1909 Point Nepean Road, in hot spot Tootgarook, is on the market with a $1.5-$1.65m price guide.

Proponents of hot spotting say the quickest way to build a solid property portfolio is to target areas on the verge of growth.

Yet, fans of investing in proven long-term performers argue the best way to maximise profit is to buy in areas with a track record of long-term capital growth.

So which approach should you choose? Here’s a look at the pros and cons of both to help you decide which strategy is better.

RELATED: Victoria’s future real estate growth markets picked by experts

Melbourne home values: Downturn deepens as stage four lockdown starts

Victoria stage four restrictions: How COVID lockdown will affect real estate

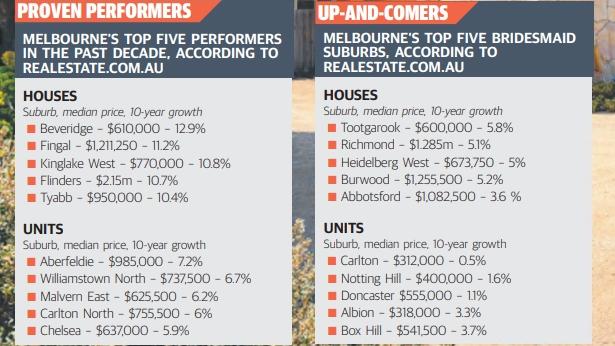

Melbourne’s top five proven performers and up-and-coming suburbs, according to realestate.com.au.

WHY HOT SPOTS ARE HOT

Because they’re generally in emerging areas, hot spots tend to be more affordable compared to the proven performers, according to property professor and author Peter Koulizos.

“You’re getting in just before the upturn so your initial cost of entry is also much lower,” he said.

He said hot spots were areas where substantial growth hadn’t occurred yet, so the potential for rapid growth, at least in the short term, was higher compared to proven performers.

As buyers make the purchase at the cusp of an upturn, there is the potential to amass equity quickly from a growth spurt.

WBP Group executive chairman Greville Pabst said up-and-coming suburbs — also known as “bridesmaid ’burbs” — were those that were predicted to grow off the back a high-performing neighbouring area.

“I look at an up-and-coming suburb as one adjoining a suburb that is already a solid performer,” he said. “If Prahran is too expensive, do we look in Windsor or St Kilda East? If Brunswick West is too expensive, then what about Pascoe Vale South?”

Philip Webb founder Philip Webb said buyers could get more bang for their buck in an up-and-coming suburb. “You are being speculative as to where the suburb is going, but can generally get more for your money — a bigger house (or better) style of property than in a tried and true suburb,” he said.

WBP Group executive chairman Greville Pabst said there was good value to be found in bridesmaid suburbs.

WHY HEAT MIGHT NOT COME

When it comes to investing in hot spots the operative word is “potential”, meaning the growth may not always come around.

Hot spots have the potential to grow quickly during the initial upturn phase. But if the fundamentals are lacking, this growth spurt could quickly fizzle out.

“The key risk is that a (bridesmaid) suburb may not have the same infrastructure, like public transport, a shopping village or school,” Mr Pabst said. Without those fundamentals, the suburb may never take off in value, he added.

PROVEN-PERFORMER POSITIVES

Proven performers are areas where there is already steady demand and growth, driven by a range of attractive amenities and lifestyle components.

“There is a desirability or cultural score that makes it more expensive and in demand,” Mr Pabst said.

“The disadvantage is stock is often in short supply and underlying demand tends to underpin price growth, making these suburbs more expensive.

“They may have a view, larger blocks, be within a good school zone or a trendy retail strip shopping precinct — it’s hard to replicate that amenity.”

Propertyology managing director Simon Pressley said there was no guarantee proven performers would continue to perform well.

PROOF ISN’T ALWAYS IN THE PURCHASE

While proven performers may have achieved strong growth in the past, there was no certainty it would go on indefinitely, Propertyology director Simon Pressley said.

“I don’t think there are any pros to picking a tried and tested performer,” he said. “It is making the biggest financial decision one can make and relying 100 per cent on complacency — it’s high risk.

“We can’t expect what has happened before to be repeated again.”

Mr Pressley warned buying in a proven performer could set investors up for failure, but said there were ways to minimise the risk.

“Don’t throw all your eggs in the one basket and buy a really expensive asset,” he said. “It’s breaking the No. 1 rule of investing, it’s like putting all (your money) on black (at the casino).”

Mr Pressley said those with a bigger budget should break it up.

“Take advantage of our huge country and buy multiple properties in multiple locations,” he advised.

DSRdata.com.au creator Jeremy Sheppard agreed there was no guarantee when buying in a suburb that had previously performed well.

“It is a risk, buying into an area that isn’t hot right now in the hope of superior long-term capital growth in the future,” he said.

“The longer the forecast, the less sure I am of what the future holds for proven performer property markets. But I’m much more confident of the short-term growth prospects of hot spots.”

157 Mandalay Circuit, in proven performer Beveridge, is up for sale with a $540,000-$570,000 price guide.

BEST OF BOTH WORLDS

The good news is you don’t have to choose between these two approaches, according to Mr Sheppard.

“Ideally you should aim for a hot spot that lies within a proven performer area,” he said.

“This way, you benefit from the demand in these proven performers and still get in at a lower price.

“I’d keep my eye on good long-term growth markets like those that are close to capital cities, and more particularly, gentrifying suburbs within them. I’d buy into them when they start to enter their next surge of growth.”

Mr Webb said preparation was the key and suggested looking for the “worst house on the best street”. “To get the best of both worlds, you have to be prepared to put in the time and the work,” he advised.

“There might be a house with really good bones that you can improve on and establish over time.

“The secret to a good purchase is to do a lot of research, go to every open inspection and search the internet. You might come across a house that is not that attractive to the general public, yet a coat of paint or a garden landscape may make it a great home.”

Mr Pressley advised learning from history to determine the factors that have had the biggest influence on property prices.

“It’s not the suburb or property (that grows in value), it’s the economic conditions of the city,” he said. “That’s always had the biggest influence and is the biggest driver of demand.”

Mr Pressley said demand was the second biggest influence, and was heavily impacted by the construction sector.

“Investing is a financial decision, and the starting point for making an informed financial decision is to remove emotion,” he said.

“(Then) get a big body of information that paints a picture of the future economy, housing supply and basic mitigation strategies.”

– With Nila Sweeney

MORE: First-home buyer guide to negotiating new builds

Melbourne stage four restrictions: Can you move house in lockdown?

Olympic golfer Marcus Fraser sells Beaumaris mid-century house

The post Property investment tips and strategy: Proven performer vs. up-and-coming suburb appeared first on realestate.com.au.