At its regular monthly meeting on Tuesday, The Reserve Bank of Australia held official interest rates at 0.25%, where it has been since mid-March.

The RBA acknowledged that the Australian economy is going through a very difficult period and is experiencing the biggest contraction since the 1930s. But as difficult as this is, the downturn is not as severe as earlier expected.

At its meeting today, the Board decided to maintain the current policy settings, including the targets for the cash rate and the yield on 3-year Australian Government bonds of 25 basis points – https://t.co/YnEMgjQzYX

— RBA (@RBAInfo) August 4, 2020

However, in a statement, the Central bank said: “this recovery is likely to be both uneven and bumpy, with the coronavirus outbreak in Victoria having a major effect on the Victorian economy.”

On Sunday, Victorian Premier Daniel Andrews announced six weeks of stage 4 restrictions for metropolitan Melbourne in a bid to stop the spread of coronavirus cases, which have surged in the state. Premier Andrews also placed all of regional Victoria into stage 3 lockdown.

The RBA has decided to hold official interest rates at a record low 0.25%. Picture: Getty.

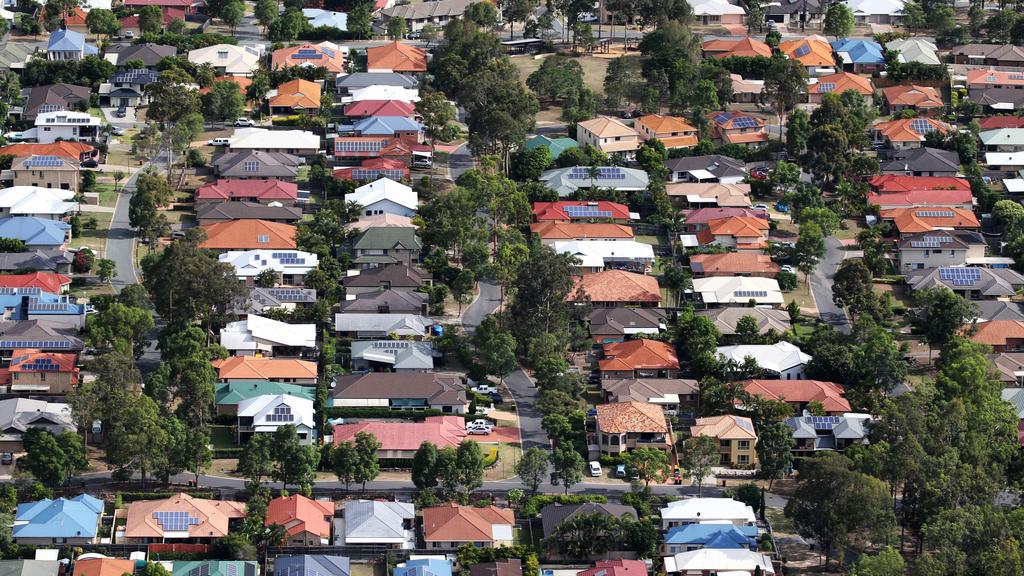

Stage 4 lockdown across metropolitan Melbourne is expected to cause a slow down in the real estate and housing sectors.

The RBA has signalled it would not start lifting interest rates until inflation approached its 2-3 per cent target range and the jobs market was strengthening.

Interest rate rise “even further away” amid Melbourne’s stage 4 lockdown

Given what’s happening in Melbourne, an interest rate hike looks even further away now, said executive manager of economic research at realestate.com.au, Cameron Kusher.

“Although the RBA has forecast inflation to remain on target for the next few years, it seems the bank is not willing to use additional unconventional monetary policy to help spur on inflation,” Mr Kusher said.

“Given lockdowns in Melbourne, the bank is now forecasting a higher peak unemployment rate than federal treasury predicted last week.”

In a baseline scenario, the Board predicted output would fall by 6% over 2020 and then grow by 5% over the following year. In this scenario, the unemployment rate would rise to around 10% later in 2020 due to further job losses in Victoria and more people elsewhere in Australia looking for jobs. Over the following couple of years, the bank expects the unemployment rate to decline gradually to around 7%.

According to federal treasury’s July Economic and Fiscal Update, weighing up the devastating impact of the health crisis on the economy, unemployment in Australia is expected to peak at 9.25% by Christmas. That’s another 240,000 people out of work.

More to come.

The post RBA holds interest rates at record low as Melbourne enters stage 4 lockdown appeared first on realestate.com.au.