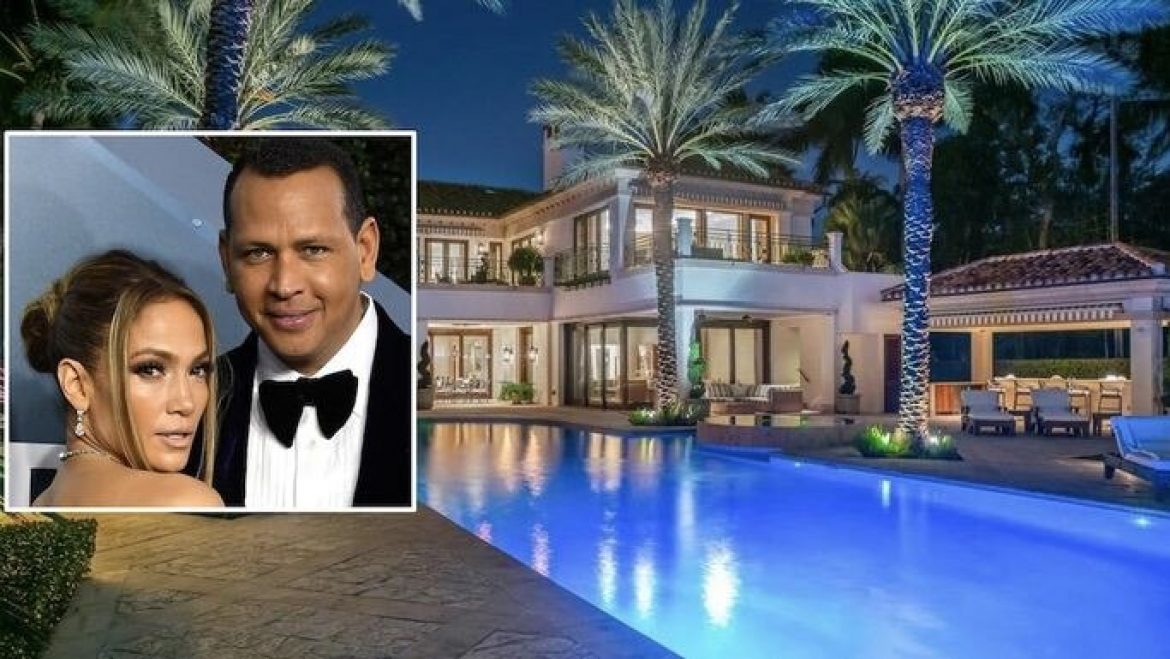

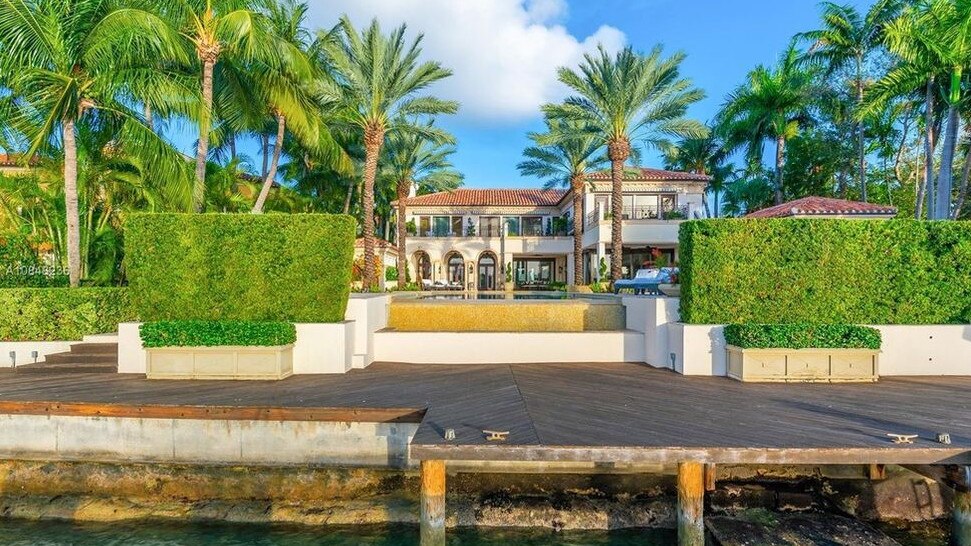

J. Lo and A-Rod have splashed out on a $45m mansion on Star Island. Picture: Realtor/Getty

For the couple who has everything, adding a spectacular piece of real estate to a burgeoning portfolio is par for the course.

A-listers Jennifer Lopez and Alex Rodriguez have acquired a staggering $45 million (US$32.5 million) waterfront property on the celeb-studded Star Island in Miami Beach, according to TopTenRealEstateDeals.

RELATED: Jennifer Lopez buys new eco-friendly house

Musician bassist Gene Simmons kisses LA home goodbye

Jennifer Lawrence loses millions selling ‘secret’ penthouse

The home has its own jetty. Picture: Realtor.com

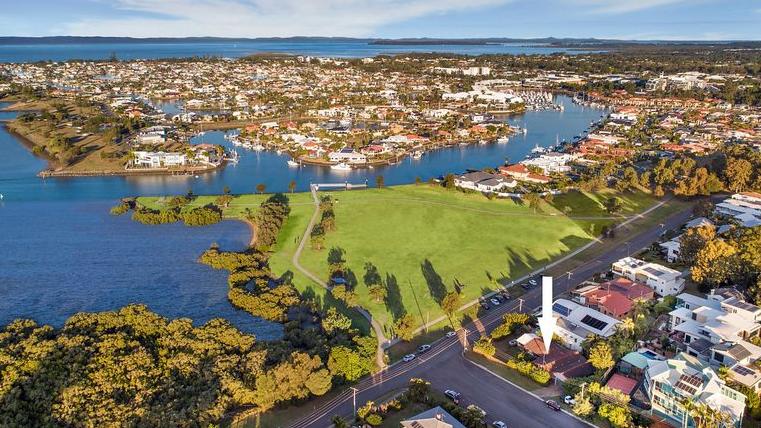

The sweeping abode sits on Star Island in Florida. Picture: Realtor.com

What a view. Picture: Realtor.com

One of the home’s 10 bedrooms. Picture: Realtor.com

Built in 2003, the estate last changed hands in 2011 for $US25.5 million. At that time, it was one of the highest-priced sales ever in Miami Beach. The owner proceeded to renovate and expand the home to make it even grander.

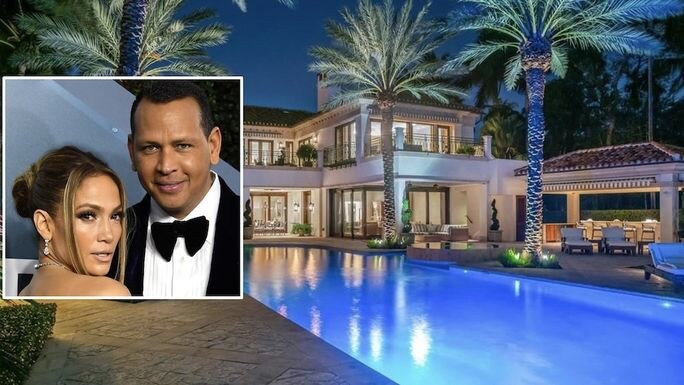

Jennifer Lopez and Alex Rodriguez, who have been together since 2017, both share a love of real estate, and have been collecting houses almost as often as Rodriguez collected base hits for the New York Yankees.

The kitchen Picture: Realtor.com

Picture: Realtor.com

The huge shower in the bathroom. Picture: Realtor.com

With multiple homes across America’s east and west coast, and currently living in one of their homes in Coral Gables, Florida during most of the pandemic lockdown, the pair ventured out recently to purchase this mansion, which is located on South Florida’s island of super-rich CEOs and entertainers.

Star Island is one of several man-made islands built back in the 1920s, and access to the oval-shaped island is by a single road. The guard-gated, exclusive enclave has just under three dozen extremely expensive homes, and is often referred to as Miami’s Millionaires’ Row.

Luxury everywhere. Picture: Realtor.com

What a view to wake up to. Picture: Realtor.com

Island living. Picture: Realtor.com

J-Lo & A-Rod. Picture: Realtor.com

MORE: Inside Tiger Woods’ $73 million island mansion

Music star’s $36m mansion has rave garage

Sofia Vergara drops $40m on sports star’s old mega-mansion

Consisting mostly of Old Florida-style homes with a few modern builds, the Lopez-Rodriguez mansion features large open-and-airy rooms that open to the sea from their backyard Biscayne Bay.

Residents, past and present, include Gloria Estefan, Sean ‘Diddy’ Combs, Don Johnson during his Miami Vice days, and Shaquille O’Neal.

Most of the rooms open to the sea. Picture: Realtor.com

Tonnes of natural light in the living rooms. Picture: Realtor.com

Picture: Realtor.com

What a palace. Picture: Realtor.com

Sitting on almost an acre of land, the 1,370 sqm home has 10 bedrooms, 12 bathrooms, an elevator, library, wine room, stunning kitchen, family room, a guesthouse and a 33m wooden dock.

The expansive pool deck has an infinity pool with spa and views of the bay and Miami skyline.

Jennifer Lopez and Alex Rodriguez in 2019 in New York City. (Photo by Dimitrios Kambouris/Getty Images)

Tonnes of room to entertain. Picture: Realtor.com

Picture: Realtor.com

Another bathroom. Picture: Realtor.com

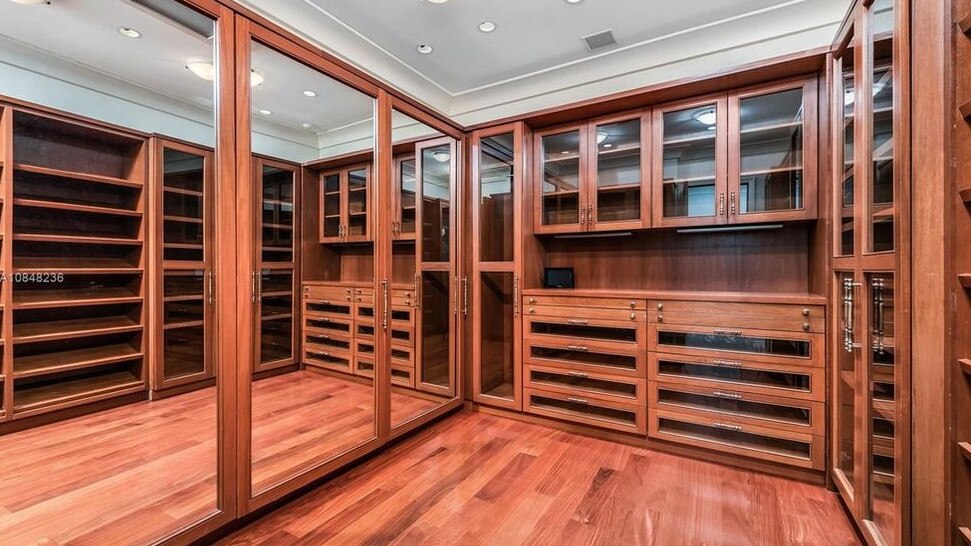

Room for a pair of shoes or 40. Picture: Realtor.com

Architectural details include exterior white rendering, large arched windows, interior Venetian plaster walls and antique fireplaces including one in the main bedroom.

It won’t be long until Jennifer Lopez and Alex Rodriguez move in, and will soon be enjoying life in their new mansion on the water with the twinkling lights of Miami in the background.

MORE: See Justin Bieber’s spectacular holiday homes around the world

Rapper Travis Scott drops $34m on curved LA mansion

Picture: Realtor.com

Picture: Realtor.com

Picture: Realtor.com

The post Inside Jennifer Lopez and Alex Rodriguez’s new $45 million island home in Florida appeared first on realestate.com.au.