Carpenter Troy Hill just bought a home in Kilsyth. Picture: Mark Stewart

Teachers can now break into prized Melbourne suburbs that had needed the annual income of a doctor, new income data reveals.

Required salaries have been slashed by as much as $150,000 for buyers looking to secure properties in blue-chip ‘burbs like Middle Park, Toorak and South Yarra.

Middle Park buyers previously had to earn $501,664 annually to meet repayments on a 4.04 per cent loan for the average house, but that’s dropped $148,318 to $343,346 amid coronavirus.

RELATED: COVID-19 housemates plan to buy a way out of share houses

Eltham house kids refused to leave sells, as virtual tours satisfy buyers

Melbourne stage four restrictions prompt sight-unseen sales

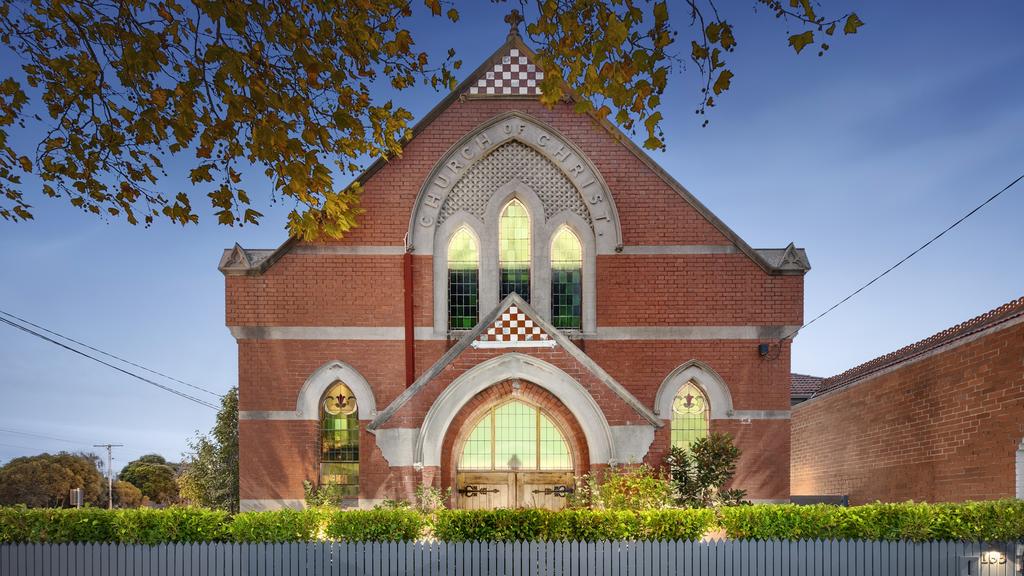

A Middle Park church conversion recently sold for more than $2m.

Buyers need a healthy stream of income to afford in Toorak.

The Finder analysis of CoreLogic data also showed that required incomes to buy a median-value house in Toorak ($611,361), Hampton ($262,505) and South Yarra ($263,196) all dropped by over $100,000 in the three months to the end of June.

Big movers that became accessible to those on less than six figures included Upper Ferntree Gully (from $155,775 to $94,364), Kingsbury ($140,992 to $96,263), Hurstbridge ($136,765 to $96,712), Sydenham ($120,448 to $82,896) and Warburton ($110,965 to $74,261).

To put it in perspective, an average house in Warburton went from about the average income of a medical specialist ($110,033) to that of an event manager ($73,480), according to Seek data.

Bucking the trend were just 15 of Melbourne’s 360 suburbs, including Waterways, where the required salary increased from $144,168 to $186,517, Oakleigh ($138,110 to $154,740) and Spotswood ($114,296 to $130,562).

Victoria’s median salary for full-time workers was $69,576, according to Australian Bureau of Statistics data to 2019.

Amy Mylius Property director Amy Mylius said conditions were more favourable for buyers than at the start of the year, but those “on the cusp of being able to afford what they want” should enter the market soon, rather than wait and risk missing out.

Julie Wilson at her Warburton property. The suburb has opened up to more buyers. Picture: David Caird

Hurstbridge was also more affordable.

She labelled Highett, Coburg, Rosanna and Geelong West as suburbs offering good value to buyers.

Carpenter Troy Hill recently bought his first home in Kilsyth, where the $686,500 median house price is accessible to a buyer earning $94,847 annually.

The 28-year-old said being a sole trader made it harder to get approval for a loan during the pandemic.

Troy Hill at the Kilsyth home he recently purchased. Picture: Mark Stewart

Liz Byrne at her home in Spotswood, one of the few suburbs to increase in value. Picture: Mark Stewart

“Getting the actual home loan became a lot harder the further we got into COVID-19,” Mr Hill said. “I got pre-approval initially, but that was void when COVID came in.”

Finder insights manager Graham Cooke said many suburbs were now within reach for more buyers.

“The door is open for lower- and middle-income buyers – with the combination of lower rates and cheaper prices, now is the time to be looking,” Mr Cooke said.

The Finder analysis assumed a purchaser bought a median-priced property, obtained an average home loan rate of 4.04 per cent, and contributed a 20 per cent deposit. It capped loan repayments at 30 per cent of a buyer’s income — a common stress test used by banks.

Realestate.com.au chief economist Nerida Conisbee said government incentives were also providing buyers with a boost.

“Every announcement has been followed by a spike in inquiry levels, it is getting more buyers into the market,” she said.

Biggest reductions in required salaries over the past three months (houses)

Middle Park, required salary: $353,346, down $148,318 from $501,664 three months ago

Toorak, $611,361, down $130,313 from $741,673

Hampton, $262,505, down $108,219 from $370,724

South Yarra, $263,196, down $107,228 from $370,424

Elsternwick, $276,480, down $98,485 from $374,965

Camberwell, $300,499, down $86,885 from $387,384

Carlton North, $227,965, down $86,610 from $314,575

Caulfield South, $216,221, down $85,626 from $301,847

Glen Iris, $279,084, down $84,307 from $363,391

Armadale, $352,309, down $81,592 from $433,902

Biggest increases in required salaries over the past three months (houses)

Waterways, required salary: $186,517, up $42,349 from $144,168 three months ago

Oakleigh, $154,740, up $16,630 from $138,110

Spotswood, $130,562, up $16,265 from $114,296

Seville, $91,911, up $15,319 from $76,593

Balnarring $117,436, up $14,630 from $102,806

Werribee South, $84,554, up $14,092 from $70,462

Wattle Glen, $110,528, up $11,111 from $99,417

Strathulloh, $71,153, up $7,153 from $64,000

Eumemmerring, $73,294, up $6,663 from $66,631

Coldstream, $89,183, up $6,606 from $82,577

READ MORE: Ballarat’s most expensive sales dominated by Lake Wendouree houses

Regional Victoria building boom as Melburnians look outside capital

The Block 2020 episode 3 recap: Scott and Shelley pour cold water on plaster plans

The post Melbourne suburbs where salary required for property has fallen appeared first on realestate.com.au.