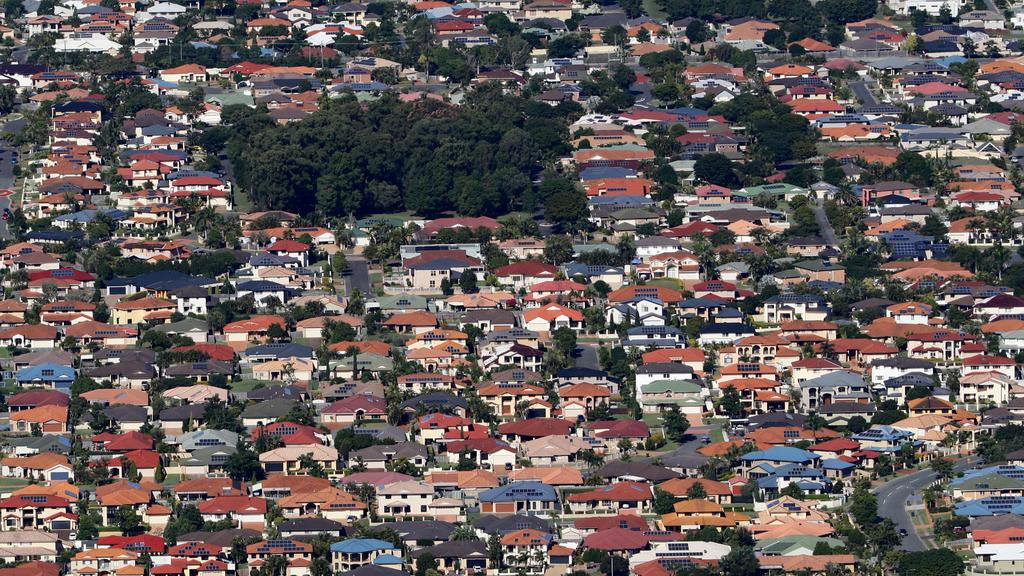

The First Home Loan Depost Scheme has opened up the suburbs to buyers. Picture: Darren England.

First-home buyers are riding into the property market on a wave of government incentives, according to figures just released.

One in eight first-home buyers this year have dipped into the Morrison Government’s First Home Loan Depost Scheme says the federal body charged with implementing the incentive.

The demand from first-home buyers for the scheme, which was an election promise of Prime Minister Scott Morrison, had come despite significant challenges.

MORE: Auction that proves regions are booming

Homebuyers rocked by lack of confidence

Arianna Merewether, her wife Annette Merewether, and dog Henry say the First Home Loan Depost Scheme allowed them to save for a home much sooner. Picture: Jake Nowakowski

The National Housing Finance and Investment Corporation (NHFIC) said interest in the FHLDS came from across the board.

“Demand for the scheme in the six months to 30 June continued despite the onset of the COVID-19 pandemic,” NHFIC CEO Nathan Dal Bon said.

“First-time buyers across age and income spectrums around the country accessed the scheme, and we saw strong interest from buyers in outer metropolitan and regional areas.”

The scheme was introduced on January 1 and was capped at 10,000 eligible buyers. That quota was quickly filled, with it re-set on July 1.

First-home buyers have embraced PM Scott Morrison’s scheme. Picture Gary Ramage

The FHLDS Trends and Insights report, discovered a number of interesting statistics about the first-home buyer. These included:

– the scheme allowed buyers on average to bring forward their purchase by four years

– almost 70 per cent of buyers purchased a detached house, with 25 per cent opting for an apartment and five per cent a townhouse

– more than 50 per cent of homes bought in capital cities were 15 – 30km from the CBD, with couples willing to buy further out than singles

– major cities attracted 62.3 per cent of buyers, with the remainder buying in regional areas

– teachers were the main cohort of key workers who accessed the scheme (37 per cent) following by nurses, who made up 25 per cent.

– the median price for houses was $385,000 compared with the $475,000 median cost of apartments, as most units were bought in capital cities.

– those accessing the scheme were concentrated in the 25-34 age bracket.

First-home buyers in Toowoomba accessed the FHLDS in the greatest numbers.

Under the scheme, buyers can purchase their first home with as little as five per cent deposit with the federal government guaranteeing the remaining 15 per cent usually required by costly insurance.

MORE: Byron Bay’s popularity with seachangers ‘peaking’

Australia’s most wanted streets revealed

Demand for the scheme was strongest in Toowoomba in regional Queensland, followed by Campbelltown in south west Sydney and the outer Melbourne suburbs of Cragieburn and Frankston.

Phillip Meyers, director of sales and marketing at Toplace, one of Sydney’s biggest and most respected developers said he was seeing this demand on the ground.

Apartments within reach of Sydney’s CBD such as Toplace’s Skyview, are proving popular with first-home buyers.

“Provided they have secure employment, we are getting a lot of interest from first-home buyers wanting to make a purchase because they see now as a great opportunity to take that first step,” he said.

“We are getting a lot of inquiries from individuals, couples and families alike who want to realise that dream of owning their first home.”

The lack of affordability of homes close to the CBD in Sydney was again highlighted by the report, with the majority of those who purchased in the Harbour City doing so at least 30km from the city centre. In all the other major cities, buyers made their purchase within 30km of the CBD.

Act now to avoid disappointment

The report also found almost two-thirds of the 10,000 capped places in the scheme were taken up within the first two months. Given the two-month period has now expired since the second allotment of places was released on July 1, first-home buyers intending to access the FHLDS in the second half of this year should do so ASAP.

NSW buyers had the most loans guaranteed, making up almost 23 per cent of the 10,000 successful applicants, Qld made up 18 per cent and Victoria made up 16 per cent.

The lower level of interest from South Australia and Western Australia was put down to the “longstanding Keystart and HomeStart low home loan deposit initiatives currently active in WA and SA respectively,” the report said.

A home close to Sydney’s CBD remains out of reach for most first-home buyers.

Almost 83 per cent of buyers borrowed between 90 and 95 per cent of the value of their home. Those buying in the greater Sydney area had the highest debt-to-taxable income ratio (4.7) in the country.

MORE: The suburbs we all want to live in

Radical way COVID-19 is changing our homes

Nationally prices have been slipping slightly in recent months but over the past year, they are well up.

Adrian Kelly, president of the Real Estate Institute of Australia, said first-home buyers shouldn’t over worry about committed to making a purchase for fear of plumetting prices as a result of COVID-19.

“If we have values falling one, two and three per cent during a global pandemic that is probably a good outcome,” he said.

“That might as well be zero. And if prices are flatlining, that is a good outcome too because that hasn’t been the case in other countries.”

The post First home buyers: How to get your home 4 years sooner appeared first on realestate.com.au.