Working from home for people like Talia Thornton, (with dog Fenton) has changed house hunting forever. Picture: Nicki Connolly

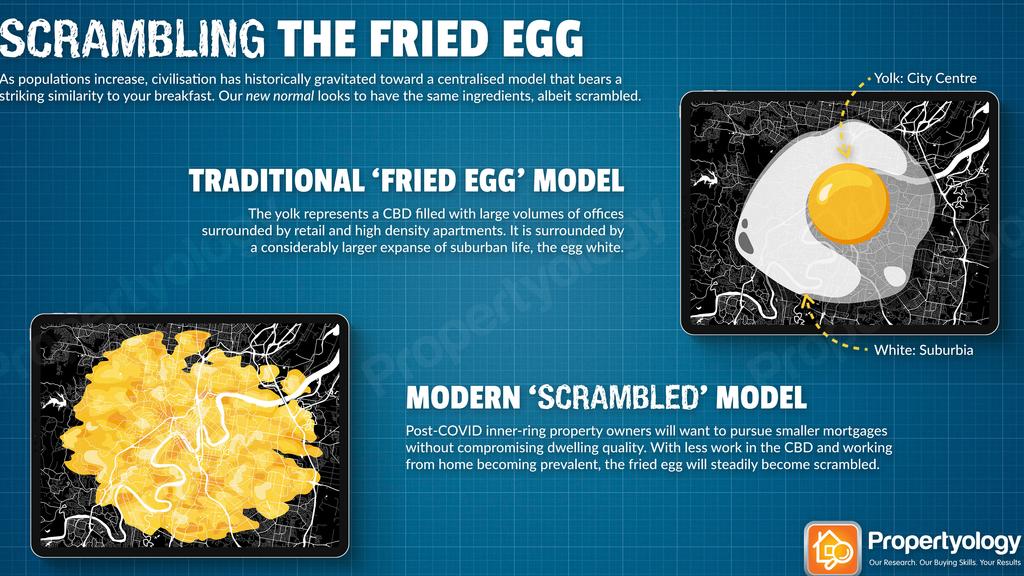

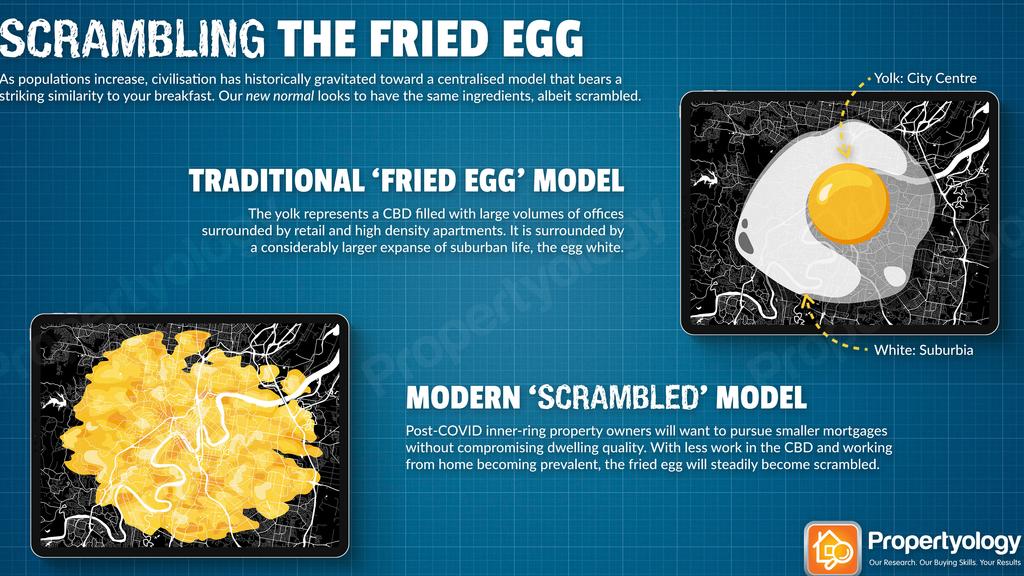

First there was talk of first-home buyers and their smashed avocado on toast, now another breakfast analogy has been cooked up to explain the current state of the property market.

“If smashed avocado had anything to do with housing affordability over the last decade, scrambled eggs will be the dish of the 20s,” said Propertyology head of research, Simon Pressley.

MORE: Tree change comes with glamping, mini donkeys

Homebuyers rocked by lack of confidence

The buyers’ agent and researcher said the traditional “fried egg” town planning model – where CBDs are filled with office towers, retail and high-density apartments (the yolk) surrounded by an urban sprawl (the egg white) – is about to be “scrambled”.

Working from home, for people such as Saumya Mehta of Hobart, is changing what they want from their lifestyle. Picture: Nikki Davis-Jones

The era of the smashed avocado, and its influence on property affordability appears to be over.

After six months of observing how COVID-19 has hit the real estate market, Propertyology came up with a number of property predictions.

“We’ll continue to live in a world of disruption until such time as a vaccine is available. But the disruption from this germ has been big enough and already lasted long enough for Australian real estate to have changed forever,” Mr Pressley said.

He said Australians are in the midst of re-evaluating their priorities.

“Before too long, there’ll be a big enough critical mass of people who will work and/or live at a different address to cause a structural shift in property markets,” he said.

“A germ does not diminish Australia’s total demand for shelter, but it will significantly influence where people choose to take shelter,” said Mr Pressley.

Knowledge-based employees and clerical workers have been able to test drive working from home and Mr Pressley said some may never want to go back to their office – or live near it.

Real estate fried egg is scrambling according to Propertyology.

A new kind of demand

More manageable mortgages, low density locations (that are less susceptible to future lockdowns) regional lifestyle destinations, and working from home compatibility will be on buyers’ wish lists from now on according to Mr Pressley.

With that in mind COVID-19 was “the final nail in the coffin” for high-rise apartments.

“This asset class was increasingly problematic pre-COVID. And now the future is uncertain for workers in hotels, restaurants and hospitality – who normally service international visitors. Ditto, the airline industry and international students. Many of this demographic are part of the egg yolk, renting an inner-city apartment,” he said.

Conversely, he anticipates detached houses within affordable metropolitan suburbs and desirable regional locations will gain popularity.

“We will progressively see some of that yellow yolk blend into the egg white.”

Chin-Chuan Lee and his partner Mark Barrett moved out of Sydney to The Blue Mountains, due to COVID-19. Picture: Richard Dobson

The decade of decentralisation

Social demographer, Mark McCrindle said the egg metaphor for our cities was apt.

“We call it the sprawl and crawl model, because the cities continue to sprawl, and then people crawl their way back into the CBD for work. It’s had obviously some inefficiencies from a time and investment perspective, which has led to ridiculously high-priced property in the CBDs and lower prices out there on the fringe,” he said.

“The employment model has been such that people have needed to spend a long time commuting into that yolk. There’ve been attempts to create, if you like, multiple ‘yolks’ in the egg to allow the population to have their ultimate goal of living, working, and playing close to where they live. It’s been trending that way slowly, but COVID has really transformed things.

“Multiple egg yolks are better than a single egg. It spreads the population and it leads to those 20 or 30-minute cities, and that’s great. But it’s not the complete solution.”

Leaving the city behind. Source: Propertyology.

The regionalisation of real estate

According to Mr Pressley, where we work and how much we earn has always had a huge influence on where we live.

“The impact of these property economics will affect a big enough critical mass to influence future property market performance. As always, there will be property market winners and losers associated with changing economic conditions,” he said.

He added that the pandemic may be the “elbow in the ribs” Australia needed to implement a decentralisation policy and see the birth of “regionalisation”.

MORE: Auction that proves regions are booming

Bizarre NASA bubble house gets world’s attention

Pressley predicts a new era of regionalisation is likely to produce about twenty low-density towns and cities that will benefit from significant internal migration.

“Just think about which Australian locations provide people with the lowest risk of future COVID lockdowns and the lowest risk of restricted lifestyles,” he said.

“Which locations have an economic profile with an industry mix that is conducive to this new world, thereby providing greater household income certainty? Where one can buy a good quality detached house in a location that offers plentiful open space and a manageable mortgage?”

It’s not just about the money

Managing the mortgage isn’t top priority for all Australians escaping the city according to Nerida Conisbee, chief economist for realestate.com.au.

“We’ve seen tonnes of searches for property outside the cities – and it’s not an affordability thing. Northern NSW is one very popular location and if you have a look at how expensive those areas in and around Byron Bay are, it’s high.,” she said.

While Ms Conisbee agreed the traditional town planning model does fit the fried egg analogy, she said she is not convinced the future looks scrambled.

“What we’re seeing now, is that more people are working from home. I think regional Australia will be a beneficiary of this. We’re already seeing very high search levels in regional areas, and I think that’s because some people have realised they don’t need to be in the city all the time. I’m not sure if it’s a scrambled egg, but yes, there will be more of a spread,” she said.

Interest in Byron, including the magical Crystal Estate, is booming.

Cities of the future

“We’ve decoupled work from location, and so now most work in a knowledge economy can be done regardless of location. That’s been the trend, but we should keep in mind that the CBDs will still be required and will thrive in the future,” Mr McCrindle said.

The inevitable change to our work set ups will have a domino effect on property prices.

“We’ll see regional areas and the outer ring suburbs do a lot better, because now we have decoupled work from location and reduced the commuting frequency. But workspaces will still required in the future,” he said.

Fried eggs are yesterday’s real estate dish says Propertyology’s Simon Pressley.

“So someone in the outer ring of a city might only be commuting an hour and a half two days a week, not five. Or someone in a regional centre still might need to go to a city, but only a couple of days a week. That’s a game changer and therefore opens up regional and outer suburban living for a lot more people.”

Quality inner city apartments such as Surry Hills Village, remain in high demand.

Where to next for units

Ms Conisbee warned we shouldn’t place inner city and suburban apartments in the same basket.

“It’s always been higher density properties in outer suburban areas that have struggled and I don’t think that will change. COVID has just made it even more challenging.

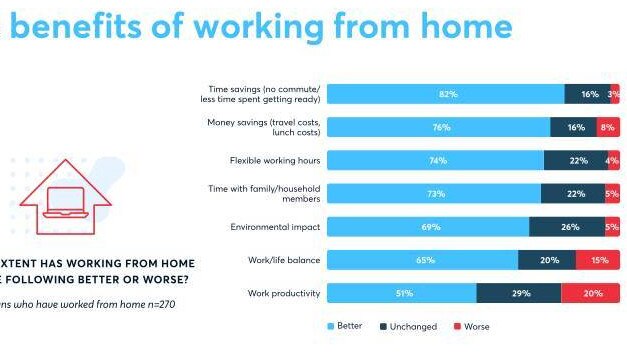

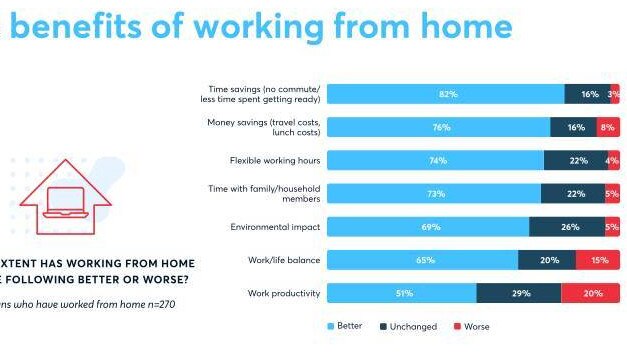

Benefits of working from home. Research from Propertyology and McCrindle.

“What people want is a bit more space and that’s showing in the search data,” she said.

But that doesn’t signal the death of all property within the inner city “yolk”.

“Working from home might still be a bit of a novelty for some, but I think people get a lot out of working with others, and being near other people in their industry, that won’t change,” she added.

MORE

: Gene Simmons kisses stunning LA home goodbye

How COVID-19 has changed homeowners

Mr McCrindle also said he didn’t see the final nail in the coffin for apartments.

“We still love detached homes, and townhouses, but we’ve had quite a few decades now of apartment living. The model has worked for a lot of people from a lifestyle perspective. Older Australians are loving apartment living,” he said.

Working from home study by Propertyology and McCrindle.

“Walkable communities that we’ve liked for so long, the cafe and restaurant culture that surrounds these apartments or high density population areas is something Aussies love and that will bounce back after COVID.”

Ms Conisbee maintained there will always be a demand for city living.

“Our cities will recover, but it is going to be quite painful between now and that recovery, and that’s where we’ll start to see a bit more of a redistribution of people in that short to medium term. But longer term, there’s definitely still a place for our cities,” she said.

MORE: Why you may struggle to find a new home

Tears flow early on The Block

The post How the Aussie property market has turned from smashed avo to scrambled eggs appeared first on realestate.com.au.