As an agent, your brand should breed trust, speak the truth and communicate value to anyone who comes across it. So, as you’re starting to build your brand, think about these five important questions.

Blog

Sydney is still serving up hot property to eager buyers, with several auctions yielding sales above reserve today – while in Melbourne, coronavirus restrictions prompted a slow start to spring.

Latest realestate.com.au auction data shows New South Wales has a clearance rate of 75% for the week to date, from 303 auction results, while Victoria’s preliminary clearance rate currently stands at 83% from 6 available results.

Here’s what happened in the auction capitals today.

87 Clarendon Road, Stanmore sold at auction today for $2.35m.

Sydney

The Stanmore home of artist Hetti Perkins – daughter of late Aboriginal activist Charles Perkins – sold above expectations at auction today, fetching a final price of $2.35 million.

Two women from Newtown won the bidding war of three registered bidders after seeing 87 Clarendon Road in person for the first time on the day.

Bidding opened at $2 million and the five-bedroom character home sold for $155,000 above reserve.

33 Lansdowne St, Surry Hills sold above reserve today. Picture: realestate.com.au

A three-bedroom renovated terrace in Surry Hills also sold under the hammer at an onsite auction today, for an undisclosed price.

Melinda Antella of Bresic Whitney said the well-located home at 33 Lansdowne St attracted three bidders, who pushed the sale price above reserve.

On the north shore, an original 1958 home – on the market for the first time in 62 years – sold for $151,000 over reserve.

The three-bedroom home at North Turramurra went for $1,901,000 after 12 bidders registered and five took part.

Read more about Sydney’s auction coverage here.

Melbourne

It was an uncharacteristically quiet start to spring in Melbourne today, with stage 4 coronavirus restrictions keeping its traditionally vibrant auction action at bay for now.

However, there were a small number of online auctions that went ahead, including 3 Allison Road in Mont Albert North – which sold online above reserve after a marathon 50-minute battle between three bidders.

This home in Mont Albert North sold online today.

Peter Schenck, director of Ray White Blackburn, said the three-bedroom home was on the market for $1,127,000 and sold for $1,170,000 after a total of 83 bids.

Mr said the property went to market just after stage 4 restrictions came into place and was “marketed totally online”.

“The [new] owners are going to renovate; they bought it based on the listing video and I think a lot of people will buy that sort of property without seeing it. It might be different with a different kind of home,” Mr Schenck said.

“The buyer was second homebuyer who knows what he’s doing; he lives around the corner, so I’m not surprised [it sold unseen].

“Active buyers are out there, they’re just waiting to be able to get back out. In this case, the seller couldn’t wait because they’d already moved, so we put a strategy in place and it sold.”

The post Saturday auctions: Sydney still hot property as Melbourne endures slow start to spring appeared first on realestate.com.au.

Artist Hetti Perkins (left) sold her Stanmore home to two women from Newtown who never inspected the property in person until the day.

Two women from Newtown have paid $2.35m for a Stanmore home, after seeing it in person for the first time on the day of the auction.

The Clarendon Rd auction had plenty of drama, with all three registered bidders trading blows from the moment bidding opened at $2m.

MORE: Inside Karl Stefanovic’s new waterfront mansion

Mansion with insane Swarovski chandelier to shatter record

Fall in home prices slows across Sydney

A lack of stock meant competition was strong, as the bidders tried their best to outplay each other for the five-bedroom home on 329sq m. This caused the sale price to end $155,000 above the reserve.

No. 87 Clarendon Road at Stanmore.

Ray White Surry Hills director Ercan Ersan said the result exceeded all expectations, but did not surprise him as the home with a detached studio and home office was popular.

“With everyone working from home, buyers want a dedicated office space, not the dining table or bedroom,” he said.

“Anything that fits this description is receiving a lot of interest from buyers at the moment.”

Mr Ersan said the way people are looking at property is also changing, with the buyer only seeing the house in person on the day after doing virtual inspections instead.

“The days of someone going to multiple open homes are over, with buyers now happy to look at the pictures and watch a video instead,” he said.

The vendor of the Clarendon Rd home was Hetti Perkins, an art curator, who is also the daughter of Aboriginal activist Charles Perkins.

A neighbour paid $420,000 over reserve for 18 Carey St at Randwick on Saturday.

Reserves also tumbled in Randwick, with a family who lived only two streets away from a Carey St house paid $420,000 over reserve for a four-bedroom home.

The Randwick home was being offered for the first time in 48 years and had 14 bidders register on Saturday afternoon.

It sold for $3.27m to the young family who now plans to renovate the home at a later stage.

McGrath – Coogee agent Mark McPherson, who sold the home with Amanda Rekes, said competition was hot, with several parties remaining in contention until the end.

“A freestanding home on a level block is about as blue chip as you can get in any beachside suburb,” he said.

“They’re not making any more properties like this, so all bidders were eager to secure it, knowing an opportunity like this might not happen again.”

The backyard of 18 Carey St.

No. 12 Lancelot St was one of the few homes like it for sale in Concord.

An opportunity to acquire a blank canvas on one of Concord’s most desirable streets saw five bidders have a crack at 12 Lancelot St.

Bidding opened at $2.2m before selling for $150,000 above the guide at $2.75m, which was also bang on the reserve.

The auction was not without drama, with Raine & Horne – Concord agent Ross Musso forced to negotiate during proceedings with the final two parties for the last $25,000 worth of bids, after bidding stalled at $2.725m.

Mr Musso said the majority of buyers, including the purchaser, were families wanting to build their dream home, as well as developers.

SIGN UP FOR THE LATEST NSW REAL ESTATE NEWSLETTER

The post Sydney auctions: Artist Hetti Perkins sells Stanmore home to Newtown couple for $2.35m appeared first on realestate.com.au.

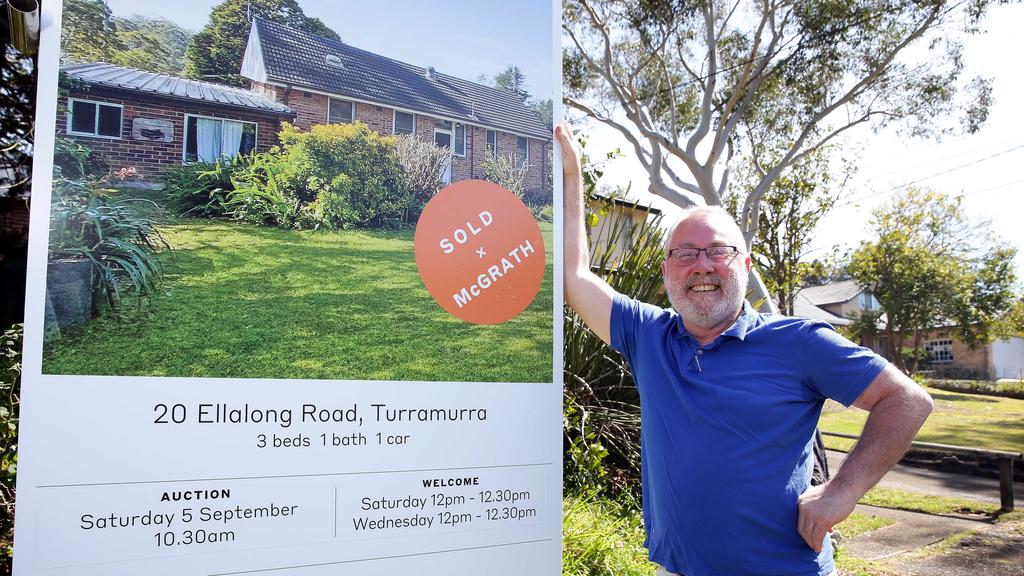

Mark Strain sold the family house along with his siblings at North Turramurra today for $151,000 above reserve. Picture: David Swift.

UNDER the basking morning sun, an army of buyers converged on an original north shore house being offered for the first time in 62 years.

Home to Strain family since 1958, the three-bedroom home at North Turramurra sold on Saturday for $151,000 over reserve at $1.901m. It was also $301,000 above the auction guide set by McGrath St Ives agent George Carey.

MORE: Inside Karl Stefanovic’s new waterfront mansion

Mansion with insane Swarovski chandelier to shatter record

Fall in home prices slows across Sydney

Auctioneer Edward Riley had 12 registered bidders. Picture: David Swift.

The impressive result of 20 Ellalong Rd came after 12 bidders registered to take part on what was the first weekend of the popular spring selling season.

Sitting on a deep 917sqm block and in need of a TLC, the interiors were completely original with the kitchen, bedrooms and fixtures largely unchanged since the home was built in 1958 after a subdivision.

A young family from Drummoyne emerged as the buyers after edging out two Western Sydney builders by $1000.

The home had been owned by the Strain family since 1958.

Five bidders took part in proceedings for the home, with auctioneer Edward Riley getting proceedings under way at the $1.6m mark. From there, bidding rose in $50,000 increments from a number of parties before it was surpassed the $1.75m reserve.

For the next $151,000 worth of bids, it was a two-horse race between the builders and the inner west family looking to construct their dream home.

As both parties tried to call each other’s bluff, the pressure continued to mount as bidding jumped in increments as low as $1000.

After close to 20 minutes of nailbiting drama in front of a socially distanced crowd, the hammer fell for $1.901m after the underbidder pulled out at $1.9m mark.

The huge block offered buyers plenty of opportunity.

Mark Strain, who was selling his late mother’s home with his three siblings, said it will be sad to farewell a house full of memories.

“It is very emotional for us, as all us kids grew up here, and mum lived at the house for 62 years,” he said.

“But we are glad it is going to another family, as this neighbourhood is a perfect setting to raise kids.”

With a 125 inspections and 42 contracts requested for 20 Ellalong Rd throughout the campaign, Mr Carey said the result proved the market was looking strong heading into spring.

“A lot of buyers are feeling very positive about purchasing in the current climate,” he said.

Five bidders made up of families and builders were active. Picture: David Swift.

“With the level of confidence remaining very high, spring is looking like it will be a very strong market.”

The North Turramurra sale was one of about 638 Sydney auctions scheduled for the week, a 3.1 per cent increase on the volume of auctions recorded last weekend, Realestate.com.au showed. Auction volumes are expected to continue to rise over the coming weeks as more sellers look to take advantage of favourable selling conditions.

SIGN UP FOR THE LATEST NSW REAL ESTATE NEWSLETTER

The post Sydney auctions: Original North Turramurra home sells for $151k above reserve in hot auction appeared first on realestate.com.au.

Allan Morriss with his kids Oscar, 13, Isabella, 16, and Lauren, 19, outside the redeveloped property at 9 Pavo St, Balwyn North, they are preparing for sale once stage four restrictions ease. Picture: Andrew Henshaw

Budding buyers and vendors are “chomping at the bit” to push ahead with their property plans now spring — traditionally the year’s busiest selling season — is here.

But the Melbourne market won’t be able to bloom until the city’s stage four coronavirus restrictions are eased.

Real Estate Institute of Victoria president Leah Calnan said a key factor would be the return of physical inspections, which had been outlawed in Melbourne since early August in a move that had crippled listing and sales activity.

RELATED: REIV slams leaked road map out of Melbourne lockdown

How to get ready to buy when the property market returns this spring

Melbourne homes lose $30k amid stage four market ‘freeze up’

SEE EVERY SUBURB’S MEDIAN HOUSE AND UNIT PRICE BELOW

1 Douglas Avenue recently sold for $1.052m in Box Hill South, a top performer for annual price growth.

Just 21 homes are scheduled to go under the hammer this weekend in the city, which normally prides itself on being Australia’s auction capital. This is the lowest volume ever recorded by the REIV, barring public holiday weekends.

“This reflects how the market has had to adjust and deal with the stage four restrictions,” Ms Calnan said.

“But we know there’s a lot of activity happening behind the scenes to prepare for sales in the coming months.

“Spring campaigns will start a few weeks later than what we’ve seen in the past, (then) we’ll probably see auction activity … through to Christmas.”

12 Albert Street, Caulfield North sold for $1.91m.

While weekly auction volumes regularly topped the 1000 mark in spring, they were highly unlikely to reach those heights while auctions were restricted to online platforms, she added.

The latest REIV data shows many Melbourne suburbs have sustained impressive annual price growth despite the turbulent COVID-19 period.

Box Hill South, Caulfield North and Hughesdale were top performers, with their median house prices rising more than 25 per cent in the year to June 30. West Melbourne and Fairfield’s unit medians gained more than 30 per cent.

Houses and units in blue-chip eastern suburbs Balwyn North, Balwyn, Mont Albert North and Box Hill also flourished in the past year.

Belle Property Balwyn agent Claire Wenn expected the pocket to keep holding its value, with plenty of buyers poised to pounce. “School zones have a lot to do with the strength of these suburbs, with Balwyn High, Kew High and Kooyong Secondary College all in the area,” she said.

1/33 Grice Crescent, Essendon sold sight-unseen for $670,000 during the stage four lockdown.

Ms Wenn said agents had been making the most of the stage four lockdown by contacting potential buyers on their database, preparing listings and booking photographers for future campaigns.

Property developer Allan Morriss is preparing to list a luxury home at 9 Pavo Street in Balwyn North this spring.

“I’ve built a few other large homes in Balwyn North and the suburb has always done well,” he said. “It hasn’t really gone down in price a great deal over the years, regardless of what else is going on.”

Mr Morriss said his family had also called the suburb home since 2008, with his five children attending the prized Balwyn High. “The proximity to shops, schools and amenities has always been a great advantage to the area,” he said.

37 Main Road, Lower Plenty notched a $915,000 sale.

On the flip side, the REIV found the median house prices in Lower Plenty, St Kilda and Carrum had shed up to 15.3 per cent in the past year. Caulfield North, Black Rock and Werribee units also experienced some of the city’s largest losses.

Wakelin Property Advisory director Jarrod McCabe said the pandemic had weakened suburbs that typically relied on one buyer profile, like family-centric Lower Plenty. But this shouldn’t deter buyers who spotted their dream home in a falling market.

“You should be buying property for the long term,” he said. “I’d see that as an opportunity.”

Mr McCabe advised “discretionary vendors” who didn’t need to sell to hold off until in-person inspections, and ideally auctions, were allowed again.

This one-bedroom unit at 2/18 Mascoma Street, Ascot Vale recently fetched $360,000.

Advantage Property Consulting director Frank Valentic tipped “a flurry of activity” to help boost prices in struggling areas once physical inspections and on-site auctions returned.

“It could be likened to the pent-up demand we see in February every year, after the market has been shut down since December,” he said.

The vendor advocate said he had 15 clients ready to hit the spring market once restrictions eased.

But he forecast a shortage of stock compared to most spring seasons, with any more than 250 online auctions per week unlikely until street sales could return to Melbourne.

He said a scarcity of available housing stock was helping insulate prices from big drops.

“There are still more buyers than there are properties for sale, which is why you often see five or six families fighting for a home at auction,” he said.

-with Samantha Landy

MORE: Victoria freeze on evictions, rental support package could stretch into 2021

Century-old South Melbourne pub sells amid trying time for hospitality

Ex-AFL player’s California-inspired holiday home ‘Dollywood’ for sale

Median price, and annual increase or decrease, for every Melbourne suburb

Houses

ABERFELDIE: $1,382,500 / 8.7%

AIRPORT WEST: $809,500 / 3.5%

ALBERT PARK: $1,806,250 / 11.2%

ALTONA NORTH: $785,000 / 1.9%

ARMADALE: $2,275,900 / 22.5%

ASCOT VALE: $1,256,000 / 2.7%

ASHBURTON: $1,550,000 / 2.9%

ASPENDALE: $999,000 / -2.8%

AVONDALE HEIGHTS: $791,000 / -0.3%

BALWYN: $2,206,000 / 0.6%

BALWYN NORTH: $1,772,500 / 15.4%

BAYSWATER: $755,000 / 4.5%

BAYSWATER NORTH: $697,500 / 5.4%

BEACONSFIELD: $820,000 / 3.9%

BEAUMARIS: $1,750,000 / 12.1%

BELGRAVE: $680,000 / 3.8%

BENTLEIGH: $1,494,000 / 4.1%

BENTLEIGH EAST: $1,150,000 / 12.1%

BERWICK: $729,000 / 4.4%

BLACK ROCK: $1,600,000 / 2.9%

BLACKBURN: $1,450,000 / 12%

BLACKBURN NORTH: $1,043,000 / 8%

BLACKBURN SOUTH: $1,105,000 / 14.8%

BLIND BIGHT: $650,000 / 0.6%

BONBEACH: $855,222 / 6.6%

BORONIA: $693,756 / 9.5%

BOTANIC RIDGE: $753,750 / -1.5%

BOX HILL NORTH: $1,261,888 / 13.2%

BOX HILL SOUTH: $1,239,000 / 39.7%

BRAYBROOK: $652,000 / -8.7%

BRIGHTON: $2,500,000 / 13.1%

BRIGHTON EAST: $1,835,000 / 5.3%

BROOKFIELD: $493,750 / -1.4%

BRUNSWICK: $1,100,000 / 15.4%

BRUNSWICK EAST: $1,472,500 / 8.4%

BRUNSWICK WEST: $1,162,500 / 2.2%

BULLEEN: $1,164,250 / 12.6%

BUNDOORA: $698,000 / 8.9%

BURWOOD: $1,100,000 / 6.8%

BURWOOD EAST: $995,900 / 10.3%

CAMBERWELL: $2,300,000 / 12.5%

CANTERBURY: $2,675,000 / 10.5%

CARLTON NORTH: $1,590,000 / 6.3%

CARNEGIE: $1,225,000 / 14%

CAROLINE SPRINGS: $542,500 / 2.6%

CARRUM: $791,495 / -10.8%

CARRUM DOWNS: $572,000 / no change

CAULFIELD NORTH: $1,821,500 / 26.9%

CAULFIELD SOUTH: $1,513,125 / 4.7%

CHADSTONE: $980,000 / 18.8%

CHELSEA: $1,007,500 / -7.3%

CHELTENHAM: $915,000 / 11.2%

CHIRNSIDE PARK: $787,650 / 6.8%

CLAYTON: $1,051,500 / 2.8%

CLIFTON HILL: $1,200,000 / 4.1%

CLYDE: $576,500 / 1.5%

CLYDE NORTH: $575,000 / 4.3%

COBURG: $970,000 / 14.2%

COBURG NORTH: $879,000 / 15.2%

COCKATOO: $600,000 / 15.4%

COLLINGWOOD: $1,150,000 / 11.6%

CRAIGIEBURN: $553,000 / 1.8%

CRANBOURNE: $520,000 / 2%

CRANBOURNE EAST: $575,000 / 1.2%

CRANBOURNE NORTH: $587,000 / -0.9%

CRANBOURNE WEST: $501,000 / no change

CROYDON: $750,000 / 3.6%

CROYDON HILLS: $922,500 / 3.2%

CROYDON NORTH: $995,000 / 4%

CROYDON SOUTH: $800,000 / 2.7%

DANDENONG: $645,000 / 5.7%

DEER PARK: $552,500 / 4%

DELAHEY: $546,500 / 1.4%

DIAMOND CREEK: $751,500 / 1.3%

DONCASTER: $1,230,000 / 9.1%

DONCASTER EAST: $1,225,000 / 6.1%

DONVALE: $1,244,000 / 2.3%

DOREEN: $600,000 / 3.3%

EAGLEMONT: $2,029,000 / -6.4%

EDITHVALE: $980,000 / 10.5%

ELSTERNWICK: $1,651,000 / 7.8%

ELTHAM: $1,022,000 / 8.8%

ELTHAM NORTH: $966,000 / 6.6%

ELWOOD: $2,300,000 / 8.5%

EMERALD: $710,000 / 2.2%

ENDEAVOUR HILLS: $615,000 / 2.9%

EPPING: $600,000 / 2.6%

ESSENDON: $1,455,000 / 1.5%

FAIRFIELD: $1,300,000 / -1.5%

FAWKNER: $720,000 / 3.4%

FERNTREE GULLY: $734,625 / 8.2%

FITZROY: $1,550,000 / 8.5%

FITZROY NORTH: $1,675,000 / 7.4%

FLEMINGTON: $1,010,000 / 9.6%

FOOTSCRAY: $900,000 / -3.7%

FOREST HILL: $1,006,000 / 12.6%

FRANKSTON: $597,500 / 5.1%

FRANKSTON NORTH: $440,000 / -2.3%

FRANKSTON SOUTH: $868,000 / 5.3%

GLADSTONE PARK: $600,000 / 4.8%

GLEN IRIS: $1,875,000 / 13.9%

GLEN WAVERLEY: $1,218,500 / 7.1%

GLENROY: $720,000 / 6.7%

GREENSBOROUGH: $857,000 / 7.5%

GREENVALE: $728,250 / -3.3%

HAMPTON: $2,520,000 / -1.3%

HAMPTON EAST: $1,350,000 / 15.7%

HAMPTON PARK: $496,500 / -1%

HARKNESS: $520,000 / 6.7%

HAWTHORN: $2,007,500 / 8.2%

HAWTHORN EAST: $2,295,000 / 15.6%

HEALESVILLE: $610,000 / -2.4%

HEATHERTON: $1,002,500 / 6.1%

HEATHMONT: $981,250 / 1.4%

HEIDELBERG HEIGHTS: $772,325 / 3.6%

HEIDELBERG WEST: $492,500 / -5.7%

HIGHETT: $1,262,000 / 15%

HILLSIDE: $680,000 / -1.1%

HOPPERS CROSSING: $527,500 / 0.7%

HUGHESDALE: $1,505,000 / 25.3%

IVANHOE: $1,210,000 / 6.2%

IVANHOE EAST: $1,800,000 / 15.2%

KALKALLO: $585,000 / 4.2%

KEILOR: $950,000 / 17.1%

KEILOR DOWNS: $680,575 / 0.3%

KEILOR EAST: $850,000 / 9%

KENSINGTON: $990,000 / 11.9%

KEW: $2,180,000 / 12.2%

KEW EAST: $1,732,500 / 4.1%

KEYSBOROUGH: $749,950 / 0.3%

KILSYTH: $672,500 / 6.3%

KINGS PARK: $534,000 / -2.4%

KOO WEE RUP: $471,250 / -9.8%

KURUNJANG: $407,500 / 4.5%

LALOR: $580,000 / 2%

LANGWARRIN: $662,500 / 4.8%

LAVERTON: $510,000 / -4.5%

LILYDALE: $708,000 / 3.6%

LOWER PLENTY: $1,277,500 / -15.3%

LYNDHURST: $581,500 / 3%

MACLEOD: $881,000 / 3.7%

MAIDSTONE: $775,000 / no change

MALVERN: $2,500,000 / 10.6%

MALVERN EAST: $2,015,000 / 6%

MANOR LAKES: $586,000 / 7.3%

MARIBYRNONG: $1,080,000 / 5.4%

MELTON SOUTH: $427,500 / 0.8%

MELTON WEST: $452,000 / -3.2%

MENTONE: $1,059,000 / 9.7%

MERNDA: $560,000 / 0.9%

MICKLEHAM: $542,500 / 3.2%

MIDDLE PARK: $1,685,500 / -4.6%

MILL PARK: $685,000 / 9.5%

MILLGROVE: $450,000 / 4.8%

MITCHAM: $949,000 / 13.7%

MONBULK: $670,000 / 0.8%

MONT ALBERT NORTH: $1,345,000 / 23.3%

MONTMORENCY: $840,000 / -2.8%

MONTROSE: $725,000 / 5.4%

MOONEE PONDS: $1,230,000 / 3.9%

MOORABBIN: $1,015,000 / 14.3%

MOOROOLBARK: $710,000 / 4.3%

MORNINGTON: $980,000 / 18.4%

MOUNT ELIZA: $1,365,000 / 7.4%

MOUNT EVELYN: $679,950 / 1.3%

MOUNT MARTHA: $1,220,000 / 12.8%

MOUNT WAVERLEY: $1,365,000 / 10.7%

MULGRAVE: $821,000 / 7.4%

MURRUMBEENA: $1,261,000 / 20.2%

NARRE WARREN: $600,000 / -1.7%

NARRE WARREN SOUTH: $650,000 / 2.2%

NEWPORT: $1,100,000 / -2.5%

NIDDRIE: $1,050,000 / 2.4%

NOBLE PARK: $647,500 / 6.5%

NORTH MELBOURNE: $1,100,000 / 11.5%

NORTH WARRANDYTE: $992,500 / 2.4%

NORTHCOTE: $1,490,000 / 11.3%

NUNAWADING: $930,000 / 5.9%

OAK PARK: $878,750 / 14.4%

OAKLEIGH: $1,050,000 / 2%

OAKLEIGH SOUTH: $900,000 / 7.1%

OFFICER: $626,000 / 3.5%

PAKENHAM: $517,000 / 3%

PARKDALE: $1,193,500 / 4.8%

PASCOE VALE: $959,500 / 5.4%

PASCOE VALE SOUTH: $1,017,500 / 4%

PEARCEDALE: $655,000 / -1.4%

POINT COOK: $645,000 / 0.8%

PORT MELBOURNE: $1,577,500 / 7%

PRAHRAN: $1,430,000 / 4.9%

PRESTON: $1,037,898 / 13%

RESERVOIR: $790,000 / 9.3%

RICHMOND: $1,361,000 / 5.8%

RINGWOOD: $902,500 / 7.4%

RINGWOOD EAST: $905,000 / 4%

RINGWOOD NORTH: $1,012,500 / 3.7%

ROSANNA: $1,200,000 / 15.1%

ROSEBUD: $535,000 / 1.2%

ROWVILLE: $841,600 / 7.8%

ROXBURGH PARK: $540,000 / 5.3%

RYE: $665,000 / 1%

SAFETY BEACH: $920,013 / 12.4%

SANDHURST: $810,000 / 12.7%

SANDRINGHAM: $1,740,000 / 2.3%

SCORESBY: $825,000 / 13.7%

SEAFORD: $690,000 / 8.5%

SEDDON: $992,500 / 4%

SKYE: $626,750 / 4.4%

SOMERVILLE: $705,000 / 3.7%

SORRENTO: $1,440,000 / -7.8%

SOUTH MELBOURNE: $1,580,000 / 18.7%

SOUTH MORANG: $633,000 / 4.6%

SOUTH YARRA: $1,600,000 / 7.7%

ST ALBANS: $587,500 / 3.1%

ST KILDA: $1,065,000 / -12.2%

STRATHMORE: $1,366,000 / 8%

SUNBURY: $517,500 / -0.9%

SUNSHINE: $782,500 / 14.1%

SUNSHINE NORTH: $647,000 / 7.1%

SUNSHINE WEST: $645,000 / 4.9%

SURREY HILLS: $1,650,000 / 2.6%

SYDENHAM: $562,400 / -3.3%

TARNEIT: $603,000 / 3.1%

TAYLORS HILL: $683,000 / -2.7%

TAYLORS LAKES: $720,000 / 5.3%

TEMPLESTOWE: $1,430,000 / 8.9%

TEMPLESTOWE LOWER: $1,090,000 / 9.9%

THE BASIN: $827,500 / 3.7%

THOMASTOWN: $577,000 / 3.3%

THORNBURY: $1,145,000 / 9.4%

TOORAK: $3,600,000 / 7.7%

TRUGANINA: $570,000 / 2.9%

UPWEY: $718,000 / 3.5%

VERMONT: $1,211,000 / 15.4%

VERMONT SOUTH: $1,150,000 / 8.9%

VIEWBANK: $915,000 / 10.5%

WANTIRNA: $840,000 / 8.7%

WANTIRNA SOUTH: $1,070,000 / 9.3%

WARRANDYTE: $1,156,000 / -10.8%

WARRANWOOD: $874,000 / -0.8%

WATSONIA: $772,750 / 8.3%

WATTLE GLEN: $1,020,000 / 4.8%

WERRIBEE: $491,000 / 2.9%

WEST FOOTSCRAY: $800,000 / -2.3%

WHEELERS HILL: $1,320,000 / 10.6%

WHITTLESEA: $595,000 / -4.2%

WILLIAMS LANDING: $832,500 / 1.2%

WILLIAMSTOWN: $1,450,000 / 10%

WINDSOR: $1,260,000 / 13.7%

WOLLERT: $552,000 / -2.6%

WYNDHAM VALE: $463,000 / -2.7%

YARRA JUNCTION: $600,000 / 1.3%

YARRAVILLE: $1,065,000 / 1.5%

Units

ABBOTSFORD: $608,000 / 4.5%

AIRPORT WEST: $629,000 / 1.8%

ARMADALE: $483,750 / 16.1%

ASCOT VALE: $670,000 / 26.2%

ASHWOOD: $833,000 / 1.8%

BALACLAVA: $518,750 / -5.7%

BALWYN: $600,000 / 18.4%

BALWYN NORTH: $1,060,000 / 29.3%

BAYSWATER: $590,000 / 10.9%

BEAUMARIS: $885,000 / 1.5%

BENTLEIGH: $735,500 / 4.6%

BENTLEIGH EAST: $1,005,000 / 8.1%

BLACK ROCK: $755,000 / -8.3%

BLACKBURN: $820,500 / -0.1%

BLACKBURN NORTH: $740,000 / 13.6%

BONBEACH: $677,725 / 12.4%

BORONIA: $592,500 / 7.3%

BOX HILL: $600,125 / 25.3%

BOX HILL NORTH: $732,000 / 16.7%

BOX HILL SOUTH: $752,500 / 5.2%

BRAYBROOK: $643,000 / 7.2%

BRIGHTON: $1,172,500 / -0.4%

BRUNSWICK: $550,000 / 10.5%

BRUNSWICK EAST: $432,500 / no change

BRUNSWICK WEST: $420,000 / -1.5%

BULLEEN: $850,000 / -5.1%

BUNDOORA: $480,000 / 5.3%

BURWOOD: $790,000 / 10.4%

CAMBERWELL: $1,005,750 / 11.4%

CARLTON: $425,000 / -6.1%

CARNEGIE: $637,500 / 25.5%

CARRUM: $745,000 / 5.9%

CARRUM DOWNS: $450,000 / 12.5%

CAULFIELD: $775,000 / -6.4%

CAULFIELD NORTH: $670,000 / -11.8%

CAULFIELD SOUTH: $750,000 / 14.9%

CHADSTONE: $866,000 / 16.3%

CHELSEA: $640,000 / 5.8%

CHELTENHAM: $630,000 / 10.5%

CLARINDA: $750,000 / 8.3%

CLAYTON: $718,000 / 9.7%

CLAYTON SOUTH: $640,250 / 4.8%

CLIFTON HILL: $717,500 / -2.6%

COBURG: $630,500 / 3.8%

COBURG NORTH: $640,000 / 3.3%

COLLINGWOOD: $605,000 / -1.7%

CRAIGIEBURN: $355,000 / -2.8%

CROYDON: $591,000 / 7.3%

DANDENONG: $375,000 / 1.4%

DOCKLANDS: $617,000 / 0.5%

DONCASTER: $626,000 / 4.5%

DONCASTER EAST: $932,500 / 15.8%

DONVALE: $767,250 / 6.7%

EAST MELBOURNE: $1,046,500 / -5.2%

ELSTERNWICK: $610,000 / 7.6%

ELTHAM: $686,000 / 11.2%

ELWOOD: $630,000 / 9.7%

ESSENDON: $602,500 / 21.7%

ESSENDON NORTH: $563,750 / 1.5%

FAIRFIELD: $620,000 / 33.1%

FAWKNER: $500,000 / 7.6%

FERNTREE GULLY: $577,500 / 9.3%

FITZROY: $800,000 / 8.1%

FITZROY NORTH: $717,500 / 21.5%

FLEMINGTON: $491,250 / 12.5%

FOOTSCRAY: $410,000 / 6.7%

FOREST HILL: $722,000 / 8.2%

FRANKSTON: $383,000 / 1.2%

FRANKSTON SOUTH: $609,500 / -2.5%

GLEN HUNTLY: $635,750 / 1.4%

GLEN IRIS: $675,500 / 6.2%

GLEN WAVERLEY: $830,000 / 6.7%

GLENROY: $560,000 / 6.4%

GREENSBOROUGH: $647,500 / 9.8%

HADFIELD: $530,000 / 1.2%

HAMPTON: $837,500 / 18.4%

HAMPTON EAST: $684,000 / -1.7%

HAWTHORN: $677,000 / 7.7%

HAWTHORN EAST: $937,500 / 7.3%

HEIDELBERG: $646,000 / -2.2%

HEIDELBERG HEIGHTS: $680,000 / 12.9%

HIGHETT: $795,000 / 7.3%

HUGHESDALE: $450,000 / 20.2%

IVANHOE: $755,000 / -0.4%

KENSINGTON: $645,000 / 0.2%

KEW: $741,500 / 12.6%

KILSYTH: $580,000 / 10.8%

KNOXFIELD: $627,750 / 1.4%

LALOR: $483,351 / 13.9%

LANGWARRIN: $459,000 / 0.3%

LILYDALE: $507,500 / 6.1%

MACLEOD: $664,000 / 13.9%

MAIDSTONE: $645,000 / 12.9%

MALVERN: $750,000 / 16.6%

MALVERN EAST: $683,750 / -1.2%

MARIBYRNONG: $545,000 / 2.4%

MELBOURNE: $500,000 / 10.2%

MENTONE: $730,250 / 5.6%

MITCHAM: $660,500 / 13.9%

MONTMORENCY: $610,000 / 11.8%

MOONEE PONDS: $510,000 / 10.8%

MOOROOLBARK: $587,000 / 5.9%

MORDIALLOC: $745,750 / 6.1%

MORNINGTON: $583,500 / 6.6%

MOUNT WAVERLEY: $926,000 / 14.8%

MULGRAVE: $722,500 / 5.5%

MURRUMBEENA: $598,550 / 10.1%

NEWPORT: $775,000 / 9.8%

NIDDRIE: $750,000 / 1.4%

NOBLE PARK: $435,000 / 5.6%

NORTH MELBOURNE: $720,000 / 5.5%

NORTHCOTE: $595,000 / 0.4%

NUNAWADING: $650,000 / 11%

OAK PARK: $729,675 / -4.4%

OAKLEIGH SOUTH: $800,000 / 17.6%

ORMOND: $607,400 / 14.3%

PAKENHAM: $416,000 / 5.7%

PARKDALE: $773,750 / 13.4%

PASCOE VALE: $625,000 / -0.4%

POINT COOK: $410,000 / 3.7%

PORT MELBOURNE: $712,500 / -2.3%

PRAHRAN: $462,500 / 4.4%

PRESTON: $565,000 / 16.5%

RESERVOIR: $568,500 / 7.4%

RICHMOND: $525,000 / -2.1%

RINGWOOD: $572,750 / -0.1%

RINGWOOD EAST: $595,000 / 11.9%

SANDRINGHAM: $1,100,000 / -3.9%

SEAFORD: $575,000 / 6.3%

SOUTH MELBOURNE: $608,900 / 1.2%

SOUTH YARRA: $595,000 / 9.6%

SOUTHBANK: $545,000 / 7.4%

ST ALBANS: $490,000 / 4.5%

ST KILDA: $519,500 / 6.2%

ST KILDA EAST: $590,500 / 1.7%

ST KILDA WEST: $600,000 / 15.7%

STRATHMORE: $780,000 / 8.6%

SURREY HILLS: $767,500 / 9.2%

TEMPLESTOWE LOWER: $762,500 / 8.2%

THOMASTOWN: $480,000 / -0.8%

THORNBURY: $515,000 / 1.2%

TOORAK: $951,000 / -4.9%

VERMONT: $859,000 / 13.5%

WERRIBEE: $360,000 / -7.9%

WEST FOOTSCRAY: $410,500 / 12.6%

WEST MELBOURNE: $707,000 / 33.9%

WILLIAMSTOWN: $592,500 / 14.6%

WINDSOR: $619,000 / 8.1%

YARRAVILLE: $643,500 / 6.6%

Source: Real Estate Institute of Victoria, data to June 30

The post Melbourne spring property market awaiting eased restrictions to bloom appeared first on realestate.com.au.

BUYERS out shopping for residential real estate this spring will be armed with a wishlist that has been heavily influenced by the COVID crisis.

Restrictions on the way Australians live, work and travel have prompted many to reassess their housing needs and search for properties that tick a host of new boxes.

More people than ever are working from home, which means properties with a home office or space to run a business are in high demand.

Spring buyers are keen to be working somewhere that’s not the kitchen table.

Stage 2 of the $140 million No. 1 Grant Ave apartment project, under construction at Hope Island, has been redesigned to cater to home-based workers.

A “residential business centre’’ will include a fully-equipped glass-enclosed boardroom and five spacious private offices that can be used by residents any time of day.

Aniko Group is set to incorporate a business centre into its luxury $140 million No. 1 Grant Ave project which is under construction in Hope Island.

Private office at No. Grant Ave can be used by residents at any time.

Aniko Group managing director George Mastrocostas said the creation of the expanded business centre was a direct response to the coronavirus pandemic.

“We went back to the drawing board when COVID hit to create a larger business centre, knowing that the way people were working and running their businesses was changing rapidly,” he said.

“We believe these work spaces are going to become an extremely valuable asset to the communal facilities of residential projects moving forward and the expanded business centre has certainly been well received by our buyers.”

MORE:

Buyer beware: Restrictions on open homes and auctions

Why everyone wants to live in Mermaid Waters

Inside a Sorrento stunner with a long list of features

Easy access to green space, like Bim’bimba Park in Pimpama, is high on buyers’ wishlists.

High speed internet is another must for people working from home, while apartment-based workers are seeking a balcony, courtyard or access to green space to maintain sanity.

Families looking to accommodate adult children who have lost their jobs or to protect vulnerable elderly parents are searching for larger homes with multiple bedrooms, a granny flat or dual-living potential.

A renewed focus on family, good health and a desire to live away from densely populated areas has seen a surge in demand for rural and acreage real estate.

Greenery and multiple living options made this house in Wongawallan appealing.

Amir Prestige-Mermaid Beach agent Kris Valcic, who recently sold a tri-level home on 1.7ha (4.3 acres) at Wongawallan, said 40 per cent of prospective buyers wanted to accommodate extended family.

“People want to be further away from other people and we’re hearing from a lot of bigger families looking to live together in large homes on acreage,” he said.

Prospective buyers were eyeing off the tennis court at this luxury Guanaba acreage.

Kollosche agent Kara Evatt, who recently sold a luxury acreage at Guanaba, said there was a notable interest in the tennis court.

“A lot of people made comment on having a tennis court as an activity that they can do at home,” she said.

“We also had a surplus of prospective buyers wanting access to a helicopter pad.”

The post How COVID has changed spring buyer wishlists appeared first on realestate.com.au.

AN epic waterfront house lovingly crafted by its owner-builder is on track to smash the sales record at Burleigh Waters.

The two-storey, five-bedroom home at 27 Wedgebill Pde hit the market this weekend and is expected to crack the $2 million price barrier.

27 Wedgebill Pde, Burleigh Waters is set to smash the Burleigh Waters sales record.

MORE NEWS: How COVID has changed buyer wishlists

Inside Sorrento stunner with endless list of luxury features

The Burleigh Waters record is held by a property in the same street – No. 65 sold for $1.95 million in 2017.

Having spent more than 30 years as a builder, Chris Moore and wife Christy bought the property in 2015 and used their years of experience to redesign and expand the existing home to make the most of the views over Swan Lake towards Surfers Paradise.

Relax by the waterfront.

“We actually moved here from Reedy Creek with a plan to spend more time at the beach but the house has such a relaxed holiday feel, we never want to leave it,” said Mr Moore, who spent three years bringing their vision to reality.

“Once you’re out the back overlooking the water, you want to enjoy it so we spend hours on the lake, even in winter, fishing, canoeing, paddle boarding and wind surfing.

Cook up a storm in the kitchen.

“We weren’t initially planning to build the house as big as we did but when we realised we were in such a special spot, we took the opportunity to create a home that would be perfect for entertaining our friends and family, including our three sons and their mates.”

The highlight of the property is the open plan design that allows for seamless indoor-outdoor living, with all living areas opening on to an alfresco entertaining area and pool.

Welcome home to 27 Wedgebill Pde, Burleigh Waters.

Kingfisher Realty principal Conal Martin is marketing the property and said he expected it to steal the crown of Burleigh Waters’ most expensive home.

“Chris and Christy have created a slice of paradise and we are expecting a huge amount of interest in the property,” Mr Martin said.

The post The house set to smash sales record in Burleigh Waters appeared first on realestate.com.au.

This four bedroom house at 13 Bellevue Crescent, Whitfield is listed with Ray Murphy at RE/MAX and will be auctioned on September 22, unless sold prior.

Multiple and rapid offers on Far Northern properties are signs an auction is worth considering Cairns real estate agents say.

The social distancing laws enforced on the real estate market had stalled auction activity across the country, with the Far North going weeks at a time without a property under the hammer during the height of the pandemic.

REIQ Far North zone chair Tom Quaid said despite the lockdowns, demand for homes had never died.

“It’s been the story of the Cairns real estate market for the last four months — there’s more buyers than sellers,’ Mr Quaid said.

This four-bedroom house at 13 Bellevue Crescent, Whitfield is listed with Ray Murphy at RE/MAX and will be auctioned on September 22, unless sold prior.

“When you’re getting multiple offers on one property and they’re coming in quickly, it’s worth considering an auction to get the most value out of that demand.”

He said sellers considering an auction could benefit from longer campaigns, allowing buyers more time to prepare finances while banks tightened their lending.

RE/MAX broker-owner Ray Murphy said his office was experiencing a rise in demand for auctions.

“If they don’t sell prior, we’ll do about 30 in September. We did about 10 in June,” he said.

“Sellers are actually asking us more about the process and with the number of properties we’re selling sight unseen, now is the time for auction. It’s getting more Victorians interested in our market too.”

The post Auctions: Why buyers may need more time to prepare appeared first on realestate.com.au.

TO own a piece of residential “heaven” at Lake Tinaroo is a dream for many, which has just been made affordable thanks to a new property sharing scheme.

Edgewater Tinaroo’s scheme labelled Chalet+Share allows multiple buyers to share one of seven recently released lots at Lake Tinaroo from about $60,000.

The waterfront lot will feature a luxury home on a minimum of 4000sq m, on the edge of the lake.

The idea for the program, which is led by Edgewater’s director and developer Tim Wright, was born from a yacht sharing scheme.

Edgewater Tinaroo is offering a new property sharing scheme which will allow mulitple buyers to own and share a luxury house at Lake Tinaroo on a 4000sq m block.

“I loved sailing but could not afford it and did not want to have my money tied up in my own yacht that I only used from time-to-time due to work commitments,” Mr Wright said.

“I love the Tablelands and I understand that many people simply cannot afford to purchase a lot, build a home and then use it as a holiday home at Lake Tinaroo, so I launched Chalet+Share.”

He said a fully furnished luxury home and the land would cost $1.2 million and the idea was that each owner’s share entitled them to a maintained and serviced holiday house for a certain period each year, until it was sold and the owners received their share back.

“Chalet+Share will seek 20 owners at $60,000 a share so the chalet will be fully owned. This will entitle each owner to around 18 days a year comprising weekends and weekdays, all done over the net with a great booking calendar.

“So yes when it is sold say in 10 years’ time, they will get their share proceeds back.

“All money subscribed will be held in a solicitors trust account.”

He said while there would be ongoing management costs for maintenance, owners also had the opportunity to sell their share in the chalet at any point.

He said the luxury six-bedroom house would be built in three modules of two bedrooms each.

“So three families could all enjoy the house and holiday at once but still have their own privacy during their stay.

“No stone for owners’ security and enjoyment will be left unturned. The owners will get a beautiful, luxury home”.

Edgewater is now accepting expressions of interest, or for more information visit edgewater-tinaroo.com.au

The post 20 owners, one home: Lake Tinaroo luxury home share scheme appeared first on realestate.com.au.

Multiple living and development opportunities exist for the buyer of the three-bedroom house at 3 MacNamara St, Manunda.

MULTIPLE living and development opportunities exist for the buyer of this untouched, original Queenslander set in the heart of Cairns.

Sitting on a large 911sq m block is 3 MacNamara St, Manunda – a three-bedroom house which has retained much of its original character and charm from when it was built in the late 1940s.

The well constructed and immaculately maintained home has only seen one family grow up at the address and has now entered the market for the first time in its history – going under the hammer on September 19 with Cairns Property Office’s Kerry Ah Chin.

Multiple living and development opportunities exist for the buyer of the three-bedroom house at 3 MacNamara St, Manunda.

“The biggest highlight is that it still has all its original features from the 1940s,” she said.

“From the impressive high ceilings, to the ornamental corners, the casement windows, which allow in plenty of natural light, and I’m told under the carpet there are lovely timber floors.

“There’s just so much original and beautiful detail. Instantly it has a very warm feel.”

Like all traditional Queenslanders, the use of timber was not scarce, but Ms Ah Chin said the kitchen featured a special kind.

Multiple living and development opportunities exist for the buyer of the three-bedroom house at 3 MacNamara St, Manunda.

“Enter from the front porch you’ll feel the warmth as you step inside to a spacious living area through to the unique kitchen with original native Kauri Pine cupboards, dining table and bench seat as well as bench oven and cooktop.”

With three large bedrooms the master features built-in cupboards and a dresser, while downstairs there is an additional “sleep-out” alongside the laundry.

“This character-filled home is ready to live in now with the perfect palette for renovating down the track,” Ms Ah Chin said.

“It would be great for a home business.

“It’s zoned medium density residential and because it’s in a great location with plenty of space it could be perfect to build your own dream home from scratch.

“Subject to approval, there would even an opportunity to develop units here.”

The post Manunda Queenslander untouched since ’40s appeared first on realestate.com.au.