ReLEASE lets homeowners sell their houses, then lease them back for an indefinite period of time.

Blog

Brad Inman kicks off today’s Connect Now with his advice for this fall. Read an excerpt, and make plans to join us today at 11 a.m. ET / 8 a.m. PT

With buyers and sellers concerned about the risks of in-person meetings, virtual presentations are now the norm. But what can brokers tell agents who aren’t convinced virtual communication is here to stay?

Looking for a little clarity on this week’s news? Windermere Chief Economist Matthew Gardner takes another look at mortgage forbearance, explaining the latest data and insights in light of some recent headlines.

This week, our readers spill the beans on some of the worst branding mistakes they’ve ever seen throughout their careers. Here’s a list of noteworthy marketing snafus.

An apartment at 3002/61 Haig Street, Southbank, is sitting vacant on the rental market, asking $370 per week.

Check out more stories at themelbournecitynews.com.au

Want to become a digital subscriber? Join now on our latest offer here

The number of empty rental homes across Melbourne has almost doubled in the past year, with the tenant exodus hitting Southbank, Docklands and the CBD hardest.

Experts have identified the trio as “danger zones” buyers should steer clear of at all costs — but on the flip side, tenants moving in could just about “name their price”.

Propertyology head of research Simon Pressley said Melbourne’s inner-city apartment market had “grossly underperformed” for several years now.

And the COVID-19 crisis has made the sector even more hazardous by heightening pre-existing oversupply issues.

RELATED: Victoria’s biggest selling season crippled by $20b black hole

Victoria evictions ban, support for tenants and landlords extended into 2021

JobSeeker cut will hurt low-income Melbourne renters: Anglicare

Mr Pressley found 20,891 rental homes citywide lay vacant at the end of August, equating to a 3.4 per cent vacancy rate. This was up from 11,830 a year prior.

Southbank’s vacancy rate skyrocketed from 4.3 per cent to 16.6 per cent in the same period, while Dockland’s rose from 3.8 per cent to 16.1 per cent, and the CBD’s, from 2.6 per cent to 8 per cent.

Mr Pressley said employment loss in hard-hit sectors like hospitality and tourism, and the absence of international students and migrants due to border closures, had caused an inner-city tenant exodus.

“It’s sad for the tenants who have lost their jobs and had to move out (and) for the landlords who … have to try and service mortgages without rental income,” he said.

“It will be sad when these people have no choice other than to sell already poorly performing assets.”

1112/55 Merchant Street is one of many Docklands apartments sitting vacant. Its weekly asking rent has been slashed from $520 to $390.

Propertyology found a typical apartment in Southbank, Parkville and South Yarra had gained less than 1 per cent in value each year of the past decade, while Docklands units had declined 0.2 per cent.

Vacancy rates had also risen annually in South Yarra (from 2.4 per cent to 6.2 per cent), St Kilda (2.1 per cent to 4.9 per cent), Box Hill (3 per cent to 5.4 per cent), Prahran (2.2 per cent to 4.8 per cent) and Parkville (2.7 per cent to 4.5 per cent).

The figure is calculated by comparing how many rental listings have been advertised online with the total number of established rental properties in a region.

Propertyology head of research Simon Pressley said Melbourne’s inner-city rental market was a sad state of affairs.

Mr Pressley said a small silver lining was vacancy rates appeared to have remained steady outside Melbourne’s inner ring — but the city’s extended lockdown could change that.

“When the coronavirus first hit, we expected a spike in inner-city vacancy rates. It was a case of whether individual landlords had enough cash flow to get though a six-week national lockdown,” he said.

“But this is a much harder and longer lockdown.”

Continued rental price falls and landlords abandoning the market altogether were likely outcomes, he said.

Property investors are being advised to steer clear of the CBD, Docklands and Southbank. Picture: David Caird

RiskWise Property Research has also identified the CBD and Docklands among the nation’s top 10 “danger zone” markets, with chief executive Doron Pereg urging investors to be particularly cautious of buying off-the-plan apartments in the coronavirus environment.

He warned of the likelihood of further unit price declines, which could create problems at settlement, and cash flow issues, with the pandemic drastically reducing the tenant pool for inner-city Melbourne properties.

MORE: Melbourne lockdown to drive exodus to regional Victoria, interstate

Melbourne lockdown real estate restrictions leave homeowners in limbo

REIV backs down on rent reduction ‘strike’

Melbourne vacancy rates

Southbank: 16.6% (up annually from 4.3%)

Docklands: 16.1% (3.8%)

Melbourne CBD: 8% (2.6%)

South Yarra: 6.2% (2.4%)

St Kilda: 4.9% (2.1%)

Box Hill: 5.4% (3%)

Prahran: 4.8% (2.2%)

Parkville: 4.5% (2.7%)

Port Melbourne: 4.2% (2.1%)

Richmond: 3.5% (1.9%)

Kensington: 2.5% (1.2%)

—-

Greater Melbourne: 3.4% (2%)

Source: Propertyology, comparing August 2020 to August 2019

The post Coronavirus Melbourne tenant exodus amplifies inner-city danger zones appeared first on realestate.com.au.

Apartment landlords within inner Sydney may have begun to gradually attract tenants again after slashing rents.

Figures from SQM Research showed the proportion of rental homes sitting vacant in the CBD dropped from a high of 16.2 per cent in May to 12.9 per cent in August.

The change in vacancies coincided with a plunge in rents – the average asking rent for units in the CBD over August was about 23 per cent lower than a year prior.

There were also about 700 fewer vacant properties across the Greater Sydney area in August compared to July, with the vacancy rate dropping from 3.6 per cent to 3.5 per cent. The vacancy rate was the highest among capital, despite the drop.

MORE: Cricket star Smith to transform luxe home

Buy in Sydney’s exclusive east for just $225k

Separate research from the Real Estate Institute of NSW showed vacancies across the Greater Sydney area decreased for the first time in five months.

Newcastle and Wollongong also had a slight easing of vacancies in August, as did many other regional NSW areas.

The Sydney CBD has the highest level of vacancies.

REINSW chief executive Tim McKibbin said landlords may have staved off vacancies by offering more enticing deals.

“Easing of vacancy rates across much of NSW may be attributable to landlords responding to the changed market conditions brought on by the COVID-19 pandemic,” Mr McKibbin said.

“With so many people experiencing job losses or reduced pay, many tenants have had to relinquish properties and go in search of more affordable options. Landlords faced with vacant properties are now, in turn, reducing weekly rents to entice tenants.”

SQM Research director Louis Christopher said drops in rent meant there were “leasing opportunities for tenants who have chosen to stay in town”.

Tenants may be starting to pick up on the chance to get a better deal, according to Finder.com.au.

It is still a good time for tenants to negotiate rent.

A recent Finder survey revealed 31 per cent of renters have moved or are considering moving during the pandemic.

Finder insights manager Graham Cooke said it was prime time for renters to negotiate a better deal.

“The reality is many Aussies are currently paying too much for their rent. If you’re in a position to move, now is the time to find a bargain,” he said.

Mr Cooke said those who didn’t want to move should consider asking for a rent reduction. He gave the following tips:

Assess your payment history: If you never miss a payment you’ll have better luck asking for a discount.

Compare rentals in your area: Check online for properties similar to yours in your suburb. If they’re being offered at a lower rent than you are paying, raise it with your real estate agent and use these listings as evidence for your claim.

Know your credit score: If you’ve got a good credit score that can help. Your landlord should be more enthusiastic about keeping you, and if not you have a higher chance of being accepted at a different property

Be polite: Most landlords in Australia are also paying off mortgages. If you want to maintain a strong relationship with your landlord it’s important to be gentle but firm with your case.

The post Rental vacancies ease across Sydney as landlords cut rents to attract tenants appeared first on realestate.com.au.

Hawks captain Ben Stratton (right) has sold his Fitzroy home in an off-field victory. Picture: Mark Dadswell

Outgoing Hawks captain Ben Stratton has sold his stylish Fitzroy home while calling time on his decorated football career.

The three-time premiership star sold his stylish warehouse conversion at 75 Palmer Street just two weeks before announcing his retirement from AFL.

Stratton previously hinted to the Herald Sun his next move could be to “head west”, sparking speculation the defender may move back to home state Western Australia.

RELATED: Ben Stratton: Hawthorn captain selling swish Fitzroy conversion

Ben Stratton: Hawthorn captain’s Fitzroy house misses mark

Rick Olarenshaw: Premiership Bomber lists Port Melbourne pad

Ben Stratton has called time on his career at Hawthorn. Picture: James Elsby

75 Palmer St, Fitzroy was sold by Stratton in September.

The 31-year-old was raised in Dunsborough and played for the WAFL’s East Perth before being recruited by the Hawks as a mature age pick in 2009.

Nelson Alexander Fitzroy agent Mark Verrochi confirmed the two-bedroom pad sold close to the $1.55m asking price.

He said it was likely Stratton’s next property would be in WA.

Inside the swish warehouse conversion.

Modern features add plenty of flair.

“I know he wanted to move more beachside, and while I’m not entirely sure it was WA, I can only assume,” Mr Verrochi said.

“I’m not sure if Stratton had made the decision to retire when he first listed the home for sale.”

The warehouse conversion, where Stratton and his fiancee Laura Griffin lived, was first listed in June, before passing in on a vendor bid at an online auction in July.

Mr Verrochi said it was eventually snapped up by a notable artist who divided his time between Los Angeles and Melbourne.

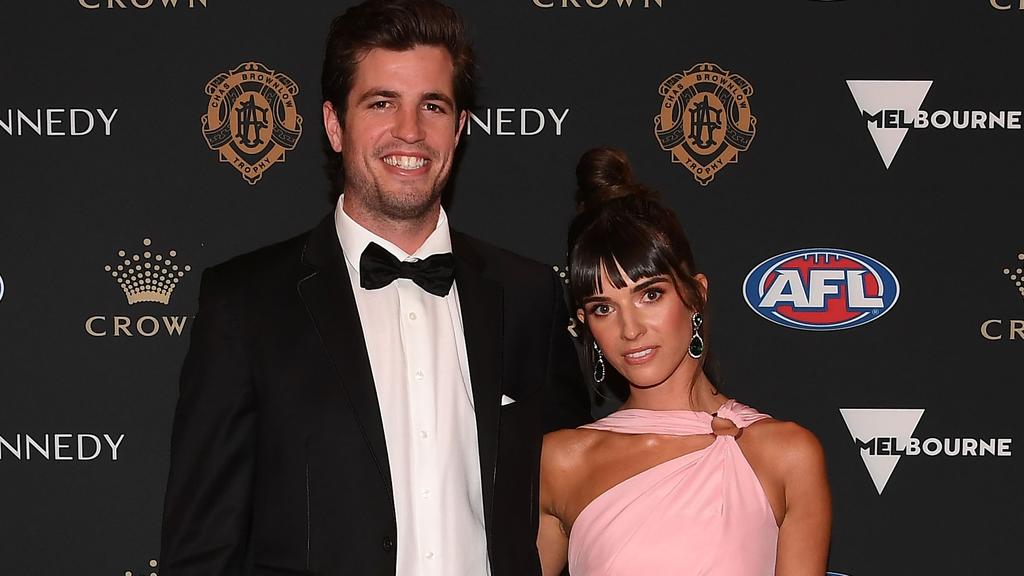

Stratton with fiancee Laura Griffin at the 2019 Brownlow Medal ceremony. Picture: AAP Image/Julian Smith

A spiral staircase and fireplace are stand out features.

“He loved the warehouse feel of it, which he can really put his own spin on,” Mr Verrochi said.

“The first thing he loved was the cathedral ceilings and how it was so spacious and light filled.”

The artist had the opportunity to physically inspect the property early in the campaign, before a ban on private inspections began.

A rear deck was perfect for entertaining.

There are two bedrooms inside the warehouse conversion.

Stratton told the Herald Sun the property had been “perfect for entertaining”, with a large open-plan living room and a deck at the rear.

“It was perfect, we had everything at our front door – so many local watering holes and favourite brekky places,” Stratton said.

“It was pretty special having Carlton Gardens in our backyard.”

The property was snapped up by a notable artist.

There are two bathrooms.

The couple added a huge bi-fold door leading to the deck, concrete floors and exposed a brick wall during their five-year stint at the property.

They bought it for $1.295m in 2015, according to CoreLogic.

Stratton announced his retirement from Hawthorn on Monday, after racking up 201 games across a 10-year career.

Stratton won three premierships with the Hawks. Picture: Colleen Petch

He starred in the club’s premiership three-peat from 2013 to 2015 and was made captain for his last two seasons.

He is hanging up the boots at the same time as teammate Paul Puopolo.

READ MORE: Surging suburbs: Clyde, Wollert among suburbs in hot demand

Stage four lockdown: Billions wiped from Victorian economy as market ban extends

The Block episode 12 recap: Jimmy and Tam’s winning streak comes to a screaming halt

The post Ben Stratton: Retiring Hawthorn captain sells Fitzroy warehouse conversion appeared first on realestate.com.au.

118B Goulburn Street, West Hobart. Picture: SUPPLIED

WHEN this gorgeous West Hobart family home hit the market, it was not just Tasmanians that had their eye on it.

In fact, St Andrews Estate Agents director Steve Yannarakis said he primarily received interest from Victorian buyers.

“It was snapped up by a Victorian couple who have had a lifelong dream of owning a Tasmanian property,” he said.

“They love Tasmania.”

A beautiful first impression.

Get busy in the kitchen.

While the home was technically sold “sight unseen”, Steve said a Hobart-based friend had inspected it for the purchaser and that FaceTime works well when showing a home to people that cannot get to Tassie due to the boarder closures.

He said it was a good tool.

“You can take people through a quite detailed inspection via FaceTime and help them to really investigate a property,” Steve said.

No.118B Goulburn Street was listed at “Offers over $1.2 million” and was sold in only a few days on the market.

Steve said his vendor was very happy with the result.

“It is easy to see what people liked about this property: it is north facing, has a magnificent garden and it is positioned at the epicentre of North Hobart, West Hobart and the city,” he said.

Spacious family living.

Ticks the relaxation box.

The house was built about 12 years ago.

The entry steps into a living, dining and kitchen zone that overlooks a cottage garden highlighted by a Heritage Listed walnut tree.

There are three bedrooms at ground level, a family bathroom and lower ground level cellar.

The upper level is home to a master bedroom and a study.

This delightful room has views toward the city and Mount Wellington.

Throughout the house there are dark stained hardwood floors, multiple french doors, an alarm system, built-in wardrobes to bedrooms and a high quality kitchen with 40mm granite benchtops, patterned glass splashback and quality appliances.

Outside there is a lined double garage with mezzanine storage.

The post A Goulburn St gem set amid a riot of colour appeared first on realestate.com.au.

32 Sedgebrook Road, Bonnet Hill. Picture: SUPPLIED

ONE of the most impressive Hobart homes to hit the market this year has a new owner.

No.32 Sedgebrook Road in Bonnet Hill fetched $1.475 million, per realestate.com.au data.

Harcourts Signature New Town Senior Property Representative Lynne Page said the property was bought by Tasmanian purchasers.

“They were drawn to the lifestyle that it offers,” Lynne said. “Working from home as academics, the opportunity the property offered for them to have space for each to have their own office was a drawcard.

“The natural beauty and scenery of the Alum Cliffs also had appeal as they are keen on bush walking and maintaining an active lifestyle.”

Light and bright.

Welcome, come on in.

Lynne said the beautiful views, the seclusion and size of the house would allow the owners to cater for extended family. “The property offers room for enhancement to suit their lifestyle,” she said. “And the expansive allotment was also a drawcard.”

Set on 2.69ha of land, the home is an 18-minute drive from the very centre of Hobart. It has a natural bushland feel with its tall trees and a view to die for that stretches far and wide from Opossum Bay to Bruny Island and Kingston Beach.

Across two levels it offers a 465sq m floorplan with five double-sized bedrooms and three bathrooms.

There are bay windows, open plan living areas, polished timber floors, a huge laundry/mud room, a study, media room and a gym/utility room.

Kitchen bliss.

Wide blue views.

Bespoke joinery features in the kitchen — white with timber accents.

Off the living room on both levels there are decks, another accessed from the kitchen plus a courtyard on the opposite side of the home.

Outside, sandstone walls accentuate the garden’s seasonal colour.

There is an almost 50sq m shed, ensuring storage will never be an issue.

The property has a massive garage and workshop with plenty of space to park two cars in tandem.

The post Large Bonnet Hill home fetches a top price appeared first on realestate.com.au.