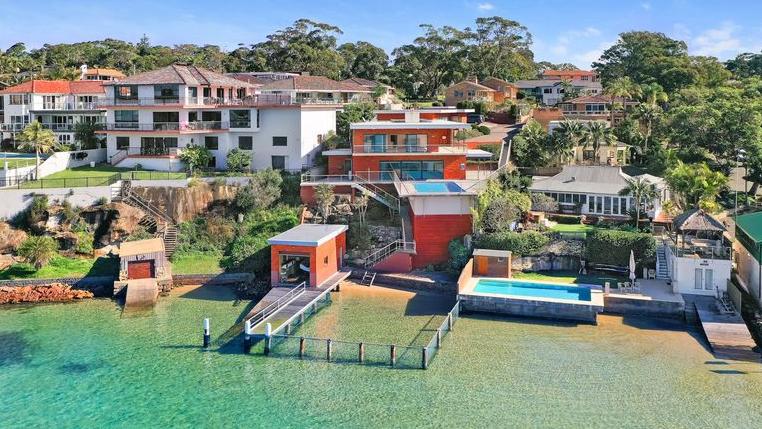

CARRUM $919,459

FRANKSTON $596,661

KINGS PARK $514,387

MELBOURNE’S BEST PRICE PERFORMERS POST-GFC (2008-2011)

ABBOTSFORD 32% to $659,434 median

KEW EAST 30.9%cto $898,797

WEST FOOTSCRAY 30.1%to $437,406

PASCOE VALE SOUTH 30.1% to $612,893

TEMPLESTOWE LOWER 30% $628,962

Source: CoreLogic

READ MORE: Park Orchards pad built by The Block’s Kerrie and Spence for sale

Beaumaris Honeycomb House demolished, Robin Boyd original under threat

First-home buyers ‘step back’ for stage four: Oliver Hume figures

The post Coronavirus recovery: Melbourne battler suburbs, regional cities tipped to rebound fastest appeared first on realestate.com.au.