Milly Waldren has been saving more due to the lockdowns. Picture: Adam Yip

First homebuyers are reporting the lockdown has been good for something as reduced social outings mean they’re saving a deposit much faster.

With heavy restrictions still in place for many activities, young Aussies reported instead of spending money on smashed avo breakfasts, travel and going out, they were saving it.

Younger Aussies also revealed their determination to get a foot on the property ladder was growing as their bank accounts swelled.

MORE: Best and worst suburbs for home auctions

Buyer pays $1.93m to wreck house

20 bidders register as home sells $625k over reserve

Two-thirds of Aussies aged under 30 polled in a recent Westpac survey claimed they’ve become more serious about buying a home since the COVID-19 crisis started.

Another Finder.com survey showed close to half of Gen Z respondents were in a better financial position compared to before the coronavirus pandemic started.

Only about a quarter of Gen X respondents felt the same way.

Aussies of all ages were pumping an average of about $100 more into savings each month than they were at the start of the year but Finder noted that average was dragged down by rising job losses.

The group estimated the savings of Australians who were still working and earning an income may be increasing at a much higher rate than the polling indicated.

Westpac head of savings Kathryn Carpenter said younger Aussies were getting a particularly big savings boost because restrictions were making a dramatic lifestyle change.

“The fact many young Australians are still able to grow their savings demonstrates small changes can have a big impact,” she said.

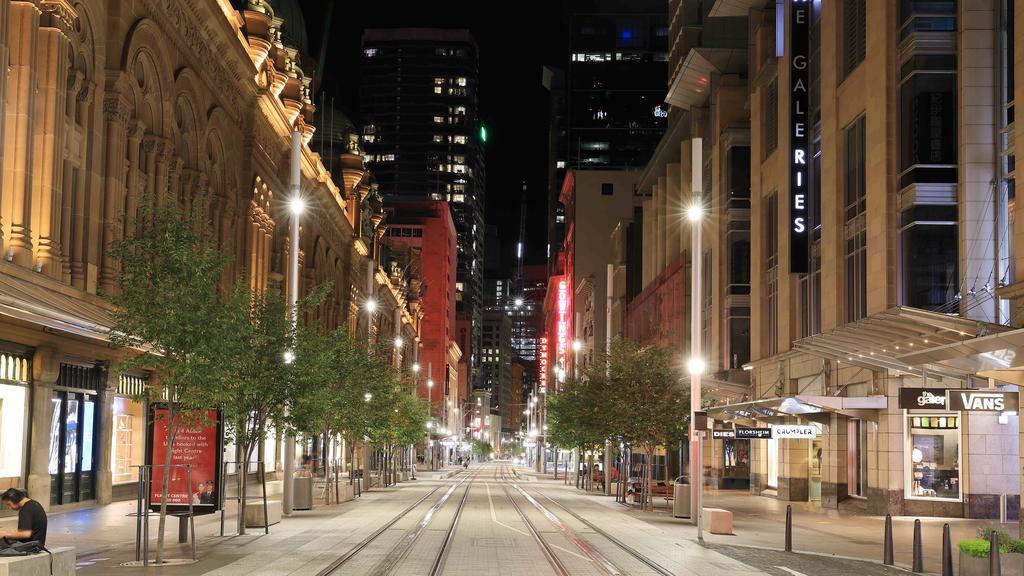

With fewer people going out, younger Aussies are saving more. Picture: Damian Shaw

“With limitations around travel and experiences that are usually popular with this generation, like attending concerts or festivals, it’s encouraging to see that many have seized this as an opportunity to double down on their home ownership goals.”

Record low interest rates on mortgage products and government initiatives such as the $25,000 HomeBuilder grant for purchasers of new properties were further encouraging younger buyers, Ms Carpenter said.

“Spending more time at home has certainly made us realise the importance of loving where you live,” she said.

Rose Bay resident Milly Waldren, 26, said her savings habits changed drastically after the coronavirus pandemic hit.

“You can’t go out any more and I haven’t lost my job so I have been saving a lot more,” she said, adding she capitalised by opening a high-interest account with a 3 per cent interest rate. The rate was introduced for those between 18 and 29 in July.

Ms Waldren said she wanted to buy a unit in the eastern suburbs.

Ms Waldren added she was getting closer to her goal of one day buying an eastern suburbs apartment.

“My social calendar has completely changed, it’s become a point of reflection,” she said.

“I’m trying to use this as an opportunity and I think property is still a wise investment because if you don’t pay a mortgage you still have to pay rent.”

The post Reduced social activity during the pandemic is helping young Aussies get closer to owning home appeared first on realestate.com.au.