It wasn’t too long ago that issues like price rises, interest rates and negative gearing dominated one of Australia’s favourite backyard barbecue topics, the property market – but COVID-19 has changed all that.

The coronavirus crisis has seen vast changes across almost every aspect of Australian culture, also filtering into our obsession with real estate and shifting the focus to a new set of issues.

New data from realtime media monitoring provider Streem shows news reports about residential property prices in Australian media dropped significantly between March and August 2020, compared to the six months prior.

This change is largely because “coronavirus is taking up so much media oxygen”, said the company’s Media and Partnerships Lead, Conal Hanna.

“A study we did earlier this year found coronavirus reached up to a point in March where it was being mentioned in about 80% of stories being published [across Australian media outlets],” Mr Hanna said.

But while media coverage of property prices might have fallen during the pandemic, some real estate issues have gained traction.

The new topics in Australian property

Mr Hanna said the best way to sum up the changes in Australian property price reportage since COVID-19 is to say there is “less reporting on housing as an asset and more reporting on housing as a basic human need”. In particular, renting coverage has spiked.

Since March, property media coverage including the topic of landlords increased by 147%, while renters and rental prices went up 41% and 30% respectively.

Australia’s rental market has been hit hard amid the health crisis, with swathes of young renters, many of whom work in the hospitality and tourism sectors, forced to vacate their homes due to job losses and financial hardship.

As a result, rental listings have increased on realestate.com.au and landlords have been left with the difficulty of finding tenants to inhabit their investment properties, pushing many to offer rent reductions and other perks as incentives.

As a property industry spokesperson, chief economist at realestate.com.au, Nerida Conisbee, said she has never before discussed the rental market as often as she has since the pandemic.

“If you think about it, the really big impact from COVID [so far] has been on the rental market, but we haven’t seen such a huge impact on house prices… there’s been a real shift in the discussion [in the media] around renting,” Ms Conisbee said.

Meanwhile, the topic of open homes increased its presence in property media coverage by 199% in the six months to August 2020, compared to pre-lockdown times when widespread bans on open homes were unimaginable let alone newsworthy.

Mr Hanna said Streem recorded a huge spike in media conversation around open homes between March and May.

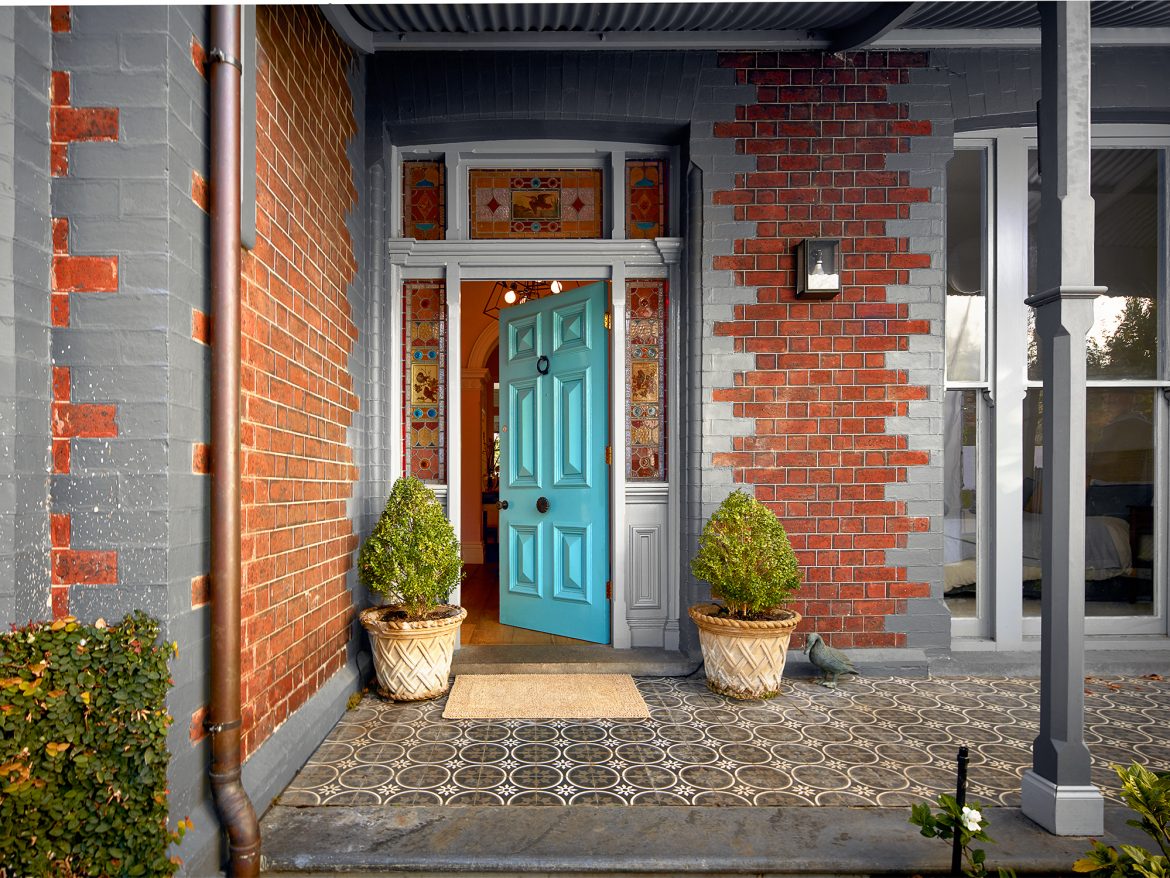

COVID has opened the door to a brand new way of talking about property. Picture: REA Group

“The conversation pretty much increased by about 500% overnight, just because it was literally something that people can relate to so much. Not many people feel confident buying a house without having been inside…so when all those [lockdown] rules came in that had real impacts on the conversation,” he explained.

Among the other topics that gained traction in property price coverage between March and August compared to the six months prior to the health pandemic were listings (6%), stamp duty (6%) and auctions (5%).

In addition, media talk of property price falls increased by 40%, while discussions around property price rises dropped by -33%.

Meanwhile, mentions of sellers increased by 20% and buyers dropped by -9%, but there were still more mentions of buyers overall.

The news items that have “fallen off the radar”

On the flip side, interest rates, a once hotly-awaited news item, dropped by 50% in the six-month period, which is a very significant decline given its dominance as a property news issue before the coronavirus crisis.

“Australia as a country has been fairly obsessed by interest rates…I certainly remember working on news desks when the first Tuesday of the month was watched extremely closely for any movement because there was a huge public interest in what was happening with interest rates,” said Mr Hanna, who is a former journalist.

“But now they’ve been fairly locked and they’re not going anywhere anytime soon, so there’s really a lot less media coverage on that as a topic.”

The RBA’s interest rate announcement was once the most hotly-awaited property news item. Picture: Getty.

Ms Conisbee echoed Mr Hanna’s sentiment saying interest rates have become “irrelevant” in the current climate. “They can’t go any lower, and they’re certainly not going up so, for now, they’re quite irrelevant as to what’s happening,” she said.

Meanwhile, the once much-discussed topic of negative gearing showed a -68% decrease in mentions in property media coverage in the six months from March, followed by capital gains (-62%), housing affordability (-60%), bubble (-48%) and housing stock (-33%).

Real estate coverage has a new vocabulary

In terms of broader real estate coverage in Australian media since the pandemic took hold, certain words have become far more prevalent.

The word COVID showed the biggest increase in frequency, but this is because the word didn’t even exist before the health crisis. Similarly, the words coronavirus, lockdown, Victoria and restriction all showed increases.

But while some words have been popping up in property news stories more often since the pandemic, other once-popular words are becoming less popular, such as growth, investment, China, trade war and Donald Trump.

“International border closures have had real impacts on the ability to attract foreign investment in property, causing topics such as investment to fall off the radar,” said Mr Hanna.

“The trade war itself with China is something that 12 months ago, in particular, was a really hot topic, as well as the ramifications for that on different industries, so that’s something that’s fallen from the headlines a little bit this year,” he added.

Where is the property conversation headed?

With the spring selling season upon us, it’s possible the property conversation could take on new, or even old, dimensions, said Mr Hanna.

“In spring there is plenty of activity in the property market and you tend to see plenty of activity in the media off the back of that…it will be interesting this year to see whether that leads to a return to the traditional coverage of property or not,” he said.

The spring selling season could re-shape the property conversation yet again. Picture: realestate.com.au/buy

Ms Conisbee predicts the topic of intergenerational equity will emerge as a hot topic in property in the coming years, particularly as a result of the coronavirus crisis.

“COVID is impacting the health of older people the most, but is impacting the livelihoods of young people the most,” Ms Conisbee explained. The long-term financial consequences for young people will likely see many of them locked out of the property market.

“Intergenerational equity has been ramping up over the past four years… now when I’m talking to boards or I’m at events with really senior people in the industry, it’s quite mainstream for them to talk about this rising unfairness.

“I think that will be a continued discussion…it’s going to get worse because COVID has hit young people the most in terms of employment loss, so that inequity is becoming even greater as a result of COVID.”

How does news impact consumer behaviour in the property market?

Media coverage of any kind has a powerful impact on those who consume it because it helps people work out how they “feel” about a particular issue, according to Dr Paul Harrison, chair of Consumer Behaviour and Marketing at Deakin Business School.

“Most people aren’t experts, and so they go to their trusted sources to help them work out how to feel about something,” Dr Harrison said, adding that people tend to look for information that confirm their beliefs.

“So if we’re feeling like the real estate market is in a decline, we tend to be more responsive and take more notice of reports that say that’s the case.

Most people look to their trusted news sources to help them decide how they feel about an issue. Picture: Getty

“If we’re feeling uneasy about the market and all of the evidence or all of the things that we’re reading tell us that there is reason to be uneasy, then that kind of reinforces and feeds into our current kind of thinking.”

He said deciding to purchase a property is an incredibly emotional choice, which makes consumers even more sensitive to what is being discussed in the media, but whether or not that has the power to shape the sector depends on how close consumers are to the decision.

“If you’re thinking about buying a rental property for Super or something like that, you would have quite a strong emotional response [to the current media coverage about the rental market], but if you have 30 investment [properties]… then it’s not going to have as much of an effect because you’ve got a less emotional attachment to those investments,” Dr Harrison said.

The post How COVID-19 has reset the property conversation appeared first on realestate.com.au.