No. 42 Drumalbyn Road, Bellevue Hill sold for close to its $6.5m price guide just hours before Tuesday night’s scheduled auction.

Fund manager Tom Sendro’s luxury Bellevue Hill home was the scene of raunchy parties and an Airbnb row two years ago.

But he’s now sold it, just hours before it was scheduled to go to auction for close to its $6.5m price guide, via Matthew Ettia of Biller Property and principal Paul Biller.

Back in 2018, Sendro’s neighbours had complained to police and council after a corporate group in town for a tattoo expoo had rented 42 Drumalbyn Road.

Sendro had told A Current Affair: “A party developed in the swimming pool. Rumours were that it was a bit of a ruckus party, quite out of my control.”

MORE:

Eastern suburbs property market ‘never stronger’

Bellevue Hill resident and Airbnb host Tom Sendro at the time of the council stoush in 2018. Picture: John Appleyard

Woollahra Council threatened him with a $5m fine. In the years since the five-bedroom, five-bathroom home with harbour and district views has been a long-term rental, earning $4000 a week.

It hit the market earlier in the year with other agents. It’s believed the highest offer had been in the high $5m range.

The house has glorious harbour views.

It was a different story on Tuesday night. “We had multiple interested parties,” Biller said.

“The ultimate buyer did not want to attend an auction so we closed the deal a couple of hours prior to the auction.

“The market’s hot — everything is selling.”

Sendro had made a couple of minor cosmetic improvements to the house since its campaign earlier in the year.

It has stylish living areas inside and out.

“We restyled it and rephotographed it and that made it look a lot better,” Biller said.

The buyers were an eastern suburbs family.

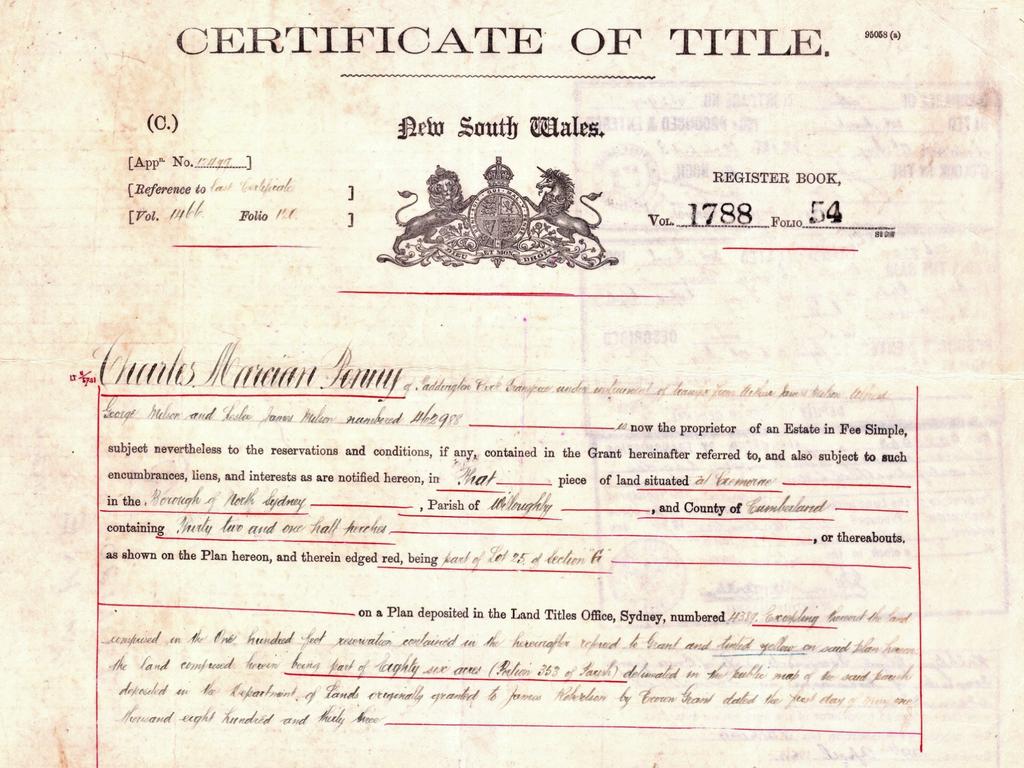

Sendro has owned the home with double garage on a 520sqm block since 1988 when it cost $1,667,500.

CUTTING EDGE DESIGN

The kitchen at 95 Moncur Street, Woollahra, looks out over a reflection pond.

The backyard.

Here’s a rare opportunity: Architect John Grove’s cutting-edge home has hit the market with a $6.2m price guide via The Agency’s Ben Collier.

The four-bedroom, two-bathroom home with double garage at 95 Moncur Street has been widely applauded, winning the Woollahra Conservation Award in 2008 and the Australian Timber Design Award in 2009.

It also received a Residential Architecture Commendation in 2011.

Grove had purchased the 247sqm site for $2.32m in 2005. It’s in the heart of the Woollahra and Paddington Heritage Conservation, but the existing house was deemed of little heritage value so he was able to build “Woollahra House 11” in its place.

The home features a well-appointed kitchen that looks out over a reflecting pond and garden.

The dining room opens to a large entertainer’s timber deck surrounded by greenery.

The bedrooms and study on the upper level – clad in timber and louvres — resemble a treehouse.

A yoga studio surrounded by a bamboo garden is on the lower level. It can be accessed separately via a parkside lane.

The property goes to auction on September 26.

A SUMMER OASIS

Moving the kitchen was the key to transforming 4 Fraser Street, Randwick. .

The property has a $4m price guide ahead of an October 10 auction.

The Randwick north home of builder Chris Griffin and his schoolteacher wife Sam has been reconfigured in the past five years to create a tropical paradise.

But with their three children grown up, the couple are now escaping the rat race to move to the Southern Highlands so the stunning home at 4 Fraser Street has hit the market with Clay Brodie of Ray White Woollahra.

The director of Burmah Constructions has completely transformed the 1920s home by moving the kitchen to the rear and adding bi-fold doors to the new pool.

Changes to the upstairs area, which houses two bedrooms, the main bathroom and a second living area, was also integral. Only the best finishes have been used.

All up there are five bedrooms and three bathrooms.

The master suite, which has a large walk-in-wardrobe and ensuite, second bedroom and fifth bedroom or study, are downstairs.

Other highlights are the 3.3m high ceilings and the new double garage accessed via the rear lane.

Brodie has a $4m price guide ahead of an October 10 auction. Thanks to Griffin’s hard work, the home is now quite different from the one purchased for $1.11m in 2002.

The post Tom Sendro’s Bellevue Hill home at centre of Airbnb council stoush sells for close to $6.5m guide appeared first on realestate.com.au.