An artist’s impression of the view from a penthouse terrace at Kalypso, Tamarama.

A block of bespoke luxury residences set to hit the market in Tamarama is tipped to be popular as buyers love affair with a beachside lifestyle gathers pace during COVID-19.

Kalypso will be a block of just nine — comprising one bedders, two-bedders, sub-penthouses and a penthouse — is a development by Dare Property’s Danny Avidan to be built at 63 Fletcher Street.

Large windows and balconies soak in the spectacular views of the stunning coastline, from Bondi in the northeast to Tamarama and Bronte in the south.

Selling agent Ben Stewart of CBRE says: “It’s going to be pretty popular … we’ve got very strong interest already.

MORE: Morning Show’s Larry Emdur quietly lists in Bondi

Former healthcare chief sells for $11.5m+ in Tamarama

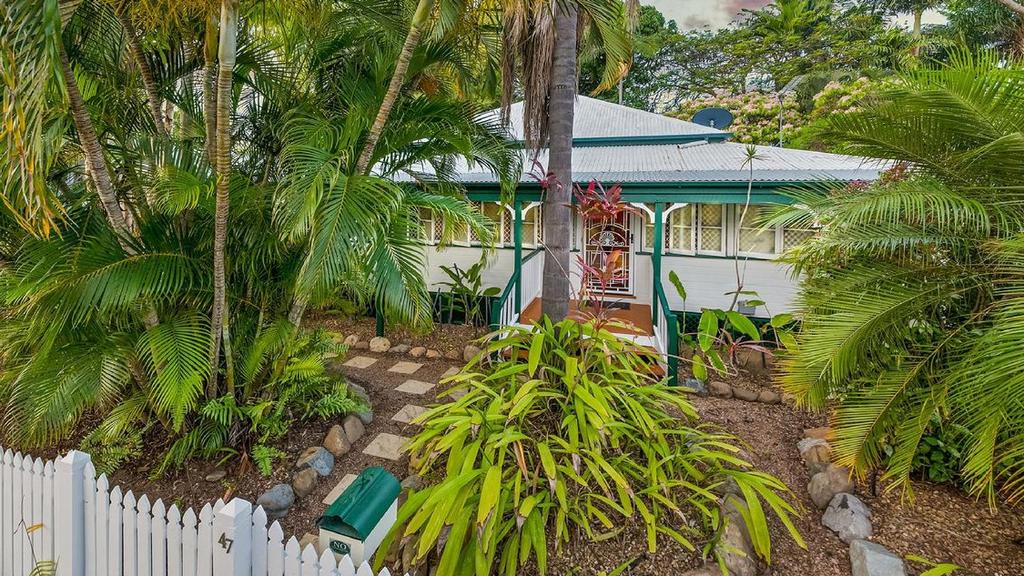

An artist’s impression of Kalypso, which is to be built at 63 Fletcher Street, Tamarama.

“There’s a real appetite for that beachside lifestyle, particularly with a lot of people working from home now.”

Avidan, once the businessman behind fashion brands Charlie Brown, Howard Showers and Hollywood Fashion Tape, has since earnt his stripes as a highly successful property developer and already built the Wave development in Fletcher Street.

This latest project, Kalypso, brings together architects MHNDU, who have created the illusion of the three-level block being carved into the sloping street, mirroring stunning cliffs nearby.

The three-bedroom residences all have fireplaces.

Interiors are by MIM Design. There are curved walls and elegant Bianco Lana marble benchtops, designed to be in synch with waves close-by.

And as afternoon blends to evening in front of the keyboard as residents of the three-bedroom homes gaze out to their ocean view, they need go no further than their copper-framed wine cellar for a well-earned drink.

They’ll also have fireplaces.

There are integrated Wolf and Sub-Zero appliances throughout.

Copper-framed wine cellars and magnificent views.

And get set for freestanding bathtubs with double vanities in the bathrooms.

The penthouse master bedroom will feature a balcony with breathtaking ocean views.

Prices are yet to be finalised, but insiders suggest the four two-bedders, with interiors of 80 to 85 sqm plus 12 to 15sqm balconies, will be priced in the high $2m range.

The three penthouse-style apartments, with more than 200sqm of internal space, will have double-digit price expectations.

The standard three-bedroom apartment will be in the $5m range.

Beautiful kitchens.

And the three one-bedders, which will also have Sub-Zero and Wolf appliances — will be in the late $1m range.

All of the apartments will come with garaging, and the three-bedroom apartments will offer two car spaces.

Lords, the builders, will start demolition on the site in December with completion not due until mid 2022.

Stewart says there continues to be strong demand for the owner-occupier properties.

Bespoke finishes.

“We’re finding prestige properties and units that are rare are still selling very well,” he said.

“Empty-nesters and downsizers are saying give me something special to enjoy my life in,

“People are definitely spending more on their principal place of residence.

“There are minimal sales in investment stock, but owner-occupier sales are very strong.”

There’s been much discussion of inner-city apartments taking time to sell, but Stewart says they are seeing good resales of quality luxury apartments.

He said there’d been a sale last week of $13.5m at the Opera Residences, the 102 unit development at Circular Quay, which equated to $87,000 per sq metre.

“There’s been an uplift in price on resale of up to 25 per cent,” Stewart said.

“During COVID, there’s definitely been a flight to quality.”

The post Tamarama’s Kalypso apartments offer grand design and spectacular ocean views appeared first on realestate.com.au.