Real estate marketing matters — that’s a given. Your approach to real estate marketing is what sets you apart from the competition. It also shapes how your clients perceive your business. Anyone can have a pretty website and consistent social media presence, but if the story your brand tells on those platforms is inauthentic, it’s not going to resonate.

Blog

Day: <span>August 3, 2020</span>

The COVID-19 health and economic crisis has fundamentally shifted Australia’s perception of property. This shift is nuanced, constantly-changing and has significant implications for buyers, sellers, investors and renters.

At REA Group we surveyed more than 5,000 visitors to realestate.com.au between May 6 and July 12 to understand their attitudes towards buying, selling and the broader economy. We also conducted the survey in four distinct waves to understand how these perceptions changed as COVID-19 wore on.

Respondents were sourced from different site sections (e.g. Buy, Rent, Sold) and represent different age groups and different states. Below you can move through our interactive to see the results or dive into realestate.com.au chief economist Nerida Conisbee’s analysis of the findings.

The post Visualised: How Australia’s attitude to property shifted over COVID-19 appeared first on realestate.com.au.

113 Commodore Drive, Paradise Waters sold for $5.5 million.

A historic Surfers Paradise mansion regarded as an architectural landmark has changed hands in a multimillion-dollar deal.

An unnamed local buyer paid $5.5 million for the riverfront residence at 113 Commodore Drive in an off-market sale handled by Michael Kollosche and Jay Helprin in June.

The grand mansion boasts wide main river frontage.

The property was sold by Flora and Sep Abedian, the brother of Sunland Group founder Soheil Abedian, following a seven-year tenure.

The Abedians previously put the property to auction in 2017 when it was passed in at $6.1 million before being taken off the market 10 months later.

The late Keith Williams, right, built Sea World and developed Hamilton Island.

The historic house was built in the late 1980s for Keith Williams, the legendary entrepreneur who built Sea World and developed resorts at Hamilton Island

Gold Coast construction figure Ron McMaster built the Williams family home which was later owned by Dreamworld founder John Longhurst.

Features include a three-level staircase inspired by the Vatican, arched windows, wrought iron chandeliers and Roman bath-style pool.

The three-level staircase inspired by the Vatican.

The 1489 sqm property also enjoys one of the largest water frontages in Paradise Waters, looking across to the grounds of The Southport School and north to the Southport skyline.

The property’s historical importance was recognised in 2015 when it was opened for public viewing as part of the inaugural Gold Coast Open House program celebrating important architectural landmarks.

The residence is considered an architectural Gold Coast landmark.

Mr Helprin said the sale price reflected the home’s stature and was indicative of buyer confidence at the top end of town.

“We’re seeing significant strength in the prestige market,” Mr Helprin said.

“Three of the last four recent transactions on the waterfront have been locals with cash.”

A grand Broadbeach Waters mansion at 327 Monaco Street sold for $5.7 million on July 11 while a vacant 1013 sqm lot with 26.4m of main river frontage at 85 Commodore Drive fetched $3.1 million in May.

Both sales were handled by Kollosche agents.

The post Landmark mansion sold off-market appeared first on realestate.com.au.

Property prices across most major Australian cities have plunged for the third month in a row, as ongoing impacts of the coronavirus pandemic beat up the economy.

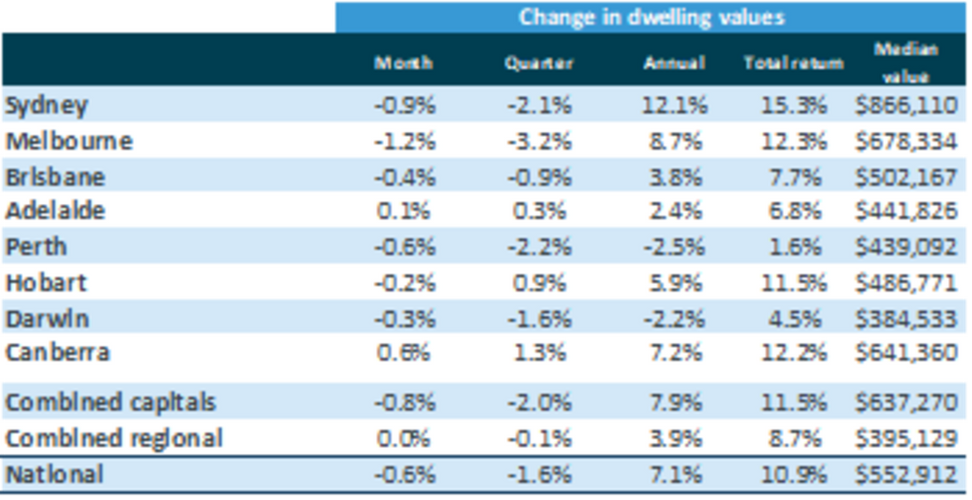

The latest CoreLogic property report shows dwelling values across Australia fell by 0.6 per cent in July compared to June, with Melbourne and Sydney experiencing the largest drop in prices.

In the same period, Sydney values fell 0.9 per cent to a median price of $866,110, while Melbourne prices dropped 1.2 per cent month-on-month with a median property value of $678,334.

CoreLogic’s head of research, Tim Lawless, said the outlook for the industry remained challenged as support measures shielding the housing market from the full brunt of the pandemic are due to be reduced from October.

“The recent concerns of a second wave of the virus and the potential for renewed border closures and stricter social distancing polices are likely to further push consumer sentiment down,” Mr Lawless said.

“This is likely to weigh on both home buying and selling activity more broadly.”

In the past quarter, the value of property in Sydney fell 2.1 per cent and Melbourne has dipped 3.2 per cent.

Mr Lawless said the housing market remained relatively resilient through the pandemic due to government and banking support measures.

“Record low interest rates, government support and loan repayment holidays for distressed borrowers have helped to insulate the housing market from a more significant downturn,” he

said.

Sydney house values have fallen 0.9 per cent, while Melbourne prices have dipped 1.2 per cent lower. Picture: Gaye Gerard

In July, Brisbane’s housing market fell 0.4 per cent compared to June, while Perth and Hobart dropped 0.6 per cent and 0.2 per cent respectively over the same period.

Brisbane’s median house price is $502,167, while Perth’s average is $439,092 and Hobart’s is $486,771.

Canberra and Adelaide were the only capital cities where values improved. Canberra values increased 0.6 per cent to a median property price of $641,360 and Adelaide median values sit at $441,826.

The report said auction volumes were showing signs of improvement and were tracking higher than 2019.

Newly listed properties are up 46 per cent compared to the lows experienced in early May.

According to CoreLogic, rental rates have continued to trend lower, with Hobart, Sydney and Melbourne having the weakest rental conditions.

“Some inner city areas of Melbourne and Sydney have seen rental listings more than double

since March due to the combined effect of temporary migrants departing, and overseas arrivals, including foreign students stalling,” Mr Lawless said.

“Compounding this weak demand position is the surge in construction activity and investment over previous years, which has added to inner city rental supply.”

The post Property prices plunge across major cities due to COVID recession appeared first on realestate.com.au.

The Westbourne Park property at 9 Richmond Road sold under the hammer at the weekend. Pic: supplied by Ouwens Casserly Real Estate

Househunters who have had their eye on a modernised Westbourne Park character home since it hit the market two-and-a-half weeks ago have missed their chance to buy it.

The 1925-built bungalow at 9 Richmond Road sold under the hammer for $1.595 million on Saturday, just 18 days after it hit the market.

Latest realestate.com.au data shows the median days on market for a house in Westbourne Park is 40.

MORE NEWS

Enjoy a Bali holiday without leaving home

The suburbs in and out of Adelaide’s million-dollar club

Chance to restore a piece of history to its former glory

Its character has been retained at the front of the property. Pic: supplied by Ouwens Casserly Real Estate

The rear of the residence is modern and new. Pic: supplied by Ouwens Casserly Real Estate

It has plenty of windows to allow natural light to flow through the house. Pic: supplied by Ouwens Casserly Real Estate

The house was one of the state’s most viewed properties going to auction last weekend on realestate.com.au, and attracted strong interest throughout its short campaign, according to Ouwens Casserly Real Estate agent Sharon Gray.

Its seamless blend of classic character at the front and contemporary design trends at the back made it stand out from other properties on the market.

“It is a really unusual home, so we had really good numbers throughout the campaign,” Ms Gray said.

Among those that missed out was a househunter required to quarantine under COVID-19 restrictions until Monday.

“We had one person who was actually in quarantine – they missed it by two days,” she said.

“They weren’t comfortable (bidding) without physically seeing it.”

Three hopeful buyers registered to bid for the home but it came down to two, who Ms Gray said were “very keen” to get their hands on the keys.

Even the older parts of the home has been reinvigorated. Pic: supplied by Ouwens Casserly Real Estate

The renovation has given the house a new lease on life. Pic: supplied by Ouwens Casserly Real Estate

She said a young family ended up snapping up the four-bedroom home.

It wasn’t just the underbidders who were disappointed – Ms Gray said many neighbours were upset they weren’t allowed to watch the backyard auction unfold.

“We were at capacity with our allowed numbers and there were probably 20 to 25 (people) who weren’t allowed in,” Ms Gray said.

The property last sold in 2000 to Michelle Kewell and Megan Roodenrys, who renovated and extended the home.

The front of the house has been set up as luxe Airbnb accommodation Two Birds Bungalow and features two bedrooms, a lounge, a kitchen and meals area, and a spacious bathroom.

A hallway leads to the main home, which features the master suite with a dressing room, a study, a bathroom and large laundry, and a generous open-plan kitchen, dining and living area overlooking the yard.

Numerous decks surround the home, and the property also has a large shed and a separate studio or guest bedroom.

The post Popular Westbourne Park home snapped up at auction for $1.595 million appeared first on realestate.com.au.

The clean up could cost more than the property.

This could be Victoria’s cheapest sale for the year.

A burnt-down building on 843sq m at 92 Lindsay Rd, Dartmoor — between Warrnambool and Mt Gambier near the South Australian border — set the buyer back just $15,000 in a whirlwind sale after just over 20 days on the market.

The sale came about after the rental property burnt down and the owner, who didn’t have insurance on the building, decided to offload the burden.

RELATED: Victoria’s future real estate growth markets picked by experts

Where property prices are defying expectations during COVID-19 pandemic

Local buyers to be winners as COVID-19 cuts international market

A fire tore through the Dartmoor property.

The fire was not deemed suspicious following an investigation, a Victoria Police spokeswoman confirmed.

Assets Real Estate Heywood & Portland agent Kevin Hughes said the buyer came from out of town to secure the property, which came on the market with price hopes of $25,000.

CoreLogic records reveal the property last changed hands for $52,500 in July 2013.

“This (buyer) will clear and flip it,” Mr Hughes said. “He may put a relocatable (house) now that they’re coming out of Melbourne.”

Mr Hughes said interest in the property came from “all over the shop”, thanks to the dirt-cheap price tag.

A police investigation deemed the fire was not suspicious.

The buyer is expected to put a relocatable house on the block and onsell it.

But the agent said there had been a wave of interest in the region because of affordability and a laid-back lifestyle.

“We’re getting a lot of inquiries from out of town,” Mr Hughes said.

“A lot of people go to Port Fairy and all of a sudden are seeing this area and realising how cheap it’s been.

“It’s nice, easy cheap living out this way.”

Beautiful beaches with “sensational” fishing were drawing out-of-towners to the region, alongside work at the Portland aluminium smelter, Mr Hughes said.

READ MORE: Phillip Island dream home with ‘own surf break’ for sale

Jamie Durie: Sustainable home style, affordable green living

Melbourne’s top 20 suburbs for house price growth since 2000

The post Dartmoor fire sale could be state’s cheapest block at $15,000 appeared first on realestate.com.au.

A Queensland development company has beat overseas and interstate competition to secure the Tweed Coast site currently home to Australia’s premier glamping resort.

The Hideaway holding at 2-6 Tweed Coast Road, Cabarita sold for ‘circa $5 million’ – the biggest sale the seaside village has seen in a decade.

The Hideaway site at 2-6 Tweed Coast Road, Cabarita Beach has sold for ‘circa $5 million’.

The sale brings a reprieve of sorts for The Hideaway following community fears for the future of the resort and possible development of the site.

“It’s been bought by a Brisbane-based civil contract company for circa $5 million,” said Nick Witheriff of LJ Hooker – Kingscliff.

“They have got a view to keep the business going as it is for now and then look at an alternative for potential development of the site down the track.”

MORE: ‘Ramshackle’ reno named best house in Australia

Palm Beach market is ‘on steroids’

The Caribbean meets Gold Coast glamour inside designer beach pad

The Cabarita Beach site is zoned for development or subdivision.

Located between the Gold Coast and Byron Bay, the 2.803ha parcel is the only development land remaining on the eastern side of Tweed Coast Road and is R3-zoned for a unit or townhouse development or land subdivision.

Mr Witheriff said the beachside holding attracted strong interstate and overseas interest.

“There were six written offers, with three rounds of negotiations to get the best and final offer,” he said.

“Offers came from Sydney, Melbourne, New Zealand, Brisbane, a local government entity and a local party.”

The Hideaway will continue to operate as a glamping resort for now.

Formerly home to the Cabarita Beach Caravan Park, the site was purchased by a syndicate of investors in 2018 before reopening as an outdoor hotel at the start of last year.

The idyllic seaside resort has received rave reviews worldwide for its spacious bell tents with all the modern trimmings and luxe bohemian decor.

News of the sale raised concerns within the Cabarita community who led a campaign to keep the land in local hands.

“There was a lot of anxiety from local community groups,” Mr Witheriff said.

“There’s been a lot of discussion around how locals might somehow retain the site to avoid future development.”

The existing infrastructure and amenities were included in the sale, due to settle on September 23, with the resort having resumed trade last month when COVID-19 restrictions were eased.

The post Top glamping resort sold in multi million-dollar deal appeared first on realestate.com.au.

Sydney has seen its third straight month of home values falling. Picture: John Feder/The Australian.

Sydney dwelling values have recorded their largest monthly fall in 16 months, as the coronavirus pandemic continues to affect the property market.

The latest CoreLogic Home Values Index reports the median property value across Sydney dropped 0.9 per cent to $866,110 during July.

The slump is largest monthly fall of the past three months and means the average dwelling is now back at January prices. Despite this, property prices still remain 12.1 per cent higher than a year ago.

MORE: Inside Karl Stefanovic’s new waterfront mansion

First-home buyers to benefit from stamp duty changes

Time warp home never lived in for 53 years sells at auction

The market has remained stable since the pandemic Picture: Gaye Gerard/ Sunday Telegraph.

The median price of a freestanding house was $1,002,107, 1.0 per cent lower than at the start of July, while the median unit price was $747,238, 0.7 per cent lower. The fall is being fuelled by homes at the top end of the market, which have suffered more a substantial drop in value than cheaper houses.

CoreLogic head of research Tim Lawless said the market has remained resilient during the pandemic, with prices only falling 2.1 per cent since the peak in April.

“Record low interest rates, government support and loan repayment holidays for distressed borrowers have helped to insulate the housing market from a more significant downturn,” he said.

Mr Lawless added government incentives that have targeted first homebuyers has result in increased demand for property from that section of the market.

With fiscal support set to taper from October and repayment holidays expiring at the end of March next year, Mr Lawless said these two events will test how strong the market is and could result in larger price falls.

“Urgent sales are likely to become more common as we approach these milestones, which will test the market’s resilience,” he said.

CoreLogic reports new listings are up 46 per cent from the recent lows of early May and are now at a similar level to a year ago.

Apartments dropped 0.7 per cent during July.

“The rise in fresh listings implies homeowners have become more willing to test the market,” Mr Lawless said.

CoreLogic property analyst Eliza Owen said the market in Sydney is unlikely to improve on a pricing front until international borders reopen and the economy starts to recover.

“The Sydney market relies on migrants to help fuel demand for property, so until they can enter again, prices are unlikely to increase,” she said.

Regional NSW was one of the best performing markets in Australia, with home values up 0.5 per cent to $468,220 during July.

Regional NSW saw home values jump 0.5 per cent during July. Picture: Tourism Wollongong.

Ms Owen said the pandemic has helped the regional property market due to Sydneysiders looking to leave the city for regions with working from home now normal.

“It is early to see how this will play out, but generally regional markets lag behind capital cities, so we could see prices begin to fall later this year.”

Values across Australia dropped 0.6 per cent to $552,912 in July, with Melbourne the hardest hit. Canberra on other hand saw property prices increase 0.6 per cent to $641,360.

The post Sydney property prices record largest monthly fall in 16 months as coronavirus affects the market appeared first on realestate.com.au.

National property values have fallen for the third successive month.

Australian home prices have fallen for the third successive month, due to the economic impact of the COVID-19 pandemic.

According to CoreLogic’s home value index, housing prices nationally dropped by 0.6 per cent in July. This followed a 0.7 per cent drop in June and a 0.4 per cent drop in May.

Overall values have slipped 0.7 per cent since the pandemic began to bite in the middle of March. For that month values were up 0.7 per cent, followed by an increase of 0.3 per cent in March.

Canberra was one of the places to enjoy home value growth in July. Picture: Getty Images

The figures indicate the resilience of the market, according to CoreLogic’s head of research Tim Lawless.

“The impact from COVID-19 on housing values has been orderly to-date, with CoreLogic’s national index falling only 1.6 per cent since the recent high in April and housing turnover has recovered quickly after it’s sharp fall in late March and April,” he said.

MORE

Australia’s hottest growth suburbs revealed

Melbourne, which has been hit hardest by COVID-19 saw housing values slide the greatest by 1.2 per cent. In Sydney they fell 0.9 per cent, in Perth by – 0.6 per cent, in Hobart by -0.2 per cent and in Darwin by -0.3 per cent.

Adelaide (0.1 per cent) and Canberra (0.6 per cent) were the only cities to enjoy a value increase in July.

CoreLogic Homes Values Index July 2020

“Record low interest rates, government support and loan repayment holidays for distressed borrowers have helped to insulate the housing market from a more significant downturn,” Mr Lawless said.

“Advertised supply levels have remained tight, with the total number of properties for sale falling a further 4.3 per cent in the four weeks to July 27th, sitting 15.2 per cent below where they were this time last year.

“Additionally, increased demand driven by housing specific incentives from both federal and state governments, especially for first home buyers, have become more substantial.”

Prices in regional areas, such as Bathurst, NSW, are holding up well.

With welfare packages JobKeeper and JobSeeker to be scaled down from October and Victoria entering stage four lockdown yesterday, the medium term outlook is for a continued drift downward of the market.

“Urgent sales are likely to become more common as we approach these milestones, which will test the market’s resilience,” Mr Lawless said.

MORE

How COVID-19 is changing what we want in our homes

Rare chance to own Sydney home from The Block

“Similarly, the recent concerns of a second wave of the virus and the potential for renewed border closures and stricter social distancing polices are likely to further push consumer sentiment down. This is likely to weigh on both home buying and selling activity more broadly.”

This is likely to be reflected first at the premium end of the market, Mr Lawless pointed out.

“Higher value markets tend to be more reactive to changes in the economic environment, having led both the upswing and the downturn over previous cycles,” he said.

“The COVID related downturn has seen this trend playing out again, with upper quartile values down 2.9 per cent across the combined capital city index since the end of March, while lower quartile values have fallen by only 0.5 per cent.”

The post Australian home prices have fallen for the third successive month, due to the economic impact of the COVID-19 pandemic appeared first on realestate.com.au.

Melbourne home values are taking the biggest hit of Australian cities amid COVID-19. Picture: Alex Coppel

Melbourne’s coronavirus-driven property downturn has deepened, with the city again recording the largest monthly and quarterly value declines of any Australian capital.

House and unit values fell 1.2 per cent in July to a $678,334 median, raising Melbourne’s quarterly drop to 3.2 per cent, according to CoreLogic’s latest Hedonic Home Value Index.

The next worst-performing capitals were Sydney, with 0.9 per cent monthly and 2.1 per cent quarterly declines, and Perth, down 0.6 per cent and 2.2 per cent.

Home values also dipped 0.5 per cent in regional Victoria in July.

RELATED: Melbourne home values hardest hit across nation, CoreLogic finds

New restrictions as Victoria declared ‘state of disaster’

Canterbury reserve smashed by almost $500k at online auction

Melbourne’s property downturn continues to deepen. Picture: AAP Image/Michael Dodge

The figures were released on Melbourne’s first morning under tight stage four COVID-19 restrictions, which have placed the city under an 8pm-5am curfew and banned residents from travelling further than 5km from their homes for the next six weeks.

Real Estate Institute of Victoria president Leah Calnan said she had not been informed of any further restrictions being placed on the Melbourne real estate industry, but that may change as a result of Monday’s more detailed announcement from Premier Dan Andrews.

“As of yesterday (Sunday), we were still able to conduct online auctions and private inspections by appointment,” she said.

Ms Calnan understood regional Victorian markets would be restricted to these methods when its stage three lockdown kicked in.

She noted many regional agents had already converted to private inspections, rather than open homes, given a large chunk of the buyers they dealt with were based in metropolitan Melbourne.

“Agents will just continue to adjust with any further changes that might be announced,” she said.

“Agents have continued to acknowledge the very privileged place they work in. We’ll make sure they continue to abide by the highest level of hygiene and processes.”

Ms Calnan said the combination of low levels of available housing stock, low interest rates and financial support measures like the federal government’s JobKeeper and mortgage holidays had insulated Victoria’s market from large price falls during a “very challenging” period.

Nick Johnstone conducts a socially distanced auction between lockdowns. Picture: Alex Coppel

It’s not clear when conditions will improve in Victoria amid a lengthened second lockdown. Picture: Jason Edwards

CoreLogic’s head of research Tim Lawless agreed, adding the total number of properties for sale across Australia fell a further 4.3 per cent in the four weeks to July 27, to sit 15.2 per cent lower than they were a year ago.

But he warned the downturn could deepen further following the tapering of financial support from October, and loan repayment holidays expiring at the end of March.

“Urgent sales are likely to become more common as we approach these milestones, which will test the market’s resilience,” Mr Lawless said.

He added the virus’s second wave and accompanying further border closures and stricter restrictions was likely to “further push consumer sentiment down (and) weigh on both home buying and selling activity more broadly”.

Consumer sentiment could decline further. Picture: Alex Coppel

Wakelin Property Advisory director Jarrod McCabe expected Melbourne’s stage four lockdown to bring “added tension” and further thin out the pool of potential buyers active in the market.

“The lack of stock throughout the whole period of COVID-19 has meant prices haven’t been as impacted as people may have thought, but that’s not to say it won’t happen,” he said.

“It’s difficult when vendors don’t have the confidence to put properties on the market and buyers aren’t as active, given lot of them don’t have the ability or the confidence to borrow.”

MORE: Victoria’s future real estate growth markets picked by expert

Melbourne’s top 20 suburbs for house price growth since 2000

Former Demon’s Northcote bank and development site listed

The post Melbourne home values: Downturn deepens as stage four lockdown starts appeared first on realestate.com.au.