National property values have fallen for the third successive month.

Australian home prices have fallen for the third successive month, due to the economic impact of the COVID-19 pandemic.

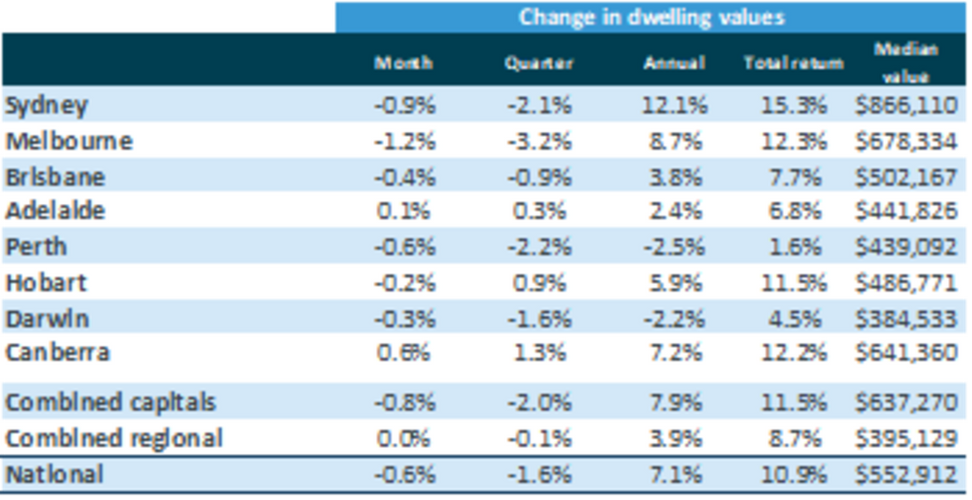

According to CoreLogic’s home value index, housing prices nationally dropped by 0.6 per cent in July. This followed a 0.7 per cent drop in June and a 0.4 per cent drop in May.

Overall values have slipped 0.7 per cent since the pandemic began to bite in the middle of March. For that month values were up 0.7 per cent, followed by an increase of 0.3 per cent in March.

Canberra was one of the places to enjoy home value growth in July. Picture: Getty Images

The figures indicate the resilience of the market, according to CoreLogic’s head of research Tim Lawless.

“The impact from COVID-19 on housing values has been orderly to-date, with CoreLogic’s national index falling only 1.6 per cent since the recent high in April and housing turnover has recovered quickly after it’s sharp fall in late March and April,” he said.

MORE

Australia’s hottest growth suburbs revealed

Melbourne, which has been hit hardest by COVID-19 saw housing values slide the greatest by 1.2 per cent. In Sydney they fell 0.9 per cent, in Perth by – 0.6 per cent, in Hobart by -0.2 per cent and in Darwin by -0.3 per cent.

Adelaide (0.1 per cent) and Canberra (0.6 per cent) were the only cities to enjoy a value increase in July.

CoreLogic Homes Values Index July 2020

“Record low interest rates, government support and loan repayment holidays for distressed borrowers have helped to insulate the housing market from a more significant downturn,” Mr Lawless said.

“Advertised supply levels have remained tight, with the total number of properties for sale falling a further 4.3 per cent in the four weeks to July 27th, sitting 15.2 per cent below where they were this time last year.

“Additionally, increased demand driven by housing specific incentives from both federal and state governments, especially for first home buyers, have become more substantial.”

Prices in regional areas, such as Bathurst, NSW, are holding up well.

With welfare packages JobKeeper and JobSeeker to be scaled down from October and Victoria entering stage four lockdown yesterday, the medium term outlook is for a continued drift downward of the market.

“Urgent sales are likely to become more common as we approach these milestones, which will test the market’s resilience,” Mr Lawless said.

MORE

How COVID-19 is changing what we want in our homes

Rare chance to own Sydney home from The Block

“Similarly, the recent concerns of a second wave of the virus and the potential for renewed border closures and stricter social distancing polices are likely to further push consumer sentiment down. This is likely to weigh on both home buying and selling activity more broadly.”

This is likely to be reflected first at the premium end of the market, Mr Lawless pointed out.

“Higher value markets tend to be more reactive to changes in the economic environment, having led both the upswing and the downturn over previous cycles,” he said.

“The COVID related downturn has seen this trend playing out again, with upper quartile values down 2.9 per cent across the combined capital city index since the end of March, while lower quartile values have fallen by only 0.5 per cent.”

The post Australian home prices have fallen for the third successive month, due to the economic impact of the COVID-19 pandemic appeared first on realestate.com.au.